Mark Riley (Journalist): Is Australia in recession today?

John Frydenburg (Treasurer of Australia): … Yes

Every Friday I prepare an Economic Snapshot – to track the Recession, pinpoint the Recovery, and help you make better decisions in your business. Subscribe here for updates by email.

When even the government says we’re in Recession, you know it’s real!

For those who are new – welcome to “Don’t Waste a Good Recession”. I publish three programs on my YouTube channel:

- A Weekly Economic Snapshot to help you make better business decisions

- A case study series on what other businesses have done through recessions in the past, and

- Longer videos with positive and practical guidance for businesses with between 2-500 employees whether they’re diving, surviving, or thriving during this recession

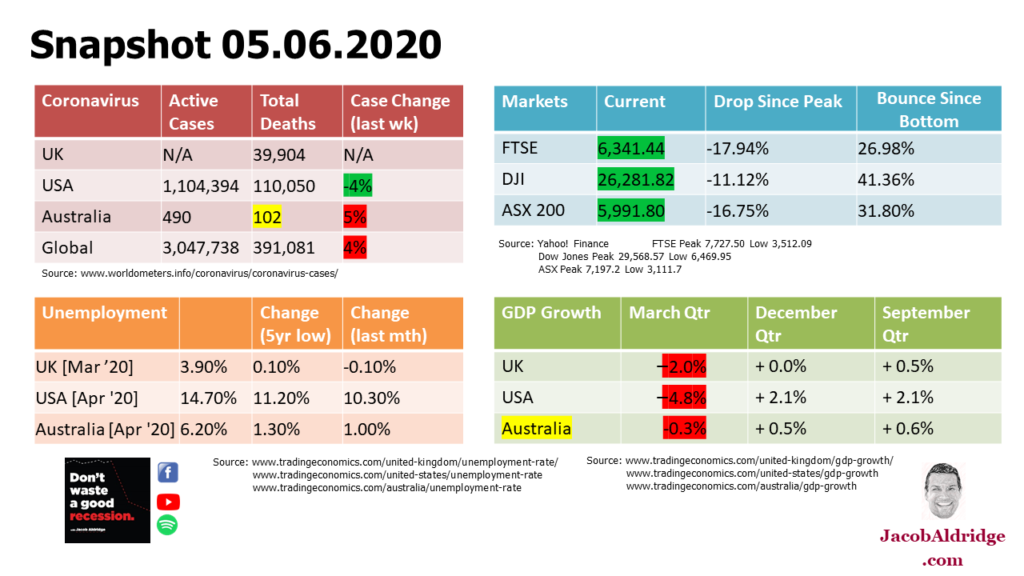

Here is the data for our four indicators this week:

- Active Coronavirus Cases. Two things to note this week: in the USA for the first time the number of active coronavirus cases has actually declined week on week. It has started to trend in the right direction. In Australia for the first time in two months that number has actually gone up, although the difference is slight and is believed to reflect the repatriation of citizens from overseas as opposed to community transmitted cases.

We also had in Australia the interesting situation where the total number of deaths from COVID-19 has declined this week. There was one high-profile case in the state where I live, Queensland, which on further investigation after his unfortunate death was shown to not have been COVID-19. So the number of total deaths in Australia was actually revised down from 103 to 102 – it went backwards this week. - Stockmarkets continued their upward trajectory, though again it was a small rise for this week.

- No new Unemployment Data

- The big news of course as we’ve led this week’s economic snapshot with is the release of Australia’s March quarter GDP Growth numbers, which showed a contraction of 0.3% for Australia.

Australia in Recession

That’s only the fourth negative quarter Australia has had in 25 years! So even though it’s not an enormous decline, especially sitting there compared to the UK and the US, that is actually quite a significant outcome within the context of Australia’s economic history.

The confirmation from the treasurer Josh Frydenberg that the June quarter is expected to be much worse (as indeed it is across most of those other countries) would suggest that the rest of 2020 for most smaller medium-sized businesses in Australia is going to be a time of challenge that we haven’t faced in the wider economy for more than 30 years.

Some of that is the actual economic situation. The largest part of it is going to be sentiment. We patted ourselves on the back through the global financial crisis by not going into a technical recession, and it’s unclear really how Consumer and Business Confidence are going to respond to the official news that we are in recession.

Of course – there are always opportunities in a recession! That’s where the theme of my channel originates. It’s not to fight it, not to resist it, not to deny that it exists. Instead ask yourself: what are the opportunities? How can I make sure that I don’t waste a good recession?

Is this the Recession we had to have?

I’m not a permabear. While I’ve been preparing my clients for this recession since late 2018 (and congratulations to two of them who have just had record months for both revenue and profit) I do feel that this point in the cycle is just a blip. We are currently in the middle, painful part of a longer 20-year bull run that’s going to continue right the way through another Roaring Twenties.

So is this recession like another Australian Treasure Paul Keating famously said?

“The first thing to say is that the accounts do show that Australia is in a recession. The most important thing about that is that this is a recession that Australia had to have.”

Paul Keating, 1990

No.

The Coronavirus Recession is not “a recession we had to have”. Modern Fiscal Policy means that the technical definition of a Recession (two consecutive quarters of negative GDP growth) is preventable.

Back in March I observed that the Australian government seemed to be slow-walking their stimulus package. They seemed to have given up on the March quarter because of the bushfires, and were trying to push all of the stimulus to arrive only at the beginning of April to goose the June quarter numbers and hopefully avoid a technical recession.

At the time, it still wasn’t clear how severe the Pandemic would be of course – they were still hoping it might be contained in the June Quarter.

That the Australian economy only contracted by 0.3 percent in the March quarter suggests that had they moved faster, had they made some slightly different decisions, they may even have managed flat or a “Kevin Rudd +0.1% Special” to have avoided a Technical Recession.

But the gist of a recession – an economic slowdown, a downturn, a spike in unemployment, that shock to the system – that is inevitable. And it’s a good thing.

Something to Celebrate!

So is there something to celebrate this week? Well not a Recession of course! But if we’re looking for silver linings, if we are looking for something to celebrate, then I will note that tomorrow is Queensland Day.

Queensland Day, the 6th of June, celebrating the 6th of June 1859 when Queensland broke free of New South Wales, the 161st anniversary of our colony which became an Australian state in 1901.

And it’s fitting that this year we’re celebrating with our border to New South Wales still closed. Something maybe we should have done 161 years ago and kept closed?

For all my Queensland friends around the world: Happy Queensland Day!

For you wherever you are watching, reading, or listening: thank you as always for tuning in.