A lot of us have spent 2020 feeling ‘Fragile’, and perhaps you wish things were different – that you and your business were more ‘Robust’?

But when I look at my clients who are doing well right now, it’s not because they’re robust. It’s because they’ve gone one step further in developing their systems, business model, and mindset.

You’ll hear more about this ‘Practical Antifragility’ later in October. For now, enjoy this video with:

- Your latest September economic indicators;

- What.this means for business opportunities in October; and

- Why 3 Jacobs are needed to explain Fragile, Robust, and the elusive “Anti-Fragile Business”.

September has ended, October is here. What does that mean?

Read ob fir an overview of the September financials and, much more importantly, the October forecast for your business. As always, there are four indicators that we look at this month: not a lot of movement or anything exciting in these numbers, and as a result, we’re going to keep the economic update fairly punchy. I’m going to dive a little bit deeper into a topic I think you’re definitely going to want to stick around for.

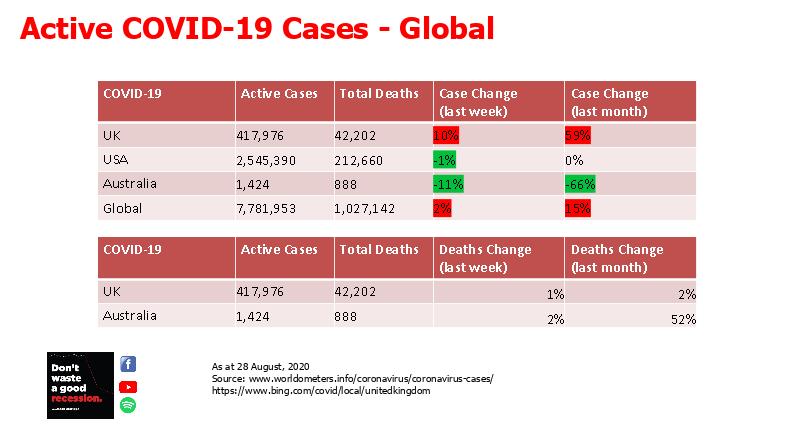

Active Covid-19 cases:

First off, let’s have a look at active coronavirus cases. And really this is a tale of two countries, but since we put this data together at the end of September, we’ve had news of Donald Trump’s positive diagnosis that really means that, while there are 7 million active COVID-19 cases worldwide, there’s only one that everybody’s really talking about. Of course, much love and wishes to everybody who is suffering from this disease, either actively or having overcome some of the lingering side effects.

So a tale of two countries: you can see them there in the green and the red the UK and Australia. Australia has experienced massive decrease in active cases for the month. Total deaths in Australia, end of August, into September, show the number was up by 52% – a huge jump, which is the lag effect of that huge jump in active cases we talked about last month.

The UK is, seemingly, a month behind. Active cases have jumped by 59% for the month with a 10% jump for the week leading up to the second of October. Deaths in the UK are only up to 2% of the month and that shows just how fast things have changed. At the end of September for the UK, in fact, between creating this data and releasing this video, there have been several record days of cases in the UK, where, in their first wave, they were looking at 6000 cases a day, we’ve now had days in excess of 12000.

So, the tale of two countries:

Australia’s second wave is clearly under control. One escaped virus from a Melbourne lockdown facility lead to a giant spike twhich forced Victoria into harsh lockdown measures

In the UK, heading into a northern winter, gives me concern from a business perspective.

One of my UK based clients has postponed a new product launch until at least next March. Another, based in the southern hemisphere, was planning on expanding to the UK, with a rollout plan from January. This has also now been pushed back, because they’re seeing active COVID-19 cases as a lead indicator of the economy and business conditions.

We are certainly learning more about the disease and risk factors. For example, it kills more men than women. Being over 70 is a risk factor, as is, obesity. And, interestingly, a study came out just last week that showed that those who have a Neanderthal gene in their body still seem to be at a higher risk of serious COVID-19. In other words, there’s a great risk of COVID-19 if you are an old overweight man who behaves like a Neanderthal.

