Are You Building Wealth via Your REAL Business? In Blackboard Fridays Episode 124, Jacob talks about Commercial Vision. Need this implemented into your business? Talk to the international business advisor who can do exactly that – Contact Jacob, Learn More, or Subscribe for Updates.

Who is Jacob Aldridge, Business Coach?

“The smart and quirky advisor who gets sh!t done in business.” Almost $50 million in closed client sales.

Since April 2006, I’ve been an international business advisor providing bespoke solutions for privately-owned businesses with 12-96 employees.

At this stage you have proven your business model, but you’re struggling to turn aspirations into day-to-day reality. You are still responsible for all 28 areas of your business, but you don’t have the time or budget to hire 28 different experts.

You need 1 person you can trust who can show you how everything in your business is connected, and which areas to prioritise first.

That’s me.

Learn more here. Or Let’s chat.

Transcript

Mo’ Money, Mo’ Problems: The SME Trade

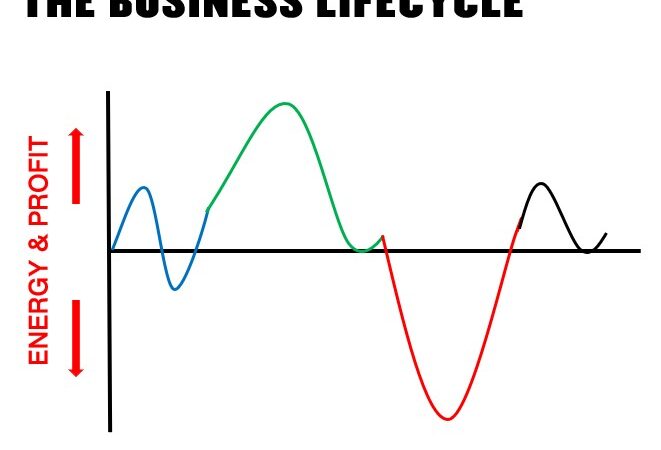

My belief, certainly my experience over well over a decade of business coaching around the world, is that there is no asset class with more potential to grow your wealth than through private enterprise, through owning your own business. And yet, for an awful lot of small and medium-sized business owners, the business is actually a drain on their finances.

They still have this aspiration, this hope that one day they will be able to sell. But they live in a reality where that’s just not a reality. Where short-term cash flow needs are creating pressures.

What I want to do in this episode is help shift your mindset.

If wealth creation is part of what you want to build for your life and your family then this is absolutely a must watch.

Your Current Business

We’re going to start over here with your current business. If you’re like most business owners, you have one business. This is your focus.

