In Business we can obsess over the Future, and chase the ‘Lead Indicators’ that help us predict it. We can lament the Past, and the ‘Lag Indicators’ that tell the story of what might have been. But when it comes to making better business decisions, there is only one time that matters: the Present, what I call Your Point of Power.

As you face this Recession like a leader, you must leverage your power. In this article (or view the video below) I will detail exactly which Indicators can help your decision making and communication, and which are simply noise that will distract you.

Now that the Recession is Over…

I am Jacob Aldridge, and this is Don’t Waste a Good Recession. You can subscribe for Inbox alerts here, or on our YouTube page here.

Today is the Fourth of July, 2020. Now that the Coronavirus Recession is over, we need to re-look at the fundamental economic indicators that we’ve been tracking for your small and medium-sized business.

Wait, What?!

– Everyone

Did I just say “the recession is over”? Yes.

Let’s talk “technically”.

There is no clear, concise, consistent definition of a “recession” versus a “depression”, or some of the other economic terms that are thrown about in a “downturn”.

The definition that’s most commonly used is “A Technical Recession is two consecutive quarters of negative GDP growth”. (Note it’s “negative growth”, not “GDP contraction”, because this is economists we’re talking about not humans.) A Depression by this definition is four consecutive quarters of negative GDP growth.

Really, as we saw in Australia during the Global Financial Crisis, you can avoid a technical recession and still have an economic downturn, still see unemployment spike, still have a lot of pain in your business.

So in the UK (negative 2.2%), the USA (negative 5.0%), Australia (negative 0.3%), and many other countries around the world, the March quarter of 2020 had negative growth. The June quarter has not been released, but given the magnitude of the forecasts (in some cases negative 8.0% growth has been forecast; even if it’s half that that’s still going to be one of the worst quarters in history for GDP growth) we’re going to assume that June is in fact negative.

March was negative. June was negative. Two consecutive negative quarters of GDP growth. That means we have had a recession.

The third quarter, the September quarter, started this week. Because the June quarter was so bad, it’s almost guaranteed that the September Quarter will be some kind of growth. Not back to where we were in March. Not back to where we were in 2019. But it will be growth. Which means technically, we have gone “Negative-Negative-Growth”.

[Side note: The Fourth Quarter for the year may well be Negative again. We could potentially fall into a long period before Growth actually takes us back to new highs. My projections are still the second half of 2021, and that we’re having an L-Shaped recession. So outside of “technically”, the recession is going to continue.

- Unemployment numbers are going to continue to rise

- Consumer confidence is going to come down

- Employment Stimulus packages will unwind or stop altogether

- There’s going to be a world of hurt and that has all still to wash through many economies including most of my readers

- So for your Small or Medium business, almost certainly the worst is yet to come.]

However, technically the recession is over. Pat yourself on the back. And use that news as evidence why using Economic Indicators to run your business is not necessarily the best idea.

Sixteen Consecutive Economic Snapshots

Since March 2020, for sixteen consecutive weeks, I have been putting out an Economic Snapshot focused on four key economic indicators.

- New and then Active COVID-19 Cases

- Sharemarket Movements

- Unemployment Rates

- GDP Growth Data

I sat down towards the end of the June Quarter, the end of the Technical Recession but really the early days of what’s to come, and I asked myself: Are those the best four Economic Indicator to be focused on?

What are some other Economic Indicators that could help you communicate and make better decisions in your small to medium sized business?

