Part 1 of 5 – The Anatomy of a Selling a Small Business

March 2015

The Toasters were Grey; my Client wore Blue.

As my newest business advisory client and her husband came into my office, none of us were aware of the journey that would take them from 2 staff and $60,000/month revenue to a $5.8 million dollar payday.

‘Toaster Installers Inc’ installed toasters for a living.

(OK, not really, but I can either share with you the hard financials or I can tell you the client’s name, and frankly you’re way more interested in the financials.)

Suffice it to say that this was a typical family business:

- young couple at the helm

- doing great things in their industry

- but with no clue how to turn “doing great things” into “running a great business”.

They didn’t track revenue. They didn’t track profit. (“I just look at how many toasters we bought – that tells me whether last month was busy”.) And their ambition was ‘growth’ – they had never even thought that someone, somewhere, might one day buy their business and send them into blissful early retirement.

Late 2020

The toasters were a bit fancier. So was their office. And I was invited to pop the champagne as the deal was done – a $5.8 million sale, for a business with an average profit (EBIT – Earnings Before Interest and Tax) of $23,179 per year.

That’s $445 per week profit. Compared to $5.8 million in their pocket, zero tax owed. Which would you take?

If you talk to your accountant, they’ll tell you that the average small business in Australia sells for around 2-4 times Profit. And that’s assuming they can be sold at all, since most businesses are worthless to anyone other than the current owner.

We’ll explore the detail of that ‘Accounting Industry Limiting Belief’ in the coming days, but just let that settle for a moment – the average sale valuation in Australia is Profit x 2-4. We just sold the business for Profit x … 250!

Revenue is Vanity, Profit is sometimes Horseshit

Straight away, let me call BS on my own clickbait figure. While technically correct, it’s misleading.

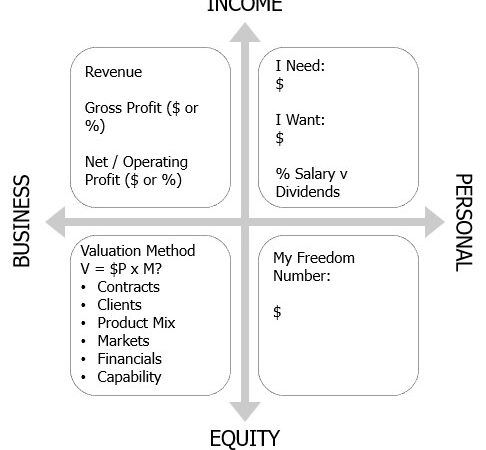

When preparing your accounting reports, there are often two competing Contexts: “Valuation Maximisation” and “Tax Minimisation“.

If your business value is a multiple of profit, and you want to improve your valuation, then you need to show more profit. But more profit means paying more tax, so if tax minimisation is your priority then you actually want to show less profit.

This is one reason why you generally want to start a Business Sale or Succession plan 3 years in advance – so you can show 3 years’ worth of financials that have a “Valuation Maximisation” context, not the less-profit outcome of “Tax Minimisation”.

Because Accounting whizjiggery can make all the difference. For Toaster Installers Inc, tax minimisation was the priority – the corporate structure and the Profit & Loss Statement reflected this. The profit on paper ($23,179 per year) wasn’t a real representation of how profitable the business was.

By 2020 the owners were non-operational (thanks to the projects I led them through, the day-to-day business mostly ran without them), but they still drew a $200,000 income. And there were other fairly normal things run through the books that a buyer would ‘add back’ to the Profit, like car and phone expenses the owners incurred which would not exist after they sold.

When you put these into perspective, the sale was ‘only’ a multiple of Profit x 26. Jacob lied to you!

Still – if you have a look at your business profit for the past year, taking into account your salary and other expenses that could be added back on top of profit … would you like to sell for 26 times that number?

Or would you prefer the accountant’s advice of 2-4 times profit?

Click here to read Part 2, all about valuation methodology principles for privately-owned businesses. (Alternative title: “He’s not an idiot, he’s just an accountant.”)

[…] Yesterday I introduced you to Toaster Installers Inc, the Australian business client of mine that I helped sell for a multiple of Profit x 250! […]

[…] Yesterday I introduced you to Toaster Installers Inc, the Australian business client of mine that I helped sell for a multiple of Profit x 250! […]

[…] here for Valuation = Unadjusted Profit x 250 | Or here for Part 2 on valuation methodologies, aka ‘He’s not an idiot, he’s just your […]

[…] (Click here for Part 1, Part 2, and Part 3.) […]

[…] so many overnight success stories, this was a deal several years in the making – going all the way back to the young couple doing $60,000 in monthly revenue who had no idea their business might one day be valuable enough to […]