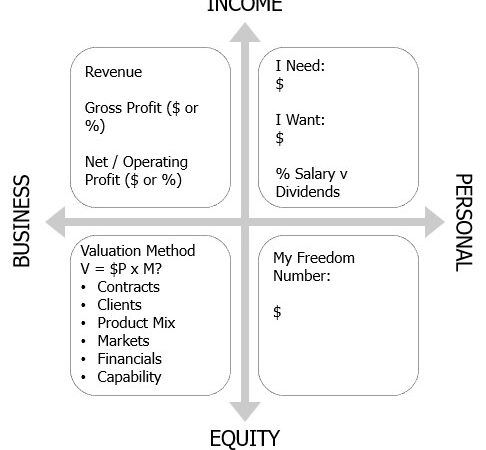

The easy way to think of Valuation is “V = P x M”.

Valuation equals Profit times a Multiple.

The Multiplier is a measure of Risk. (Some valuation methods divide by a risk factor … same conversation, and in math dividing by a percentage is the same as multiplying by an integer. If you need a 33% annual return to support your sale price, then you divide Profit by 33% … which is the same as multiplying it by 3).

If you are confident that a business will continue to provide a Profit for years to come, you will pay more!

In part this is why listed companies have a much higher valuation multiple – it’s unlikely that Amazon will collapse this year, but the local café might.

A topic for a future discussion is what “Profit” means. This is unlikely to perfectly match the Net Profit or Operating Profit on your P&L Statement, and is more likely to be referred to as “Adjusted EBITDA” or “SDE – Seller Discretionary Earnings”.

Most industries have a Standard Multiple. Some (where the cost base is either known or known to be wildly manipulated) are generally valued on Revenue not Profit.

As a generalisation, businesses in the US and Europe are valued higher than those in Australia – there’s more money around to buy you, and a much bigger market in which you can grow.

There are 3 different approaches to having your business Valued. These will each attempt to account for the risk and opportunity of your specific business.

Please note that this is different from the various accounting methods for valuing a business (Discount Future Cashflows and so on). Remember that a strategic acquirer in a competitive bid situation doesn’t care about the valuation, as long as the value makes sense to them.

[EDIT 2024: This year I helped one of my clients demonstrate this in an extreme way. He was restructuring his business so needed a formal Valuation for the bank – Category 2 below.

The qualified valuer set the value at 3x Profit (Adjusted EBITDA). Now this restructure was part of a deliberate Business Exit strategy we were running, and it triggered activity from multiple Strategic Acquirers – Category 3 below.

As a result we sold the business for 18 x Profit. The accountants understood the limits they were under, but this surprised even them.]

3 Approaches to Having Your Business Valued

1) Key Drivers / Desktop Valuation

The simplest approach is to take a Valuation that makes some assumptions about the health of your business and your industry, and can give some guidance on the key drivers you need to repair or leverage.

Some Accountants will provide this service looking at your financial statements and having a preliminary conversation. You can even use an online tool like ‘The Value Builder System’ to do this yourself!

This approach often yields a Valuation Multiple between 2 and 4 times an average of your last 3 years’ Profit. If nothing changes, the assumption is that most businesses are able to stumble forward for a few years before falling over. This valuation range reflects that.

2) Formal Accounting valuation

Have a chat to your accountants about their approach and service offering (and I could introduce you too, if it would help).

A formal valuation costs more than the desktop version, because the accountant usually assumes more liability for the number/range they provide you and therefore they want to get it right.

Expect a lot more manipulation of your Profit & Loss Statement and your Balance Sheet. This is the “adjustment” in “Adjusted EBITDA”, so looks at (for example) which costs an acquirer would not incur and which revenue or expenses could be reclassified in a way that increases profit, since ‘Higher Valuation’ is a different context to ‘Lower Taxes’.

This will likely provide you with a more specific Valuation number, and one that you can justify to an acquirer. It still assumes that your acquirer is looking to you for fairly standard reasons and will run your business in largely the same way moving forward.

It won’t (and under accounting standards, can’t) factor in any hidden assets that a strategic acquirer might value differently.

3) Strategic Valuation process

More expensive and thorough again is a process that will investigate some of those Strategic valuation opportunities. The Shirlaws Valuation Framework is a good simple example of how this can be applied (and one that I have some training in, though I am not a business valuer and do not profess to be one).

A Strategic Valuation considers the subjectivity of the Sale process, and how different potential acquirers might leverage your business asset in the future – a funded start-up vs established competitor, for example.

When pursuing a Strategic Valuation, it’s useful to use a company that can help with both the Valuation and the Sale – you want them in your corner during the negotiations, using their research and expertise to justify a valuation that’s higher than what an accountant may provide.

Strategic Valuation tends to be relevant are you approach or exceed the $5 million valuation. Smaller companies find it difficult to justify large strategic assets – if they have them, then why aren’t they a much bigger company already?

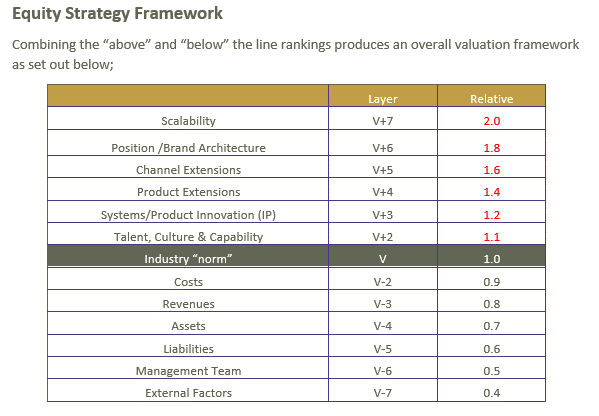

Shirlaws Valuation Framework

The Shirlaws Valuation framework looks at these strategic factors, based on their research and partnerships in the Valuation and Sale space (primarily in Europe and North America, so remember that Australian valuations are generally lower).

‘Above the Line’ factors increase the Multiple, especially when compounded (ie, you have each layer sequentially). Don’t get too optimistic about doubling or quadrupling your industry Multiple. You have done well in some areas which will help; the biggest opportunity is mapping out a plan to fill other gaps in the future … and then aim to value the business on that future, without having to do all the legwork yourselves.

‘Below the Line’ factors decrease the Multiple. The biggest ones are the Management Team Capability (ie, am I buying a business that runs itself or am I buying myself an income?), though be aware that the Standard Industry Multiple for coaching and consulting already factors some of this in; and the External Factors (short term, like a possible Recession this year, and long term like the ones that impacted Typewriter Ribbon sales).

Part of building your Equity Storyboard is painting a picture that shows all these factors in the best light (while remaining honest), and then tailoring the context to each potential acquirer and what they value.

Next Steps

Want to learn more about how this can apply to your business? It costs nothing to chat:

- Email me jacob@jacobaldridge.com (I read them all)

- Call, Text, or WhatsApp me +61 427 151 181

- Or just Subscribe https://jacobaldridge.com/about/subscribe-to-jacob-aldridge-com/ to stay in touch