I was born in 1981. This means I, and those born a couple of years either side, are singularly placed for our retirement plans to be screwed by a combination of demographics and economic cycles. The good news is we can, as individuals, do something about this (and collectively, we will still be able to blame the centenarian Baby Boomers).

One: 70 is the new retirement age

I’ve been saying for a decade that I care little about my superannuation total, because the government would shift my retirement age to 70. In this week’s Australian federal Budget, they’ve done exactly that.

Well almost – the retirement age has actually been changed to 70 for my parents! (To be fully accurate, by 2035 the Commonwealth Aged Pension will be available only to 70 year-olds. That’s the year my folks turn 72 and 73 respectively, so they will qualify aged 69).

By the time I reach age 70 (November 15, 2051), the goalposts may have moved again. 75 perhaps. Or more. I might see Halley’s Comet again before I can qualify for a government pension.

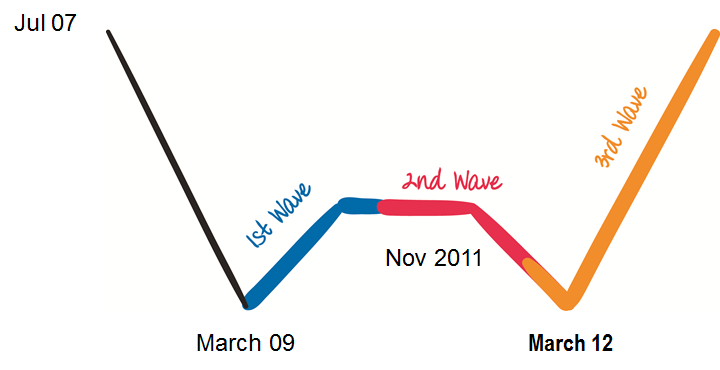

Another One: Western economies can expect a Double dip recession / global financial crises every 35-40 years.

If you want some great commentary about economic cycles and how to profit from them, go and download the e-book Thrive not Survive by Darren Shirlaw written as articles from the period 2007 – 2011. The key article you want is number 31: Ride the Second Wave on page 76, as this gives an overview (as does this more recent article, with pictures!).

Look at the mid-1930s. The mid-1970s. 2009 – 2014 (remember that?). All of these experienced the worst type of economic recession, the W-shaped Double Dip. Essentially two recessions, back to back.

Why is the W-shapred recession the worst type? Apart from being ‘twice as bad’ as a normal recession (which we see about every 7 years), in a business or work environment the W-shape is worse because most of us only see it once in our working lifetime so we are completely unprepared to manage it. Of course, your working lifetime only used to last for 35 years (Aged 20 – 55ish).

Now you’re working until 70. Remember?

So when is the next W-recession due? 35-40 years from now. Around the year 2051. How old will I be in 2051? 70.

One plus Another One Equals?

So yeah – all of my retirement plans, assuming I planned a standard retirement, are moving me towards having sufficient superannuation to retire at exactly the time the next massive financial crisis is scheduled, which could (as per 2008) wipe half my life’s accumulated investments away in a matter of months.

If you are my age and planning on working until retirement age, I would urge your to consider your plans.

WHAT TO DO ABOUT IT

Don’t plan to retire at 70. Retire young, retire rich, and never retire.

Have fun along the way. If you’re having fun and are set up financially so that you can retire when you want (or never, by choice) then who cares what the global economy does at about the exact moments those fellows born in nurseries beside you attempt to cash in their pensions. If you’re cashed up at that point, you’ll be sitting on a tropical arctic island drinking a fine 2021 red wine vintage from some region in France that wasn’t at that point ravaged by global warming.

Not sure how to do that? Subscribe to my newsletter, attend some of the events I recommend, and most importantly choose right now to go through life with the awareness that the world will collapse financially right at the time you least want it to. And so every financial decision you make between now and then will be done so in the knowledge that you HAVE to take control of your life.

The great news is that the world wants you to do that anyway. And you do have several decades of mistakes to make, learning along the way.

If you leave me, can I come too…? Click here to subscribe to my infrequent updates

If you’re Dustin Curtis, you should follow me on Twitter here.

And please tell your friends: Sharing is Caring