Wealth Quadrant for Business Owners. In Blackboard Fridays Episode 5, Jacob talks about Commercial Vision. Need this implemented into your business? Talk to the international business advisor who can do exactly that – Contact Jacob, Learn More, or Subscribe for Updates.

Who is Jacob Aldridge, Business Coach?

“The smart and quirky advisor who gets sh!t done in business. I’ve helped more than $50 million in business exit transactions.”

Since April 2006, I’ve been an international business advisor providing bespoke solutions for privately-owned businesses with 12-96 employees.

At this stage you have proven your business model, but you’re struggling to turn aspirations into day-to-day reality. You are still responsible for all 28 areas of your business, but you don’t have the time or budget to hire 28 different experts.

You need 1 person you can trust who can show you how everything in your business is connected, and which areas to prioritise first.

That’s me.

Learn more here. Or Let’s chat.

Transcript

Hi! I’m Jacob Aldridge, international business coach. Today, I’m talking about Wealth: the Wealth Quadrant Framework for business owners.

What’s Your Number?

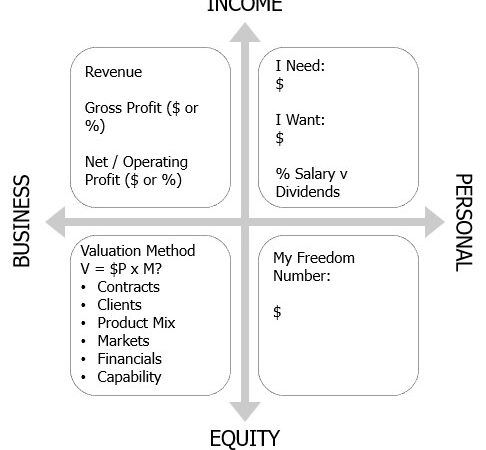

When I sit down with business owners, whether at the start of their business journey or towards the end, maybe they’re starting to think about selling, one of the key questions I always want to know is “What’s Your Number?”

What I’m really asking is, “What is the dollar amount that you feel you need to have sitting in your wealth quadrant in order to retire and to live the rest of your life with the freedom to do whatever it is that you want?”

When I analyse this for most business owners, quite often that number ends up being a whole lot smaller than they expected. In fact, recently, I had a conversation with the business owner and we went through this and realised that based on the valuation of his current business, he had already in fact reached the number that he wanted to live on forever.

Here’s the conversation and a little bit more of the structure behind it.

The Wealth Quadrant Framework for Business Owners

So, this framework is what we call the Wealth Quadrant.