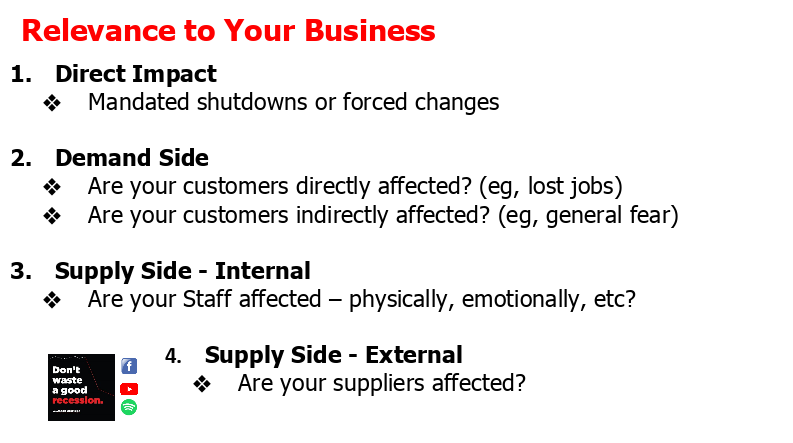

Active cases impact on your business

I’m not going to jump into these details – you can go back and look at the last two economic snapshots. The key point is: ‘look global act local’. Look at what impact this is this having in your community, on your supply chain and demand chain and on your customers.

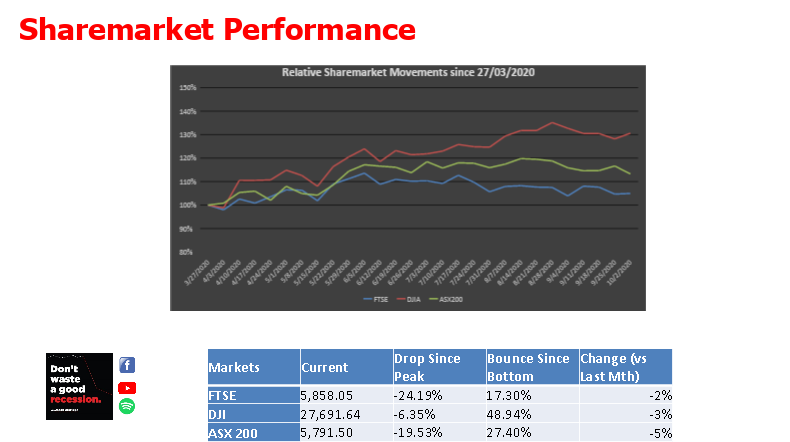

Sharemarket performace

The second area we investigate at every economic snapshot (which we’re now doing monthly, to give you more signal less noise) is what the share markets are doing.

For the month of September, we looked at the three main indices: the FTSE, the Dow Jones and the S&P 500 – all of which were down slightly, not by anything significant. And I remember last month I talked about how the US tech stocks had broken through previous highs. If you took them out the rest of the market and the rest of the world, have not yet reached that ceiling from February, which was a key indicator of whether or not the economy was going to continue really cold or we’re still having this volatility and uncertainty through COVID and are at risk of another great slump.

Since then, almost to the day that I published last month’s economic update those tech stocks have fallen a little bit in all of those markets

What does this mean for your business? We’re getting at a one-month indicator. September was down slightly certainly less exuberant in the markets, so I would suggest that your October is going to be slightly more difficult than your September was.

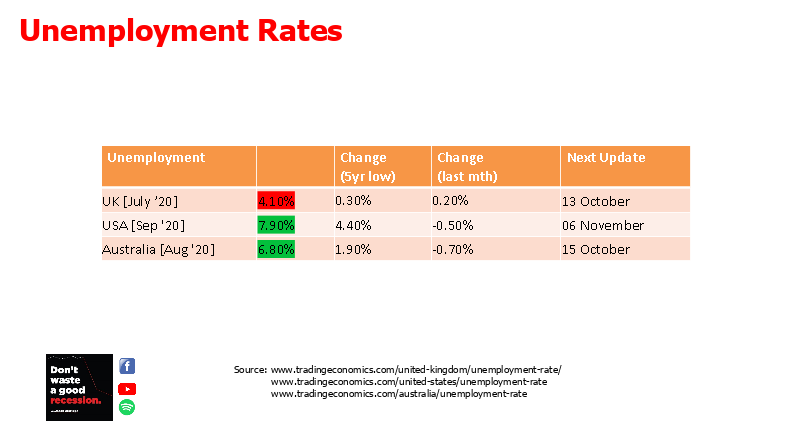

Unemployment rates

The first of these lag indicators is a mixed bag. This month the UK is up slightly – it’s actually moved. (i still contend their numbers are horsesh*t). But, though up slightly, it’s still incredibly low.