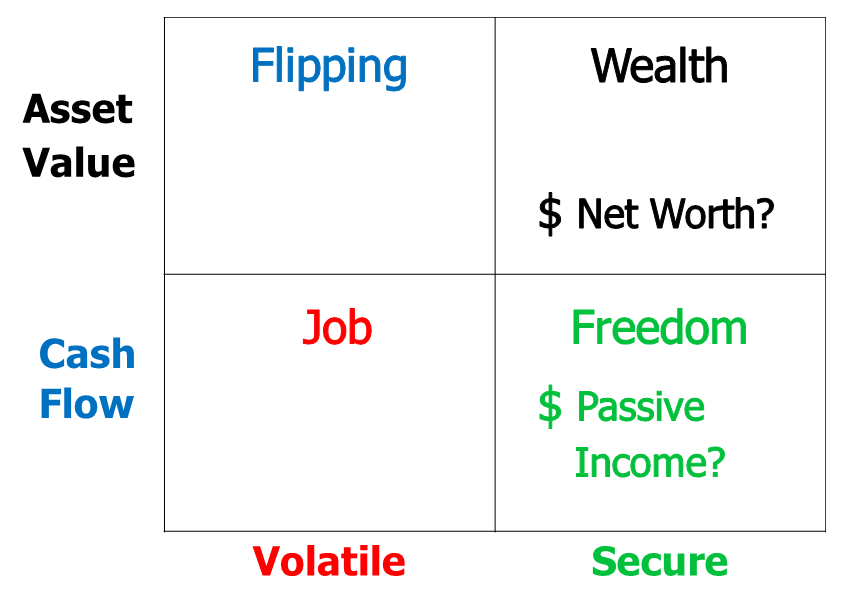

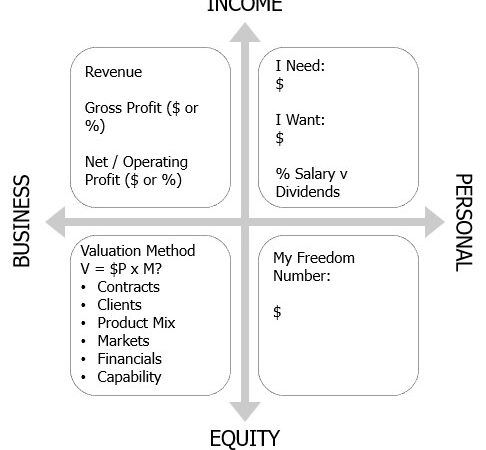

The first question you’ve got to ask yourself is “Am I running this business as an Income business or as an Equity business, where it actually has value and the potential to be sold one day?”

Most business owners have a dream of selling their business. But in reality, they’re not doing anything to actually significantly make their business worth any kind of value or investor-ready.

Do You Spend-Save or Save-Spend?

When it comes to the money that comes into the business, do you spend what comes in and and save (reinvest) what’s left over? Or do you invest first, take that off the top and then set a budget based on whatever might be left?

It’s a little bit like the home budget. There’s an awful lot of families who save whatever’s left at the end of the month … and surprise surprise, that there’s never any money left at the end of the month. (Sometimes there’s too much month at the end of the money, and I’ve met a few businesses like that too.)

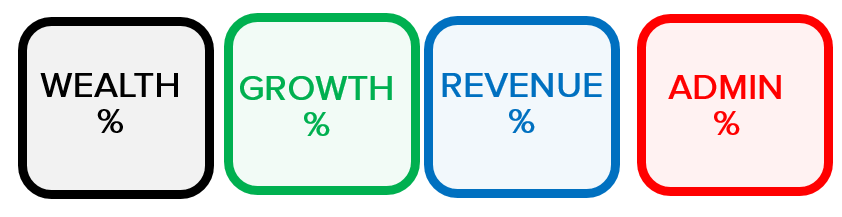

So in your business, what I’m going to encourage you to do, is to start to ring-fence, to take a portion, maybe it’s 5%, 10%, off the top, that you’re going to put aside for reinvestment.

Here’s the mental exercise I need you to do right now.

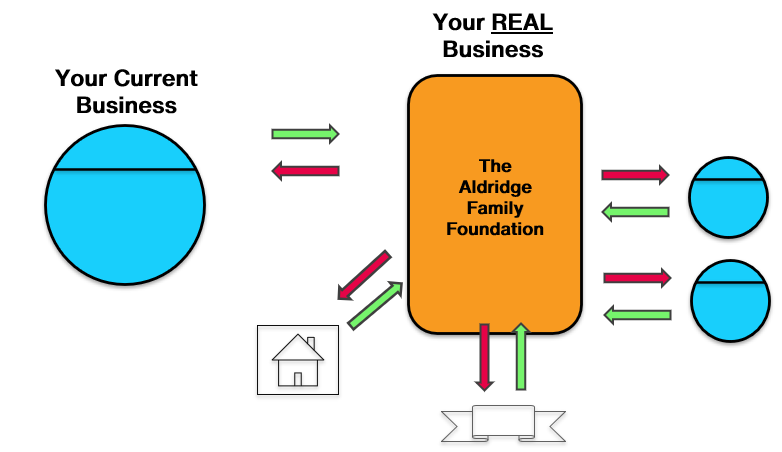

Understand that your current business is not your real business. Your real business is separate, what I’m calling in my case the Aldridge Family Foundation. Now don’t get caught up on structures like Foundations, Trusts, and so forth – mentally just understand that your family wealth, your REAL business, sits in a separate conversation to your business.

