The Horrible Cost of Thinking Culture is Vision. In Blackboard Fridays Episode 78, Jacob talks about Commercial Vision. Need this implemented into your business? Talk to the international business advisor who can do exactly that – Contact Jacob, Learn More, or Subscribe for Updates.

Sometime after the ‘Greed is Good’ meltdown of the late 1980s, management theory finally realised that there’s more to life than money … and how relevant that is for business.

As business owners we make decisions based on gut feel not perfect logic, and our team members stay because they’re happy as much as they stay for the paycheque. But increasingly I’m seeing this “Culture eats Strategy for Breakfast” philosophy send companies in the wrong direction.

This is particularly true if you have ever run a Vision exercise for your business that was solely focused on the Cultural side – Mission, Values, Purpose, Intent and so on. This is just as one-sided as creating a business based solely on how much money you can make, and it’s just as unsustainable.

So in this week’s episode, which you can watch below, I give you permission to TALK ABOUT MONEY. To connect with your deepest, capitalistic dreams and to put up some dollar figures that help define where you want to go as a business, and with your personal life. Connected to the Wealth Quadrant episode, we also talk in both Income and Equity.

Business is never ‘just’ about the money; critically, it’s never ‘just’ about the Culture either. So whatever your Cultural Vision, use this week’s framework to ensure your Commercial Vision connects.

Who is Jacob Aldridge, Business Coach?

“The smart and quirky advisor who gets sh!t done in business.”

Since April 2006, I’ve been an international business advisor providing bespoke solutions for privately-owned businesses with 12-96 employees.

At this stage you have proven your business model, but you’re struggling to turn aspirations into day-to-day reality. You are still responsible for all 28 areas of your business, but you don’t have the time or budget to hire 28 different experts.

You need 1 person you can trust who can show you how everything in your business is connected, and which areas to prioritise first.

That’s me.

Learn more here. Or Let’s chat.

Transcript

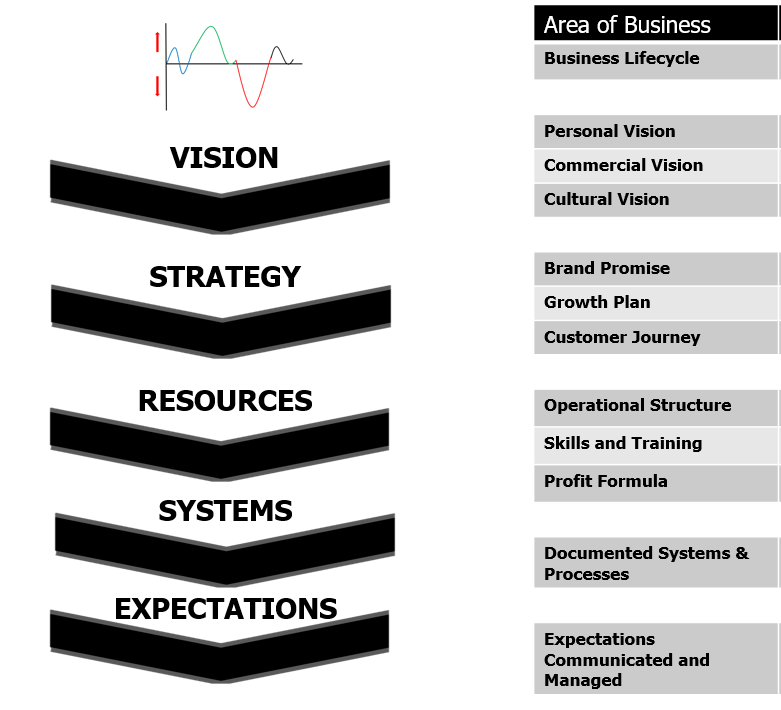

Today starts near the beginning, at those Layers of Context, the key decision-making filters that drive every aspect of your small to medium business.

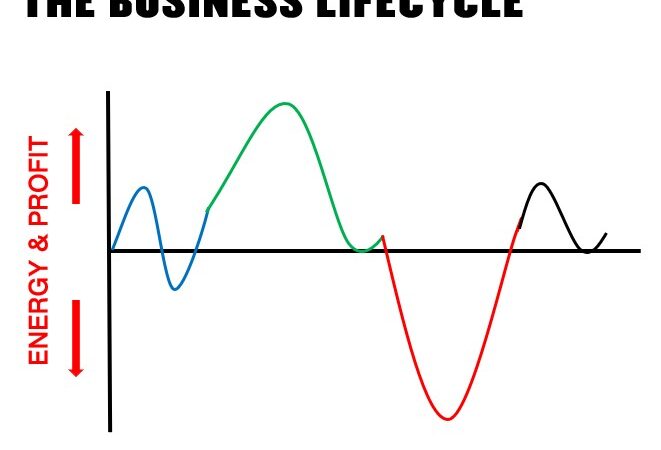

Sitting just below the Business Lifecycle, the top Layer of Context is your Vision: Personal, Cultural, and (as we’ll discuss today) Commercial.

