This week I decided to throw a grenade into an accounting group that made the mistake of welcoming me as a member.

And I’m going to expand on my thoughts here, because they’re important to every business that has an accountant – which I hope it all of you, because you need an accountant long before you need an advisor like me.

The topic in that discussion seemed simple – “When businesses are struggling, what help can accountants give?” Unfortunately, the answers were all wrong…

(Side note: Look, #NotAllAccountants. And despite some taking it personally, the flaw is mostly a result of the Accounting business model not individual accountant hubris. Mostly.)

Most of the answers fell into the trap of recommending “Growth” without acknowledging that “Growth is the Most Dangerous Word in Business”. If you click through to that video and article – the foundation for one of the most important business topics I help owners with – you will see it talks about “Capacity”, a topic that didn’t rate a mention in the first five-dozen accountant replies I read before my head exploded.

Predictably, this “Growth” advice came with all the old chestnuts – “increase your prices”, “sell more”, “set targets”, “cut costs”.

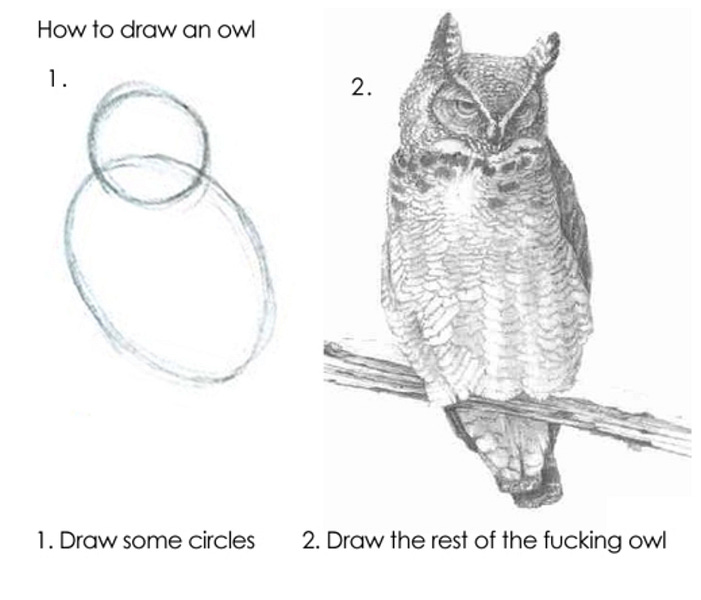

I call this “Draw the Rest of the F^%&ing Owl” advice, and it doesn’t work.

Numbers on a spreadsheet or a forecast tool (and I use both in my advisory) are the baby step at the start of the change process. It’s very easy for many accountants – who work in an in-demand profession, have never made a ‘no need’ sale in their life, and in most cases have never had a zero revenue week like their clients did at startup or faced a month of negative $50,000 in free cashflow – to confuse a spreadsheet solution with the actual answer.

- “Step 1, here’s a spreadsheet showing the profit if you just raise prices.

- Step 2, draw the rest of your f^%&ing business.”

Then it’s easy to dust their hands and say “well, I told the client what to do, you can’t blame me because they didn’t listen.”

There’s More to Business Than a Spreadsheet

Most business owners would benefit from more financial literacy. Do numbers give you the heebie-jeebies?

- Watch some 5min Blackboard Fridays videos on this topic

- Enjoy this Leadership workshop I ran last year on ‘The Big 4 Numbers You Need to Know’

- If you’re really serious about improving cash flow and profit, take control with Alan Wick’s Business of Finance course

I love mentioning Alan because he’s one of the few numerate business experts I’ve worked with who speaks in terms of love and humanity. (He was a co-author with my on the best-selling book Visionary Male Leaders: How to embrace Feminine Leadership.)

Because it’s not easy for most business owners who are a discretionary spend to tell a loyal client that prices are going up by 12%.

The fact your accountant’s forecast shows “+12% means break even” has approximately 0% relevance to the value, and perceived value, of the work to those clients.