Creating Wealth Through Your REAL Business

This is where your real wealth is going to be created. So you’re now taking out some of the money from your current business and parking it in the Family Foundation for reinvestment.

At first, you are only doing this movement of money mentally. You don’t actually have to transfer it out of a bank account, you don’t necessarily want to send it from your company into a family trust or any of those kind of things that might trigger tax issues.

Mentally, I want you to think, if I take that money (let’s say it’s a $100,000), and I take it out of the business, and I ring-fence it in the family foundation: where is the best place for me to invest that $100,000?

Now as I say, in my experience the best returns are almost always back in your business. That’s why I say you don’t actually have to transfer any money, you just mentally have to make that decision.

If you’re going to get a better return by investing in property, investing in shares, rather than going back into your business, then do that. If your business has potential for growth to create future income, future equity value, then absolutely invest in your business and get that growing.

A 2025 Case Study for Business Reinvestment

12 months ago I spoke with a couple at a crossroads: they had an offer to sell their business for $3 million, which was awesome but not enough to retire. Their plan was to take the money and invest in shares while they kept working for another 10 years – figuring by then their $3 million would be worth $6 million.

Instead, they decided to invest in my coaching back into their business. We’re now in conversations about selling the business for $4 million – they’ve made $1 million tax free in a year, compared to $3 million over a decade investing elsewhere.

There are good family reasons why they might take today’s offer; but they’re also very tempted by the idea of selling for $5 million in 2026!

Income Follows Assets: When You Have Too Much Money

Eventually, because of the business growth you’re creating, because you’re reinvesting, you’re going to have surplus money that is available. The business doesn’t need an infinite amount of money to be invested, at some point external returns become attractive if only for diversification purposes.

Hot Tip: Retail investors love the concept of “Diversification”. Many seem to think it’s a magic bullet or a free lunch, that “more diversification” means “better returns”. They are wrong. Diversification is a “risk management” decision – and as we know, higher risks are necessary if you want higher returns which is why less diversification and more business focus can lead to a much, much better ROI.

With your surplus you can start to build your portfolio. If you go back to one of my very first episodes I looked at the Wealth Quadrant for Business Owners, and I talked with you about the Wealth Quadrant being where you build all of your different assets – the top right corner being where most of your Family Foundation assets are controlled.

So maybe you’ve got a house, maybe you’ve got an investment property, maybe some shares that you own. And each of these you’re investing in, and over time, they’re generating a return.

Look at the Foundation diagram again, and the Green Arrows – those investments are bringing money back into the Family Foundation, that allows you to continue to reinvest, to continue to make more choices. In fact some of those choices may be to set up other businesses, become a portfolio entrepreneur who has this one business, which was your first business, but it’s no longer your only business.

Nurture Your Wealth Mindset

It’s no secret I love coaching portfolio entrepreneurs, those (usually high net worth) individuals who own more than one business. Done well, those business investments magnify your energy – done poorly, of course, they wear you down in a way that more-passive investments never will.

This wealthy mindset begins by not just focusing on your business today but focusing on the wealth of your family and the potential to have multiple assets for the future. This has the benefit of helping you create long term sustainable wealth, which is probably part of the reason why you started a business in the first place, and also has a benefit for your current business today.

Because when you start thinking long term, when you start making decisions based on equity, not short term income, your business will be better for it, your family will thank you as well.

Next Steps

Want to learn more about how this can apply to your business? It costs nothing to chat:

- Email me jacob@jacobaldridge.com (I read them all)

- Call, Text, or WhatsApp me +61 427 151 181

- Or just Subscribe https://jacobaldridge.com/about/subscribe-to-jacob-aldridge-com/ to stay in touch

[…] Episode 124, Are You Building Wealth via Your REAL Business – https://jacobaldridge.com/business/are-you-building-wealth-via-your-real-business/ […]