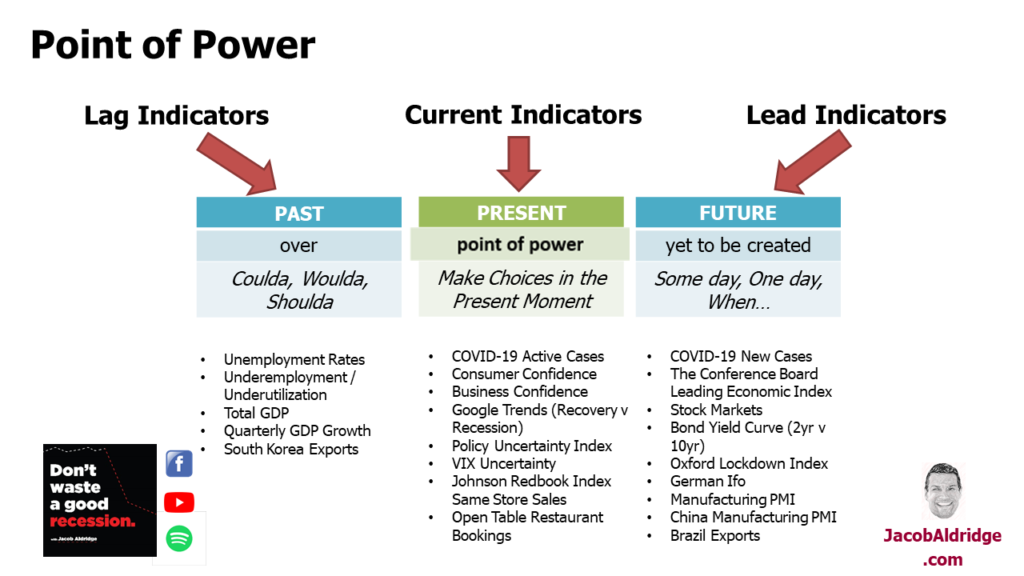

So I spent a few weeks diving deep into a range of other economic indicators, broken into three time frames: Lead Indicators (helping predict the future), Current Indicators (acknowledging right now), and Lag Indicators (data about the past).

Lead Economic Indicators in a Recession

- COVID-19 New Cases

- Leading Economic Index

- Stock Markets

- Bond Yield Curve (2yr v 10yr)

- Oxford Lockdown Index

- German Ifo

- Manufacturing PMI

- China Manufacturing PMI

- Brazil Exports

Current Economic Indicators in a Recession

- COVID-19 Active Cases

- Consumer Confidence

- Business Confidence

- Google Trends (Recovery v Recession)

- Policy Uncertainty Index

- VIX Uncertainty

- Johnson Redbook Index Same Store Sales

- Open Table Restaurant Bookings

Lag Economic Indicators in a Recession

- Unemployment Rates

- Underemployment / Underutilization

- Total GDP

- Quarterly GDP Growth

- South Korea Exports

Look, I love Economics as much as the next person but that’s a LOT of data! So how do you make sure that the data, the Economic Indicators, you are using are meaningful and not just noise?

Your Point of Power

Ultimately in business, time spent lamenting the past or fearing the future is wasted time. Any Indicator is only useful if it is meaningful right now, if it impacts your Present Point of Power.

None of that economic data matters if it doesn’t influence you where decisions are made and when communication is done. This present moment is where your life is created. So what is going to help the small to medium-sized business owner / CEO / business leader with 2-500 employees?

Here’s what I observed diving deep all of those economic indicators: they are only going to help you in your present moment if they actually also give you three bits of information:

- They have to be Country Specific. When America (or China) sneezes, the world catches a cold, but data in your country is going to impact your business much more than data on the other side of the world.

- It’s relevant to your Industry. Hospitality and Tourism businesses in the past three months haven’t been able to make decisions based on Oil Production data or what’s happening with Online Sales. If the data is not relevant to your industry, it’s going to have a limited use.

- It has to give you some idea of Timeframe. A Lead Indicator can tell you what’s going to happen in the future, but if it can’t tell you whether that’s one month away, six months away, or 18 months away, then how much can you use that data to make strategic decisions today.

Noting this, I then examined all of those economic indicators and I compared them to the four businesses I’ve been working with most through the Coronavirus Recession.

None of these businesses have been directly hit by Lockdown measures – no restaurants or airlines here. They are spread across multiple countries. In response to the Recession, their financial results have varied – preliminary June Quarter results across the four companies show a 15% Decline, a 5% Decline, a 15% Growth, and 20% Growth (with three record months out of the last four!).

I compared the economic data available, including Country and Industry Specific indicators where available, to see what could have been used to predict or influence those financial results. I found limited actual correlation.

Even looking at all of those numbers could not have helped those businesses to predict what was coming.

[Another side note: At various points in my life I’ve been a regular reader of financial newspapers, like the Australian Financial Review, Financial Times, and even the wonderful City A.M. The first time you pick up one of those rags, the writing seems impenetrable, much like the first time you watch Bloomberg TV. Stick with it for a few week, however, and it begins to coalesce into something that makes sense.]

