A common assumption is that when the economy turns for the worse, it’s the premium-priced businesses that are most likely to feel the brunt of changes. History has shown – that’s not always the case.

Here is my guide for responding to the Coronavirus Recession – whether your business is Haute Couture, Bargain Basement, or Mid Market. And if you’re looking to pivot or start a new business, these price and service guides will also help.

Feel Bad for Insolvency Lawyers

You may have noticed that I hold ‘Insolvency Lawyers’ up as the paradigm of a counter-cyclical business – an industry sector that thrives when others are struggling.

I’m raising them here for a key reason (see next paragraph) although it’s worth noting that Insolvency Lawyers are actually struggling for work right now; modern Fiscal Policy (when governments fire up the money machine and flood the economy with cash to help prop up the economy) has created Zombie Companies, who are still alive only because of that stimulus. These companies otherwise would have collapsed – and still may – so their ‘undead’ status is harming the insolvency firms ready to help them through their end of life journey.

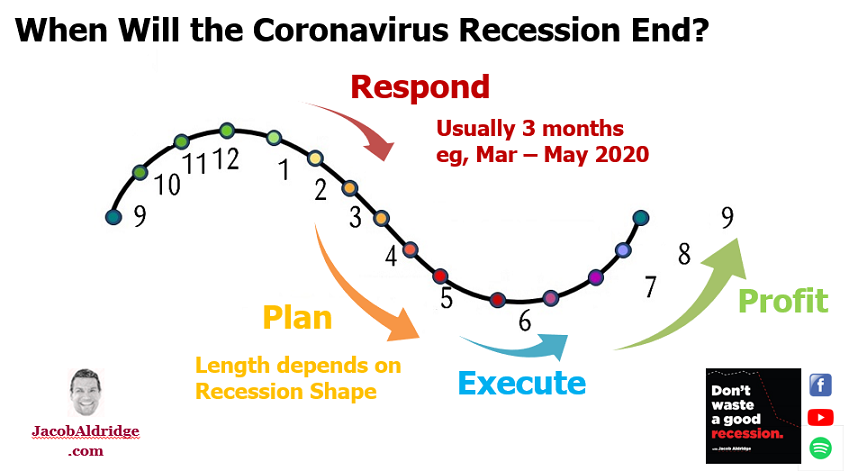

But I digress – the reason to raise counter-cyclical sectors is to remind us all that this Recession is just part of an ongoing economic cycle. And knowing where we are in that journey can help your business make better decisions.

Almost all of us have moved through the ‘Respond’ phase of the Coronavirus Recession; we are now firmly in the ‘Plan’ phase – planning for the future.

Pricing your products or services, or creating new products to target a different price point, is part of how you Plan and Execute for the future.

Luxury Goods in a Recession

Surprisingly, Luxury Goods often survive a recession in good shape. When debt is cheap and inflation is low, high net worth individuals generally have more disposable cash and respond to a recession differently from those whose incomes are affected.

Undoubtedly, some Luxury Brands will be impacted. If we look at the Great Recession / Global Financial Crisis, we see two main trends that negatively impacted companies at the high end of the B2C market: corporatisation and consumer shopping trends.

When the stockmarkets freefall (like we saw in March 2020), it’s rare for any sector to avoid the fallout. Over the past 25 years, many luxury consumer brands have grown through mergers and acquisitions funded by equity by listing on the stock exchange (LVMH being a prime example). When markets drop by 20% or more, those companies are impacted even if their underlying financials remain strong.

Through the Great Recession and beyond, we have also continued to see the migration of consumer sales away from Brick & Mortar Retail towards online purchases. Those luxury B2C brands that were dependent on foot traffic, like premium department stores, were hit worse – as much by the larger trend as by the recession.

Many luxury B2C brands grew through the Great Recession, and the same opportunity exists in the Coronavirus Recession: follow the money.

- Change your target customers, if those with money has changed. In the Great Recession, this was the great flight of luxury brands to China and the Middle East (and away from Europe). Think laterally about who will value your product and how to target them, especially if they are less- or un-affected by the underlying Recession.

- Cut Supply Chain and Channel costs. Those brands who did best through the last Recession were those who realised the consumer flight from retail also gave them an opportunity to go direct. Exclusive products, or deals, and the ease of online ordering worked in their favour and aided margins accordingly.

While we remain in the early phases of the Coronavirus Recession, it has been clear that online shopping has been a big ‘winner’ from the pandemic. We have also seen the flow of spending away from ‘physical’ services (like dining out) towards products or services that can be purchased online.

If prestige is part of your luxury brand, you may need to find a way for people to show that in a world of lockdown – the Gucci Facemask solution.

And also be laser targeted not only on the supply chain impact of the pandemic and recession, but also consumer sentiment. The push back to ‘manufactured locally’ may create opportunities for you to cut-through – even if it means higher prices to the end user.

The Sandwich in the Middle

Broadly, in many sectors the mid-market is being squeezed out: customers who want (and value) high levels of service will be willing to pay for it, while all others will race to the bottom on price as your product or service becomes commoditized.

A Recession environment creates opportunities in this mid-market, however; and it creates them from both ends – top down and bottom up.

The Great Recession saw the rise of a new food market, ‘Fast Casual’, epitomized by restaurants like Burger Urge in Australia and Shake Shack in New York.

This market category successfully took customers away from both the more expensive dining options and the lower end of the market.

By offering quality food and a dining experience that was superior to fast food joints, it became socially acceptable to “go out to dinner” at a fast casual joint rather than fine dining. People who may have spent $100+ per head pre-recession now spent $50, which is still profitable when you don’t need cloth napkins; and it also created the slightly-better option for those who might otherwise have been happy with Taco Bell – for an extra $10 you can have a completely different experience.

In the food sector, many of these companies have seen margins smashed by Uber Eats et al, especially as they have been forced to rely on delivery due to the pandemic. Still, as another recession rolls through, they may be better placed to survive than the top end of town whose margins (especially on alcohol) fast casual restaurants could only dream of in good times.

- Any sector with a wide gap between ‘cheap’ and ‘fancy’ is ripe for a recession re-positioning and profit.

- Are there customers in your market who are looking to cut costs (at the high end) and/or improve their experience and service slightly (at the low end)?

The Race to the Bottom

At the lower end of the market, cheap home essentials generally ride through turbulent economic times with limited volatility – toilet paper as the exception that proves the rule!

When unemployment peaks and savings rates climb (as people fearful for the future save rather than spending everything) premium alternatives to basic goods will suffer. In the grocery store this is reflected in both the products on the shelves, and even the choice of supermarkets as low-cost providers such as Costco and Aldi are better placed than the more traditional supermarkets.

If you are selling a staple, a product or service that will always be in demand, look at how you could change your product (or create your own competition) to reduce the cost to the bare minimum. In most industries, which haven’t been truly commoditized like iron ore, this runs counter to the advice I usually give – so recognise that this isn’t a long term solution.

If you end up with multiple products at different price points, collect the data to test how they interplay with each other. As I shared in one of my ‘Don’t Waste a Good Recession’ Business Case Study videos, sometimes having the Hero (high end premium) Product can help you generate more revenue even if you never sell that one yourself.

- Where was your business positioned prior to the Recession: Low, Mid, or High?

- How have your customers responded (or how are they likely to respond)? In other words, is a repositioning even required?

- Can you follow the customers to maintain revenue – either by doubling-down on your existing initiatives, or following them into a new price point?

- Can you create a new market or new customers, by positioning your existing product differently?

- Can you create a new product – with the same, or even a different brand – to better position yourself as a recession alternative to a new market?