There are a number of elements in a business that impact its valuation. These can be positive impacts (eg, new product lines) or negative impacts (eg, abnormally large liabilities on the balance sheet).

When I explain these elements to business owners, I talk about the two biggest negative impacts on Valuation as ‘Temporary Paradigm Shifts’ and ‘Permanent Paradigm Shifts’. In this context, a ‘paradigm’ is a way your customers and investors see the world – when it shifts, that will impact how they see and value your business.

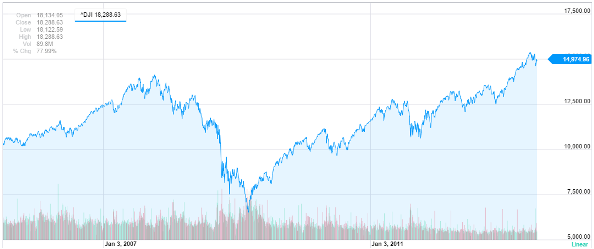

A temporary paradigm shift might be the recent double-dip recession. While we all believed our economies would recover eventually, at the time there was much uncertainty and so confidence and valuations dropped. A graph of the stockmarkets over the past 8 years shows both the drop and the recovery – it was temporary.

Click here for a good blog post on market trends and business.

A permanent paradigm shift doesn’t recover. The classic example is manufacturing whips for horse buggies (cars replaced buggies) or manufacturing typewriter ribbon (computers replaced typewriters). Companies don’t recover from these shifts, so their valuation is normally discounted by 95% or more.

Paradigm Shift Case Study: Kiko

Sometimes it’s hard to know whether the shifts in an industry are temporary or permanent, of course! Let’s take the example of Kiko – the YC-funded startup launched as the world’s first AJAX web calendar back in 2005/06. As I recall it, they were gaining traction and fans back in 2006 until one day the Google bomb was dropped on their business model: Gmail was adding Calendar functionality, and it was all going to be free.

This had an obvious and immediate impact on their business model and subsequently any Valuation they may have achieved. Their biggest challenge, however, was deciding whether Google Calendars was going to be a Temporary impact or a Permanent one. In the end, they decided it was permanent (ie, they would never be able to develop, sell and scale a calendar product while Google was giving one away) and so they sold their code base and went on to bigger and better things.

(That eBay auction valued Kiko at $258,100. A lot better than the $50,000 they thought they might get for their assets, and about the initial value YCombinator was using to value their early stage startups back then.)

Fast forward to February 2015, when Microsoft announced the acquisition of the calendar app Sunrise … for $100million. Kiko founder Justin Kan was full of praise, congratulating the Sunrise team for building “the calendar app I always wanted Kiko to be”.

So does this suggest that Google entering the market was only a Temporary shift – that Kiko could have survived and the team gave up too early? After all, they still had cash in the bank when they decided to exit.

The only ones who can really answer that question are those who were involved at the time. Would Kiko have evolved into Sunrise (which everyone acknowledges is a far better product)? Maybe they were simply too early to the space (the original iPhone wasn’t announced until 2007)? And any assumptions about what might have been need to account for the fact they would have to had slogged through the Great Recession, regardless of whether you consider Silicon Valley to have been immune.

Given the team’s subsequent success with Justin.tv, Twitch etc, I suspect they were glad they made the decision they did, even if ultimately it could be argued that they quit too soon. I have nothing but the utmost respect for every startup entrepreneur / team who backs their own decisions to launch … and to deadpool. So let he who casts the first stone make sure they’re only doing so from a platform of their own $100MM exit.

Two critical #startup #entrepreneur tips: 1) Fail fast 2) Never give up

— Jacob Aldridge (@jacobaldridge) September 17, 2014

If you leave me, can I come too…? Click here to subscribe to my infrequent updates

If you’re Dustin Curtis, you should follow me on Twitter here.

And please tell your friends: Sharing is Caring