The same is true of all that economic data. Viewing one point in time won’t help. Monitoring all of them, through every update, over a period of time, will tell you something. But I found that something was just as easily understood by tracking only two lead indicators: New COVID-19 Cases, and Stockmarket movements.

As New Coronavirus Cases in their geography went up, business declined. As Stockmarkets moved both down and up, business followed – with about a one month delay (so much less notice that we were getting during the Great Recession, when that lag was more like six months and it could be used more strongly as a Lead Indicator).

Everything else, from Lead Indicating Commodity Exports in Brazil to Lag Indicating Technology Exports in South Korea, had a limited impact on the decision-making and the actual outcomes for those four businesses. And the time spent collating and analysing the data would be time better spent on other Indicators: those that are generated from your actual business.

Why I’m Not Surprised Economic Indicators Couldn’t Help

In business, there are other factors at play. Your business, for example moves through its own Business Lifecycle: if you’re in the Scale Up phase with momentum and acceleration, even a deep recession may barely dent your growth; similarly, even a mild economic downturn is going to dramatically impact a Step Up business that’s already stuck in a brick wall or unable to get over that Start Up phase speed bump.

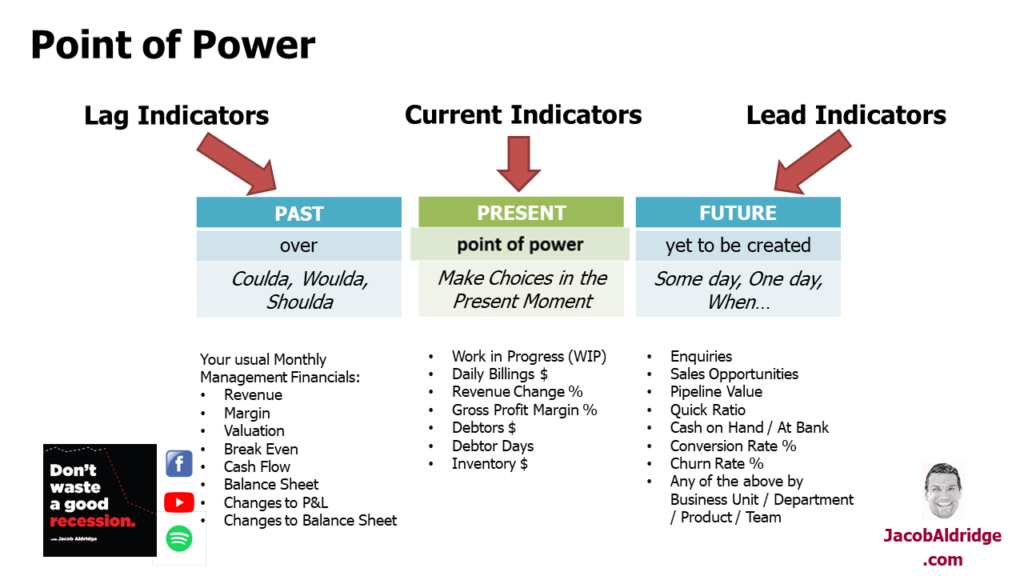

The more I looked at the economic data and compared it to business reality, the more I realised that the key Indicators were your own.

Benchmark Business Lead Indicators in a Recession

- Enquiries

- Sales Opportunities

- Pipeline Value

- Quick Ratio

- Cash on Hand / At Bank

- Conversion Rate %

- Churn Rate %

- Any of the above by Business Unit / Department / Product / Team

Benchmark Business Current Indicators in a Recession

- Work in Progress (WIP)

- Daily Billings $

- Revenue Change %

- Gross Profit Margin %

- Debtors $

- Debtor Days

- Inventory $

Benchmark Business Lag Indicators in a Recession

These are your usual Monthly Management Financials:

- Revenue

- Margin

- Valuation

- Break Even

- Cash Flow

- Balance Sheet

- Changes to P&L

- Changes to Balance Sheet

I explain each of those in a teeny bit of detail in the video above, starting at the 12 min 40 sec mark.

That list can look like a lot for you as a business owner; if you feel that way, I would challenge you to pick five additional measurements to what you’re currently using and work with your team to see how you can get that information in a timely manner.