I talk sometimes about how Strategy, the second layer of Context, is like going on a road trip – where your Vision is the destination.

If I jump in a car here in my home city of Brisbane, with no idea of where I’m going to drive, well I might end up in Cairns or I might end up in Melbourne. And I certainly don’t feel like packing for both.

With your business it’s the same: having a clarity of vision that you and (most importantly) your team understand ensures that all of the stuff that’s going on in your business is guided and informed by where your business is headed.

The 4 Corners Commercial Vision Framework

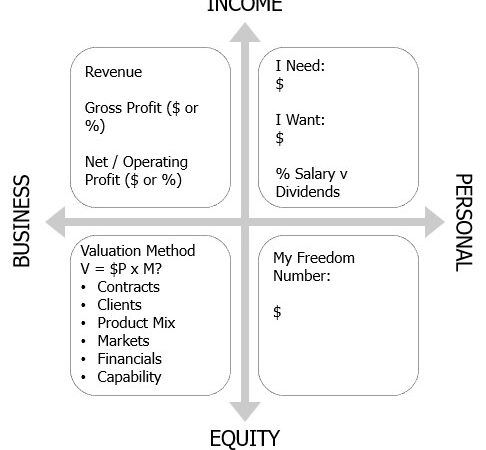

This is a simple and powerful framework that I use to help business owners articulate all 4 Corners of their commercial vision for them. Less colourful than most of the Como business frameworks, because at this point we’re purely in the black.

This seemingly straightforward matrix asks just four questions (see below), but let’s take a moment to understand the diagram.

First, we have separated Equity and Income. If you go back and watch the Wealth Quadrant episode, one of the very, very first Blackboard Fridays episodes we did, I talked about the critical difference between equity and income to ensure you achieve the financial security you need, to have the freedom in life you want.

The other axis separates Business and Personal. I’m helping you to understand that the business commercial goal is connected to your personal objectives, and yet the two of them may be separate – particularly if you have business partners on this hand, or life partners over on the Personal side.

Answering the Commercial Vision Questions

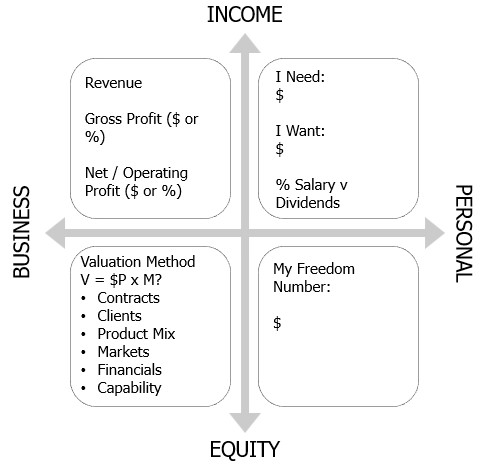

Here is a version of the matrix with the key questions asked.

So which corner do you start with?

At a fundamental level, it doesn’t matter where you start (though I provide a more guided process below). When I do this activity for most business owners – especially those portfolio entrepreneurs who own more than one business – one of these 4 Corners jumps out most. Some people immediately want to talk about the amount of revenue they dream of one day generating in the business; or potentially the amount of income that they want to bring home.

Others are much more equity-oriented – it’s very clear in their mind that one day they want to sell this business for however many million dollars. While this is usually “a round number vision” – which I’ve talked about in previous episodes means it’s been driven by ego and not fully examined – whether that’s one million, ten million or a hundred million it’s a good business equity target for you to start with and build upon when you do your Strategic Capacity Planning [2024 Update: That link now goes to a video of my recent webinar on Strategic Financials and Capacity Planning].

I actually don’t talk to too many business owners who think about the equity they need in their personal life – the personal net worth you’re building outside of the business. This is a mistake – you do not want to be one of those many business owners who only discover when they go to retire and sell the business that their “10 million dollar business” is actually only worth $8 million or $2 million or $0.00 and they haven’t actually built personal equity outside of the business.

Stepping through the 4 Corners Commercial Vision Exercise

Step 1. The Personal Income Corner

If you’re not sure where to start, or would like a guided walk through, then let us begin at the top right hand side – the Personal Income corner of the Commercial Vision framework.

You will notice two key questions in that Corner: How much money you Want, and How much money you Need.

Understanding the difference between your personal Wants and Needs is pivotal. With no awareness of the difference, you will spend everything you earn and have no money remaining to invest in equity, which is your future income.

I don’t judge “Needs” – you might “need” $200 a week to buy ramen, and you might “need” $20,000 a week because of the Notting Hill mortgage, public school fees, university savings, and aging parents in care. The important thing is that you are honest with yourself and your business/life partners.

Also be clear about how much you “Want” to be earning. And be specific – we’d all love to do less work and earn a billion dollars a week. But what is the vision you aspire to? We will return to this in Step 4.

My personal wants dollar figure is inflation adjusted by being defined as “A weekly income equal to two return Business Class flights from Brisbane to Paris”. When I set that vision in my early 20s it was a much smaller number than the [Edit: 2024] number of $15,742.