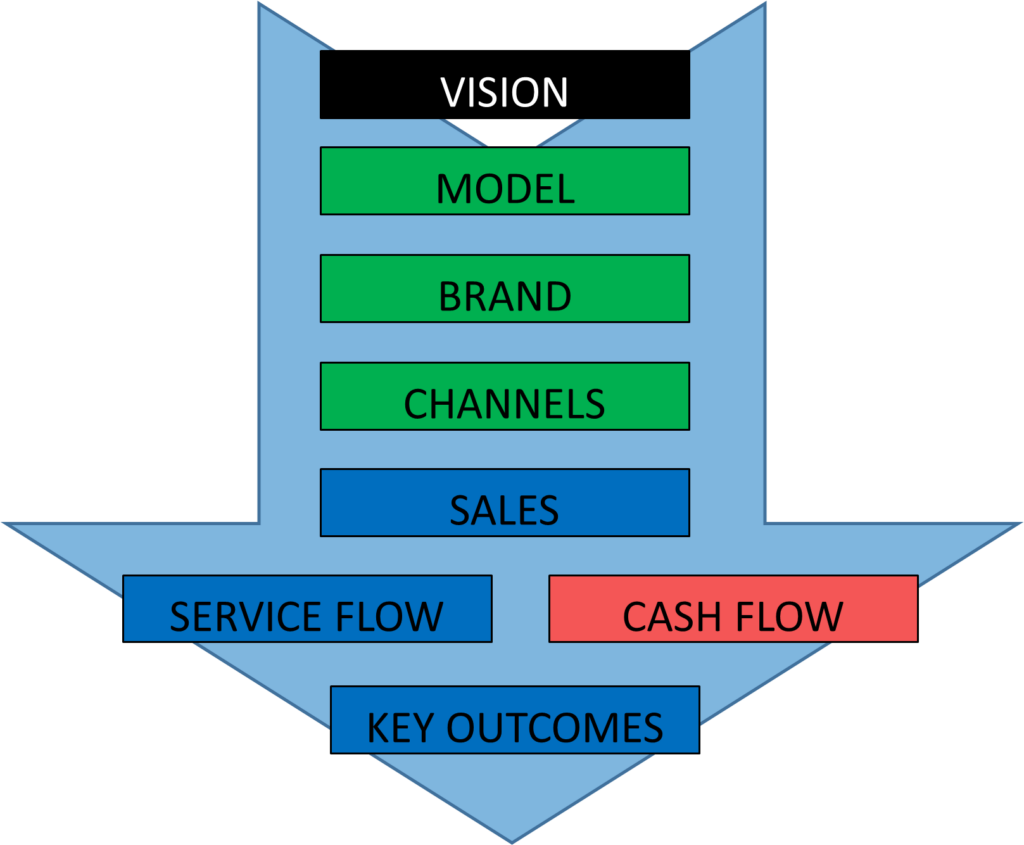

Rolling out a sustainable pricing strategy means piecing together many moving parts – otherwise the desired outcome (more revenue, profit, or cash flow) will fail to materialise.

For your price increase to be well received you may have to review your Brand Promise so your clients perceive the value … and then run some Culture exercises to make sure you have a team that can deliver on the Brand Promise … oh, and then find Workflow Efficiencies to do that delivery … which means you have to fire the long-term team member who no longer fits … and don’t forget to improve all your marketing and sales literature so expectations are clear … and run a campaign for advising of the price changes … and then hope it works because (unlike the accountant who gave you the advice) your clients don’t have a quarterly BAS deadline that mandates they buy from you.

All of which costs more time and money of course – the absence of which you are trying to fix by Growing as suggested!

Will your accountant show you how all these pieces fit together? Almost certainly not – and to be clear, this is partly because they don’t know how, and partly because they have 100+ clients and none of you are paying them to deliver that type of work.

If you want your business to Grow – whatever the heck that means to you – then you need to take responsibility.

Chances are your Accountant has an amazing spreadsheet … and is wondering why you won’t just Draw the Rest of the F^%&ing Owl.