Since then, in the US and Australia (where we have figures for August and now September – late September the US.) Accordingly, those numbers have come down and it continues the great slide.

There was a great fear in September that the economic stimulus packages were due to start expiring, that we would see unemployment jump, but this hasn’t happened. In some cases those policies have been extended.

In the case of the US, Slate magazine did a great article that looked at why it hadn’t had an impact because the US weren’t able to extend. What it showed was a few different factors: a summer boost; some of the unemployment checks are, three-four months later, still getting mailed out. And so, people are actually getting the stimulus package in September, with still some due to get it in October. So, you know, they’re still having a little bit of wash. They also had a once in a decade hiring boom the census is on in the US at the moment. A lot of temporary staff does decrease the unemployment numbers, which is a good thing good, but it does mean that there’s some of that data that’s a little bit soft as the economy moves forward and certainly beyond the election there.

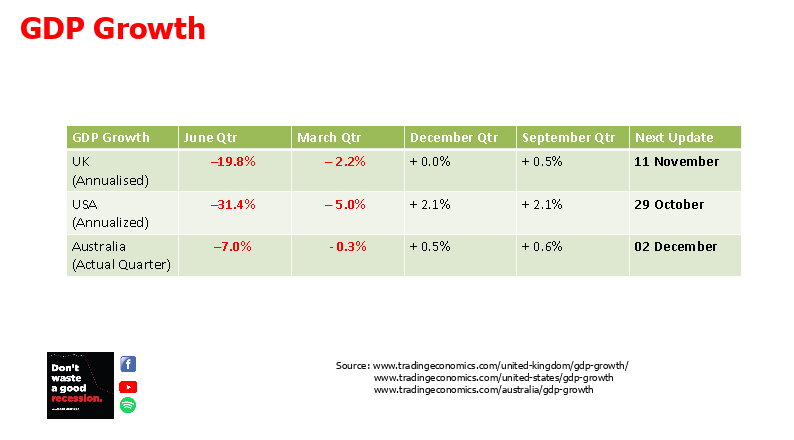

New GDP growth numbers

Final numbers in the UK and US, were both slightly better than the preliminary numbers. In many cases we’ll get preliminary numbers this month, for example in the US, the stock market (which is not the economy – GDP growth is not total GDP).

We are in the middle of an uplift in this quarter – it’s going to be the end of the recession, you will see those headlines when the data is released (29th October, US, 11 November, UK, 2nd December in Australia) where we just wait til we’ve got it right and put it out. That doesn’t necessarily mean anything specific for your business. It certainly doesn’t mean that the lingering effects of the recession, are completely over or even that each quarter is now going to go back to growth.

When you think of COVID-19 – it’s a disease, it kills many and can leave lingering long term effects on many others who haven’t recovered. And the same is true for the coronavirus recession. If your business is still here today. Fantastic. Congratulations, you have faced a pretty heavy punch in the face. But the boxing match still continue. You are not yet, out of the ring, out of the woods, insert your metaphor. There’s still more to come.

Where is your business?

Now that we are at this point, a little over six months since the coronavirus recession, really hit. In March of this year, it really started, in many Western economies, six months on, the end of September, how is your business going?