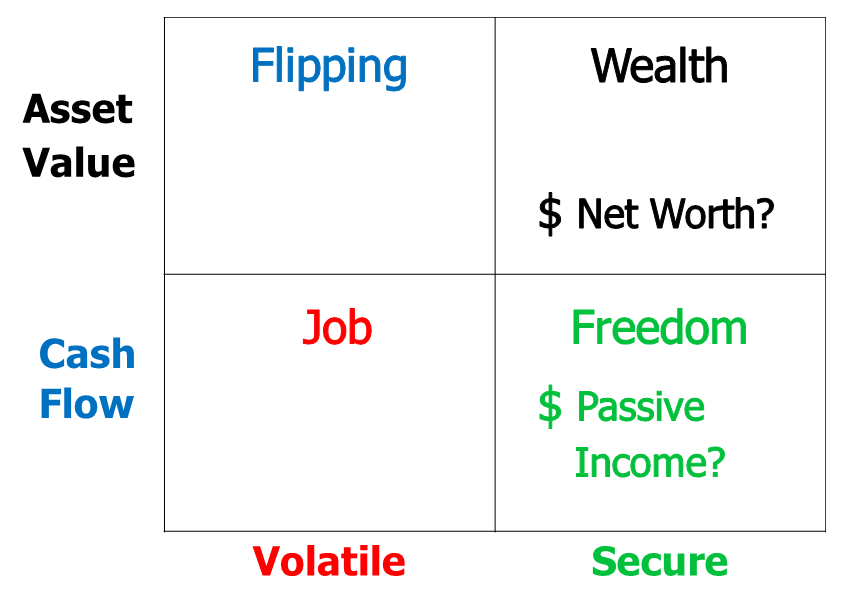

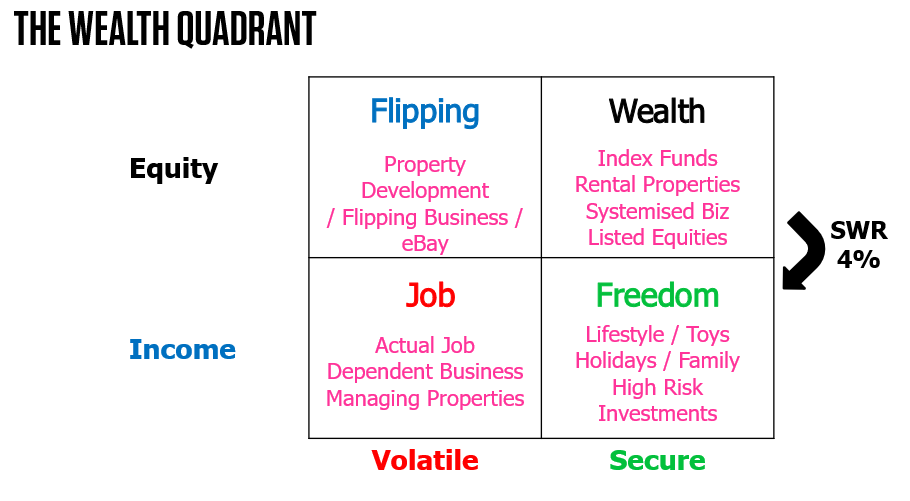

What we’re looking at is four different types of money and financial assets that sit within your life.

- Some of them are Volatile, lots of short-term ups + downs, unpredictability;

- Some are a lot more stable and Secure.

Similarly,

- Some will provide an Income–oriented Cash Flow; and

- Some are more Equity based Asset Value.

The Job Quadrant: Volatile Income

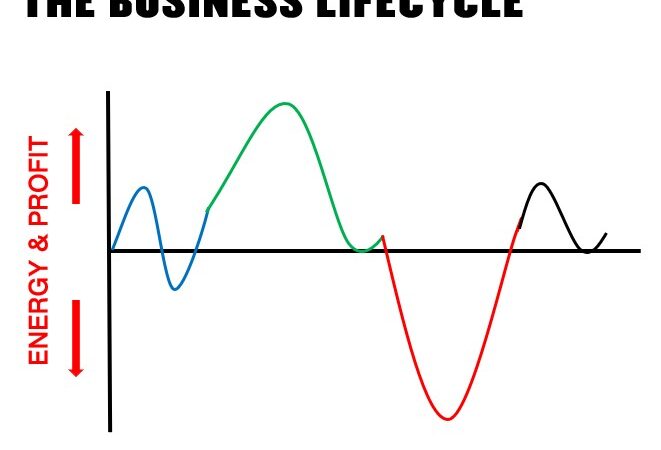

Most of us start our life in the Job Quadrant … and many small and micro business owners are still actually sitting in the Job Quadrant. Their income is Volatile. They’re not confident about what revenue they’re going to have coming in in 3, 6, 9, or 12 months’ time.

This is a quadrant that is inherently filled with anxiety and anxiousness. The reason we as business owners put up with that anxiety is because we believe that we’re building something of value for the longer term. We’re optimistic that one day we’ll be able to sell this business and as a result, all of those years of anxiety and volatile income won’t matter because we will have that wealth.

The Wealth Quadrant: Long Term Secure Assets

Of course, up in the Wealth Quadrant there are other forms of equity that you could be building: Investment properties, portfolio of diversified index funds, shares, bonds – the kind of things I also mentioned in my video and article Are You Building Wealth Through Your Real Business?.