(A timely manner is critical. There’s no point knowing that ‘Sales Opportunities’ were down last month; you want to know that Sales Opportunities are down now so that you can do something about it now in your Point of Power.)

If you really don’t know where to start, please reach out to me. In addition to helping businesses myself, I have an international network of trusted partners who range from experienced CFOs to automation geniuses that can help you see all this information in real time.

The client of mine who had three record months during the Coronavirus Recession? They have a television in the middle of their office dedicated to their Dashboard, including some personalised micro-indicators relevant just to them, so the whole team from the business owner down can immediately see Lead, Current, and Lag Indicators from their business and act accordingly.

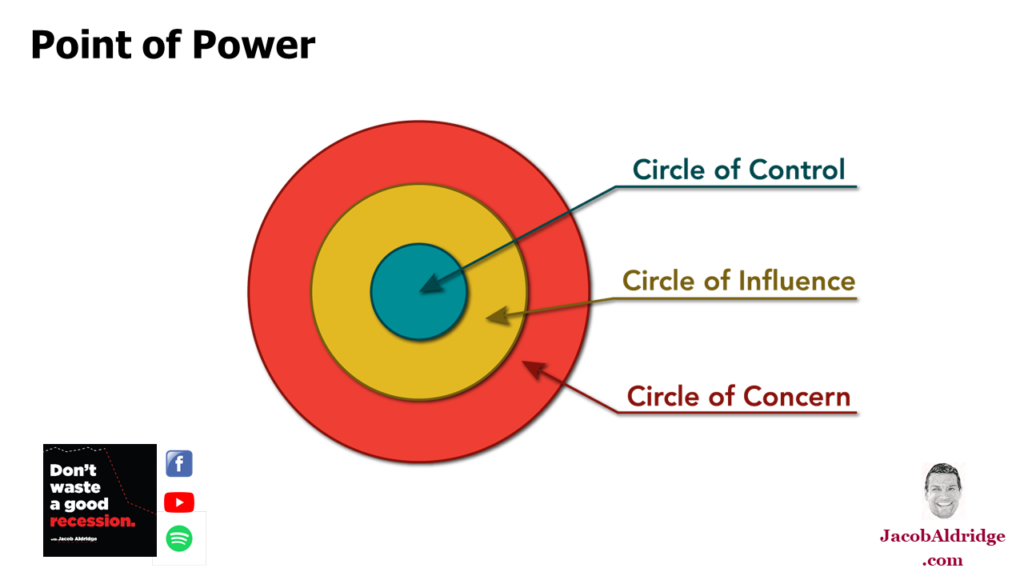

Move Back to the Circle of Control

I introduced this diagram in Presentation #4 of ‘Don’t Waste a Good Recession’ when we discussed Fear and Control for business owners in a Recession.

The diagram shows three circles:

- The Circle of Control. The things that you can completely Control – like whether you go to football training.

- The Circle of Influence. The things you can Influence, but not fully control – like whether your football team wins on the weekend.

- The Circle of Concern. Things outside your influence, which may Concern you and impact you – like whether your favourite English Premier League team wins on the weekend.

Your Business Indicators live entirely within your Circle of Control or your Circle of Influence. The wider Economic Indicators live in the Circle of Concern – you can’t influence those economic fundamentals, but they can influence your emotions, your communication, your decision-making if you let them. You can’t change the outcomes, but they can change you.

At all times in business, and especially during a recession, you need to bring everything you can within the Circles of Control and Influence and not let the Circle of Concern impact your emotions.

The Future of Don’t Waste a Good Recession

I began this programme in March 2020 as a way to share my experience as a Business Advisor in a Recession with as many small and medium sized business owners as I could.

(If that’s you, please do subscribe for emails here, or on YouTube here. And remember: Sharing is Caring, especially sending links to your business owner friends.)

Having awareness of Economic Indicators is important, so I will continue to track this data weekly and produce my Economic Snapshot programs on a Monthly basis.

That also creates a lot more space in our schedule for writing and/or filming valuable business content you can use – whether that’s critical content, timely actions, or our Recession-business case study series.

Your questions, requests, or suggestions are always welcome – by email, or leave a comment below!

[…] Learn more about the new economic fundamentals, and the key business benchmark indicators here. […]

[…] Benchmark business indicators to read why I use these 4 […]