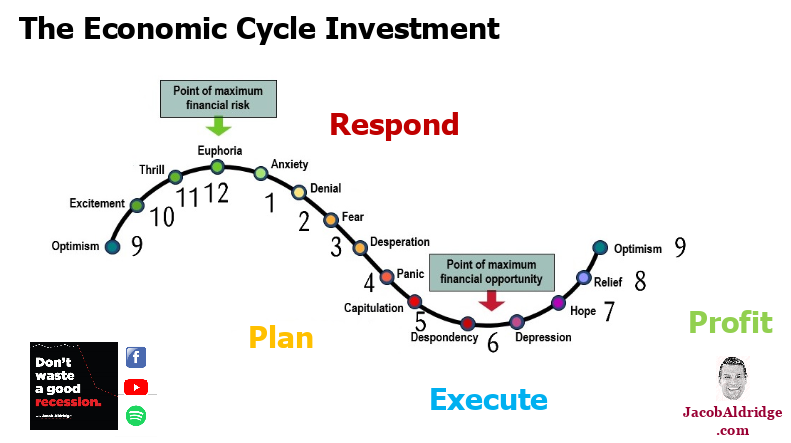

You may recall, (again, we’ve talked about this in many of the earlier videos), the economic cycle is just a cycle. There are periods of great growth, euphoria and everyone feels fantastic. That’s actually the point of greatest risk. I was warning people in my videos, 2018 2019, – that that’s where we were coming up to. COVID-19 or not, we were heading for recession. We’re certainly in the emotional downturn. – we see the fear, the despertion, the panic.

How are you feeling? How are your team feeling? How do your competitors feel? Your clients? Your suppliers?

Having connection with both your emotions and those of the people around you in the business community is a great way of knowing what’s coming next. It’s a great Lead Indicator, because the decisions and the communication that’s done in the present moment comes from those feelings in many cases, and will impact what happens next.

In the graphic above, we overlaid the four phases of a recession to your business: that first three-ish month period where you really have to respond an catch your breath.

If you’ve made it through to the second part, this is the time for planning for the future. What does your business look like post-recession? Post-COVID-19?

I know for many businesses this is a second wave. For example in Australia, particularly in Victoria, you had to kind of go back and respond to some of that. This isn’t a perfect linear system, but the underlying thing is we’re now shifting. We know more and we need to plan for the future. We don’t want to get ahead of ourselves – we want to plan so we’re ready to that bottom point of maximum financial opportunity we can execute, and then get all of that uplift in our business, all of that profit, which is to come.

I’ve talked about three ways that many businesses are facing any recession:

- DIVE: There are many that will already have dived, either because they were significantly impacted by lockdown or because while we all ended up in the same stormy seas, they showed up in a leaky canoe. They were already an ‘at-risk-business’ and this is what tipped them over the edge.

- SURVIVE: Businesses that maybe found it hard or fortunately managed to not die, they managed to survive. The business that survive will follow the economic cycle, up and down.

- THRIVE: The third option is the ones that thrive. Not necessarily because they’re counter-cyclical because they have the systems processes mindset in place. They can respond quickly. They still have that dip, as you can see in that diagram – they don’t perfectly keep growing in the face of something as severe as a global pandemic. But, they have the systems andbusiness models in place to thrive, regardless.

And so, the question I’ve been asking is: which of these are you experiencing? Which of these do you want to choose: dive survive, or thrive?

Robust, Fragile and Anti-Fragile

I’m going to use some slightly different language, because for the last 12 months and particularly the last six months, as the coronavirus recession has been impacting my one-on-one advisory clients, I’ve been road-testing a new approach – a recessionary approach – that I’ve been preparing for a little while, that looks at this same concept, using slightly different language. Fans of Nassim Nicholas Taleb will recognize some of the language.

I want you to think about those businesses that are fragile, robust, and then a third category, of businesses that are anti-fragile.

Fragile:

So what does fragile mean? It’s 2020. I think by this point we all have a pretty good feel for what fragile looks and feels like.

A definition of fragility:

the individuals and businesses that are fragile, don’t necessarily look fragile from the outside, only when you interrogate it. So Taleb gives us a definition: something is fragile when it has more to lose than it has to gain. a simple example would be a teacup. it may do its job for centuries, but a little bit of volatility in the wrong place, the teacup will smash, and will never be put back together as good as it was when it was new.

The same is true of many businesses. They might be going on for years, decades, with an exposure to weakness that just hasn’t been hit in exactly the right point. They can be fragile, and the way we know that when we look at the business. We look at the system we see that those risks are there that could send the business into a tailspin, but there isn’t a corresponding opportunity to grow. So what most business owners do when they feel fragile? They think to themselves: how do I get out of this? I need something a bit more robust.

Robust:

A lot of people think that the opposite of fragility is being robust and strong. Something is fragile, because it can break from volatility, then truly the opposite must be something that doesn’t. This is a limited worldview which takes away an awful lot of opportunities for you in life and in business.

