Business Risk Profile Part 2. In Blackboard Fridays Episode 14, Jacob talks about leadership. Need this implemented into your business? Talk to the international business advisor who can do exactly that – Contact Jacob, Learn More, or Subscribe for Updates.

Who is Jacob Aldridge, Business Coach?

“The smart and quirky advisor who gets sh!t done in business.” Back independent since 2019.

Since April 2006, I’ve been an international business advisor providing bespoke solutions for privately-owned businesses with 12-96 employees.

At this stage you have proven your business model, but you’re struggling to turn aspirations into day-to-day reality. You are still responsible for all 28 areas of your business, but you don’t have the time or budget to hire 28 different experts.

You need 1 person you can trust who can show you how everything in your business is connected, and which areas to prioritise first.

That’s me.

Learn more here. Or Let’s chat.

Transcript

Hi! Jacob for businessDEPOT here talking a little bit further about the topic of risk profiling and how it impacts business partnerships, business leaders, and couples who are in business together.

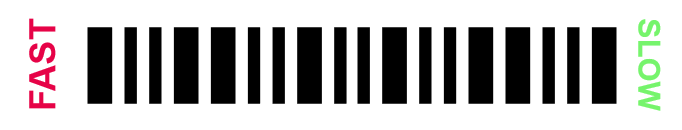

In the last video, we talked about the very simple scale of your risk profile from 1 to 10 and how people with a different overall appetite for risk can disagree about behavior and decisions within the business and that can create tension and holds a business back. I recommended that you go to this link to do the compass risk indicator. Part of the reason for that is that will not just give you that top line score, which you can then objectively compare with your business partners, but it will also break down your risk profile into these four categories cause not all risks are created equally.

We break the risk first into two aspects. First is what you do before you make an investment decision and second is what you do after you make an investment decision. Remember we’re talking about this in a business context. Investment may be things like new products, new premises, recruiting new staff members. We’re not talking about your personal investment.

The first element is your investment risk profile. In other words, what level of due diligence do you like to do before you make a decision? If you’ve got a low risk profile there, you’re going to do a lot more research before committing. A high-risk profile there means just making decisions off gut feel.

Returns is about how much of a risk you’re willing to take to chase bigger returns. Are you always looking for the things that are going to double your money in 60 days or less? Are you quite comfortable doing things that are going to give you 10 to 20% incremental growth within your business? There’s no right or wrong with any of these scores but if you’re not aware of where you’re sitting, you can’t change your behavior or have a conversation with your fellow business partners around where there are those differences and what problems those are causing.

After you’ve made an investment decision, you have two more categories. Fourth is volatility how much will you tolerate the ups and downs that come with the decision that you’ve made? You put on a new staff member and they call in sick in their second week, does that mean they’re out the door immediately? If you’ve got higher risk profile in that volatility space, you’re much more likely to let it ride. The last one is management risk is how carefully do you monitor the investments that you’ve made.

Really interesting comparison, I had with a couple that were in business together and they had a lot of frustration around investment decisions because he was very quick to make decisions and she would get frustrated that having decided, he would then second guess it. We used this exercise and identified that for her, she had quite a low investment risk whereas his was quite high. She would do a lot of due diligence before making the decision. On the management risk side though, it was almost the other way around he had a very low risk score there and she was quite high.

In general, their balances balanced out. She would do the due diligence before deciding and then be quite happy to let it ride. He would make the quick decision but then would very carefully monitor to make sure he got the outcome that he wanted. Once we identified that they approached the same decision, the very similar overall context, but just in a different way, that were much more able to go forward without the frustration and stress that came with her holding him up and then him getting in her way on going.

Once again, I’d encourage you if you’re in business with fellow directors or a partner to get all your business owners and your leadership team to take this risk profile test to get an understanding of where your behavior is today and how that might be impacting decision-making and communication across your team. I’d also love to hear from you if you’re interested, in an analysis of that. Maybe even running some workshops with your team about this and the other elements of leadership behavior, the way we see is such a critical context for growing a business.

Next Steps

Want to learn more about how this can apply to your business? It costs nothing to chat:

- Email me jacob@jacobaldridge.com (I read them all)

- Call, Text, or WhatsApp me +61 427 151 181

- Or just Subscribe https://jacobaldridge.com/about/subscribe-to-jacob-aldridge-com/ to stay in touch

[…] Episode 14, Business Risk Profile Part 2 – https://jacobaldridge.com/business/business-risk-profile-part-2/ […]