You could even have a systemized business that is not dependent on you at all, sitting up here providing you with some long-term value.

So when I work with my business owner clients to genuinely build your business, not just create a quick fix for income purposes, what I’m looking to do is take that volatility and uncertainty and create systemization and stability.

Exactly what projects and processes we go through will depend on exactly what your number is – in particular, I’m always looking for ways to increase your valuation multiple not just your normalised net profit.

The Flip Quadrant: Creating Rapid Equity

There are other ways, of course, to build equity: like Flipping.

Flipping houses, investment properties, property developments, day trading, are all different ways that people create short-term volatile equity opportunities. It’s even possible to Flip Businesses – indeed, that’s the model for many private equity companies who never achieve a positive cash flow return but are able to acquire cheap and exit for a large capital gain.

The Freedom Quadrant: What’s It All About Alfie?

What you’re really looking for from this Wealth Quadrant concept … is an idea of what Freedom looks and feels like for you…and what that costs.

At the end of the day, your financial situation is not an end of itself – it’s a means to an end. Financial wealth creates the freedom and choice that you want for your family for the long term.

What I encourage you to do is have a think about how much money you actually need to live on each year to fund the lifestyle that you want. And really think about it – especially if, like me, you have kids and some investment debt that would be gone in this ‘financial independence’ scenario.

One of the benefits of doing a household budget is that you’ll often find a lot of the gut feel assumptions we make about what we need to live on are rounded up.

It’s much bigger particularly when you look at things like paying off a house, no more school fees for children, and even just the day-to-day commuting and lifestyle costs that you may have built in while you’re running the business. You may find that freedom to travel, to be philanthropic, to do things that you want to do with your time actually cost a lot less than you currently need for your lifestyle.

Connecting Your Freedom Cash Flow Number to Your Wealth Quadrant Net Worth

Now we take this figure and we relate it back to the Wealth Quadrant – your Net Worth.

There’s a body of research that suggests to be super safe (it’s described as “exceedingly conservative behaviour”) you can draw Four Percent of your net worth every year to fund that lifestyle. In other words, if you need $120,000 a year, you need $3,000,000 in net assets. ($3,000,000 times 4% equals $120,000).

Over a 40+ year time frame without ever wanting to work again, maybe 4% could be a medium risk approach. People with a low-risk appetite might target 3% – they need more in the Wealth Quadrant because they’re drawing a lesser amount, lower percentage, each year to fund the Freedom Quadrant.

Many business owners like myself and my clients find that they’ve got a higher risk profile, and also a desire to continue contributing to society in a way (like starting or investing in other businesses) that can be lucrative in the long term. You may want a 5% withdrawal rate, which means you need a smaller amount in the Wealth Quadrant to fund that year after year after year.

I Won’t Retire Like My Grandfather

The great thing about the freedom quadrant is that it doesn’t necessarily mean retirement.

In fact, like many business owners, I know have no plans to retire in the traditional sense; however, what I want for my family is to make sure that we have choice, freedom, and flexibility in our life – independent of a need for short-term, volatile cash-flow.

As long as your business is keeping you sitting in the job quadrant, volatile, uncertain, a little bit anxious, you will struggle to see the opportunities and the dreams that are sitting in front of you.

Como Business Coaching has a mission statement that drives us: Freedom Through Business. When I work with my clients, it’s not just about helping their business for the short term. It’s helping you to create long-term wealth so that you can live the life of freedom and impact that you really want to live.

Next Steps

Want to learn more about how this can apply to your business? It costs nothing to chat:

- Email me jacob@jacobaldridge.com (I read them all)

- Call, Text, or WhatsApp me +61 427 151 181

- Or just Subscribe https://jacobaldridge.com/about/subscribe-to-jacob-aldridge-com/ to stay in touch

[…] that help define where you want to go as a business, and with your personal life. Connected to the Wealth Quadrant episode, we also talk in both Income and […]

[…] Episode 5, Wealth Quadrant for Business Owners – https://jacobaldridge.com/business/wealth-quadrant-for-business-owners/ […]