So something might be robust, if it doesn’t have some of that downside. Instead of being a tea cup, it’s more of a steel beam – it’s not going to have volatility. But if we think about that definition, something is fragile when you have more to lose than it has to gain. Well, something that won’t lose but can’t really gain, either, isn’t the full story. And that’s the problem with being robust, you might be that steel beam that’s not going to get shattered, but, as we learn from the song, a rock feels no pain, but an island, never grows. If you as a business owner, as a human being, want to grow and develop, and you need to have some benefits from resistance. It’s not sufficient to avoid being a teacup and become robust.

Anti-fragile

If you really want to be the opposite to fragile, if you really want to benefit from the reality of the world, you need to be anti fragile:

If fragility is something that has more to lose the gain, then volatility will invariably send it into ruin and the only way over time is down

If robust doesn’t have that downside, but it also doesn’t have the upside. In many ways it’s not impacted at all by volatility.

Something that is anti fragile has more to gain than it has to lose. It’s like the teacup except it gets stronger every single time that it gets broken. Business exists because we’re in a volatile chaotic world. And a lot of us as business owners, driven by our emotions, misunderstand what volatility really means, because we’re so used to that fragile side of things. Volatility just means the ups and downs, the unpredictable-ness, the uncertainty, the ambiguity, the complexity, which is the modern world. Then we start to realize we kind of give up probably control it. And that’s the weird thing we tend to do as business owners, our business exists because of some complexity or some chaos that’s out there in the world and once we start and get some traction, the first thing we’ll do is, don’t make it robust and we’re trying to get rid of all that chaos and create an equilibrium. We never can and that’s the challenge that we constantly have as business owners. What if instead of trying to be robust decided to be anti fragile? If we decided to work on those things that meant when volatility invariably showed up you weren’t gonna smash like teacup, but instead of being the steel beam, the island that never grows, you actually benefit from the volatility. When chaos reigns, you actually profit. That sounds like a much better business. A much better fit for 2020, and beyond.

Now, I appreciate, that’s a bit of a complex concept: fragile robust and anti-fragile. So why don’t we get the three amigos here to run through an example of each, and just help explain that a little bit more. Can I hand it over to you, Jacob.

Let me freeze those guys so that the nodding doesn’t drive you crazy. Let me give you an example of our concept: in terms of physical, emotional, and then, in regards to your business

Physical:

Think of somebody breaking a bone, although I want you to focus not on the extremes, but on the systems the physical systems that may be set up so that they don’t necessarily look fragile, but there’s a greater risk there and so perhaps someone who’s immuno-compromised, somebody who’s had a transplant who’s going through chemotherapy, in many cases from the outside, you wouldn’t necessarily know, but their body is fragile. They’re in a far greater risk of catching a cold. Potentially, something as simple as a common cold may be fatal to their system.

Emotional

When I say emotionally fragile, you might think of people who are constantly breaking down or having breakdowns, full on mental breakdowns or just very very out with their emotions and not being able to control it. For me, a much trickier emotional fragility is that people were suppressing what’s going on, who are fighting against the feelings that they’re having. As the saying goes: What you resist persists. Fragility around emotions often comes not from not having them and not for letting them out. Instead from pretending they don’t exist, ignoring them. As we go through that continuum and look at what is a fragile business look like he’s about to realize it from the outside, it might look like it’s quite strong. It might look like it’s here for the ages, but just underneath the surface, perhaps there’s a whole lot of issues that the business owner is trying to suppress that the business is not even aware of.

A great test of fragility of business is to just ask, what would happen if you have a really great month?. What impact would that have on your profit? What would happen if you had a really bad month? A Fragile business will do far worse in a bad month than it will benefit from the good month. Perhaps an opportunity that increases the revenue by 20% in a month and they won’t actually be able to grab that because of all the systems in place. And during a bad month 20% could wipe out all of the profit they’ve made for the past three years.

Have a look at your business. Can you grab up opportunity? and with that volatility, as a down month, what impact will that have on the viability of your organisation? How fragile are you?

If you’re not fragile fantastic, then maybe you build a business that’s robust instead. What’s the problem with that?