Step 2. Business Income aka Profit

As a business owner, your Personal Income is delivered by … your Business Income (top left hand Corner).

Now, this is a Vision exercise so rather than dig into the specifics of your Free Cash Flow, we’re just going to set a Net Profit number with buffer. Your Net Profit Vision needs to cover two specific amounts:

- Your Personal Income Needs

- The Surplus cash you want to reinvest back into Business or Personal Equity Corners

Needless to say, if you Need a Personal Income of $200,000 per annum, then you can’t also target a $200,000 Net Profit in your business. Not if you want any buffer, or any ability to invest and grow. Trust your intuition, and if that fails you then a useful test is “Personal Income Need x2” – and then sensing for yourself whether that is too much or not enough.

Once you have a Net Profit goal, work backwards to determine your Gross Profit and Revenue goals.

Now repeat these steps for your Personal Income “Wants”. You will land at a much larger Revenue number. How exciting!

Step 3. Business Equity Corner – What’s Your Number?

How much would it cost me to buy your business from you today?

It’s a fun question – and note that I’m not asking “What is your business worth today?”, but rather what it would take for you to willingly sell it to me. As I like to say to real estate agents about my house, “I am always happy to sell for 50% above market value”.

So What is Your Number? What is the Sale Price you ultimately want to receive for your business? And why do you want that number?

Maybe there is no number – your Business is priceless, they’ll take you out in a box, or your greatest desire is to pass the business to the next generation. There is still a commercial aspect to that – whether the shares are sold or inherited, do you intend for them to have some value?

An important thing to remember is that Income follows Equity. The greater your business value in the bottom left corner, the easier it is to generate income in the top left corner. And the details framework diagram above lists some of the key ways you can add equity value.

Step 4. Your Personal Equity Vision

Ultimately, your business is not your real business. For all the commercial and cultural joy it brings, it forms just one part of your overall ‘Family Foundation’. This is the Equity corner where your true wealth resides.

As a Commercial objective, when your Personal Equity corner becomes large enough to fully fund your Personal Income Wants, then you have achieved independence from needing to work for an income ever again.

Like me and most of my clients, it’s unlikely you would stop working again. But (to pick a real example) a business owner who wants $250,000pa to fund his family and has a business he can sell for $9 million is running that business purely from personal choice not financial obligation.

It’s beyond the scope of this week’s episode to teach financial literacy, but if you want to dive deeper into this rabbit hole then the research you want to explore is known as “financial independence”, sometimes discussed as FIRE (Financial Independence / Retire Early). Depending on a range of factors including your risk profile (and most FIRE bloggers are quite risk averse, compared to the average business owner) you can withdraw 3%-5% of your personal equity amount each year, adjusting for inflation, and never run out of money.

The happier you are with risk taking (eg, because you’re already 75 not retiring at 35) the higher the amount. To take the 5% withdrawal rate, that means if you Want an income of $250,000pa then you have achieved financial independence when your Personal Equity Corner reaches $250,000 divided by 5% = $5,000,000.

There’s a lot more nuance to it than that. But now you know… that’s your Freedom Number.

What to do with your Commercial Vision now it exists

At the end of this exercise, you want to have information in all 4 Corners. Some Corners be more detailed than others.

If [Step 1 Personal Income] you Need $100,000pa and Want $250,000 …

then [Step 2 Business Income] your vision might be Net Profit of $200,000, meaning GP of $2 million and Revenue of $3 million.

giving you ongoing investments in [Step 3 Business Equity] increasing the Valuation Multiple of your business, to ultimately sell for $4 million …

adding to your other personal investments so that [Step 4 Personal Equity] you have a personal equity portfolio of $5 million. Your Freedom Number achieved.

Add or subtract zeroes as you require…

Having this clearly documented allows you to talk to your life partner about what you’re building commercially, wealth-wise for the family. To talk with your business partners and make sure that you are all aligned on the same page. And then to take some of this information adding to your team.

You don’t need to share your personal aspirations with the team. You don’t need to share every aspect of the business side with your team. If you want to be on a million dollar business, you don’t need to explain to the team the things you’re doing from a tax perspective to make sure that most of that goes into your pocket. You don’t need to talk exactly about how much profit you want to be making as a business owner each year – unless that’s relevant for their role.

Communicating out key elements of the Commercial Vision lets your team know that you are building a financially stable company that they can work out to the future. For their personal vision they can connect and see how working for you and helping you achieve your dreams similarly helps them to achieve theirs.

Here’s to your Freedom. A Culture I can get behind!

Personal Vision: Drink more of my favourite champagne house,

at my favourite hotel, atop my favourite lake in the world.

Next Steps

Want to learn more about how this can apply to your business? It costs nothing to chat:

- Email me jacob@jacobaldridge.com (I read them all)

- Call, Text, or WhatsApp me +61 427 151 181

- Or just Subscribe https://jacobaldridge.com/about/subscribe-to-jacob-aldridge-com/ to stay in touch

[…] Episode 78, What is Your Commercial Vision – https://jacobaldridge.com/business/the-horrible-cost-of-thinking-culture-is-vision/ […]