A robust business may not have the risk of the downside but doesn’t necessarily have the upside. Think about it in a physical term, somebody who is robust physically may not break down they may not have some of that immunocompromised for example but they’re not necessarily building with the nutrients, the things that are going to allow them to grow.

Again, emotionally somebody who’s robust isn’t necessarily in a space where they can connect with their feelings and benefit from, learn from gut feel, which drives so many good decisions for business owners, or be able to empathize with others around them.

Not to say that being robust is the end of the world. For many people, building robust systems in their business is critical. You don’t want to be in that fragile space, but it’s not the end game, and it’s not where you really want to be.

A business that’s robust, when asked that question about a great month, and about the not so great, might actually look at all of the systems and processes and realize that well, we’d be safe from the downside. If we had a really bad month we’ve got the systems and processes in place and we’ve got the client base to be able to manage that sort of work. We wouldn’t go out of business because of one or two bad months, but the same systems that protect us also restrict our upside. By having safe commitments to those clients to smooth out revenue we don’t actually have the opportunity to get the growth, grab the new opportunity.

What’s the real alternative?

Building some systems that benefit from the volatility. And really, if we look to nature we can learn this. Think about the healthy human body. It actually benefits from some of that stress. Now, nobody wants to get hit by the truck and break all of their bones, but something like weightlifting actually has a positive impact on your body. Overall, an initial stress, the strain, the pressure on your muscles your bones, actually leads them to bounce back even stronger. So even though that has negative effect of that stress that actually gets stronger as a result of it. That’s the fragility.

It’s the same in an emotional space . The people who are in tune with their emotions, who are willing to share them and who recognize that things like being mad or sad or scared are normal part of the human experience. Those are thepeople who do better with their emotions and actually find themselves being able to benefit from emotional state, the very least be in touch with their emotional state, so they can talk about them instead of acting through their feelings.

And in business. Businesses that do those things that welcome some of the stresses that take risks on purpose because of the opportunities, those can create. Whi talk openly and vulnerably about their emotions because business is run by people, and put the systems in place to benefit from volatility. So that a month where revenue might be up by 20%, could see an enormous upswing in profit, where a down month might only have a minor impact. Not that it has no impact as to join the circle inside, you’re possibly still going to have a dip when a global pandemic kicks in, but it is nowhere near the size of the upswing you get. Volatility isn’t just getting hit by a truck. It’s the normal ups and downs of business life.

When you build an anti-fragile business you benefit from the ups and downs. And ultimately, that’s what we want all of you to go through. Because the ups and downs are going to continue. Only those businesses that are antifragile, that are going to really make the most and thrive the coronavirus recession and beyond.

Okay, cool concept, but how do you apply?

Well, this model has been applied to some of my clients who are having record months, month after month, even in the middle of a recession. This is not because they’re counter cyclical – it’s because their business model is set up with that anti-fragile approach, where they benefit from volatility.

I’m calling this approach practical antifragility.

It’s not just a high-brow concept. It’s ‘how do you actually take that and apply it within your business’?

Put this date in your diary: Monday, the 26th of October, and make sure you either like the Don’t waste a good recession group on Facebook, or subscribe on YouTube, or to the email newsletter on site here.

This way, you’ll get the updates as specific invitations and times to come and join me when I do a live workshop program at the end of October, on practical antifragility for your business.

You’ll have the opportunity to jump in live when we run each of those five one hour workshops, each day, or to jump in and access the recordings, while they remain live for a limited period of time.

If you want to know how to shift your business from fragile, not only to robust, but to antifragile. As the recession lingers, to be in a position where your business actually benefits from the uncertainty that is a part of the world.

Make sure you subscribe, make sure you join me and many other business owners just like you asking their questions and having us talk about their businesses, at the end of the month.

Lastly, tell your friends, subscribing is fantastic, acting is even more important when you tell your friends, your team, your clients, your suppliers, you get them thinking positively about the coronavirus recession. That gives you an enormous boost as well. I’ve been telling you for six months now. Don’t waste a good recession. Don’t keep it a secret. I look forward to seeing you in those events at the end of October, and as always for the economic snapshot, and the business forecast, Number 20, coming out at the beginning of November.

As always, I’m Jacob Aldridge. Don’t waste a good recession.