Welcome to economic snapshot and business forecast number 20.

First, my prediction that Donald Trump will lose the Electoral College 369-169. Of course, that prediction is from November 2016: sometimes being early is the same as being wrong.

- What are your October economic indicators?

- What does this mean for business opportunities in November?

- How can you ensure your business rows its own course, instead of riding the economic wave?

As you can see in this month’s Economic Snapshot and Business Forecast, I’ve been a lot more accurate with the Coronavirus Recession and how your business needs to respond. As many of you enter lockdowns and a Winter wave of active cases, I hope this video (and our Critical Content playlist) provides some practical and positive direction.

Thanks for everyone who joined me on last week’s ‘Practical Antifragility’ series. There will be more opportunities like that this month, but for now:

The two track recovery now has a definite geographic bent, as the second wave plunges the northern hemisphere countries into a cold recessionary winter of discontent. While in the southern hemisphere, some countries are managing to thrive, while others still face their own economic challenges.

What does that mean for you, your small and medium size business?

I’m Jacob Aldridge and this is Don’t waste a good recession.

Thank you to so many business owners from around the world for registering and tuning in live ton my practical anti-fragility workshop series last week where, over the course of five days, one hour workshops on each day, we jumped into some of the practical things that you can be doing for yourself in your business right now to evolve your business so that it benefits from volatility.

Never has that message been more important. And that’s why I’ve evolved my business advisory programs to put that front and centre. It’s no longer sufficient to maintain and manage risk. You now need to establish a whole system of what I call the ‘Anti-fragile Method’ in your organization, so that when volatility comes, as it invariably will, very very soon, if not already, your business has far more to gain than it has to lose.

That was a lot of fun. I’ll be doing more of those detailed workshops, before Christmas, and then a full Transformation Program that I’ll make available to all of the ‘Don’t waste a good recession’ subscribers early in the new year.

First though, let’s have a look at the economic snapshot: the forecast for your small and medium sized business in the month of November.

Here are the four indicators as always detailed in the link below to the video, where we explain those four indicators

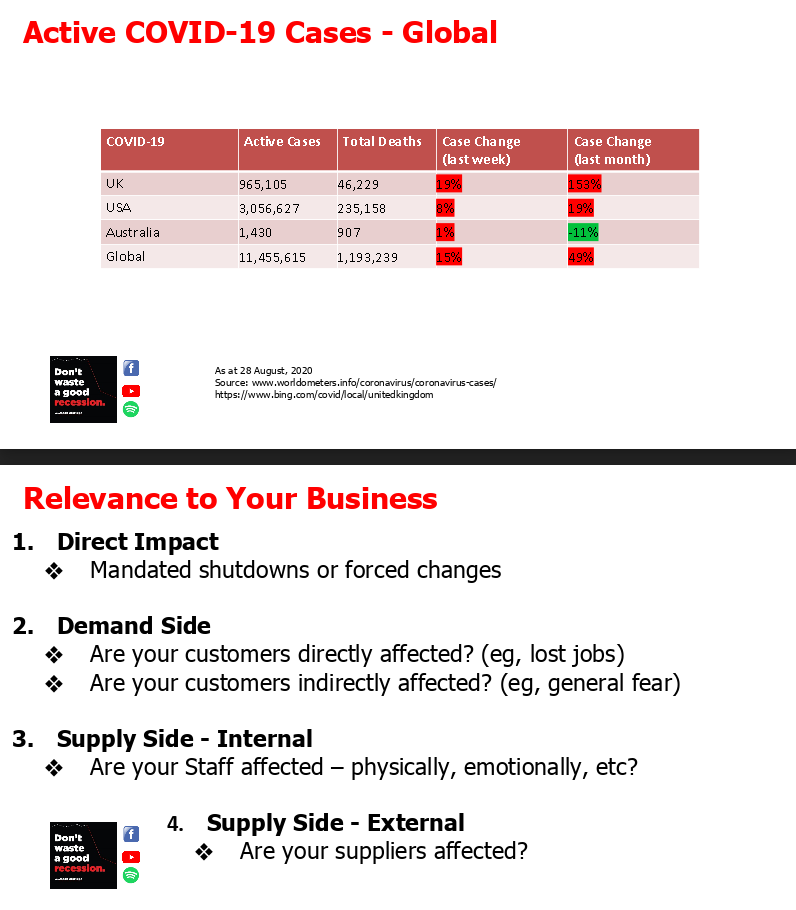

Lead indicator number one : active covid 19 cases.

And so, Europe, North America… many countries that never really ended the first wave, and now heading into the colder time of year, with a definite second wave starting to overwhelm them. Percentage-wise, the UK is up enormously in terms of sheer volume.

The USA continues to lead the world and you’ll notice a slight uptick in Australia there that reflects the fact that we’ve now down under increased the quota of Australians that are allowed to return home, so that represents an increase in cases that are happening in hotel quarantine returned to the country. To move between some of our states, you’ve got to go through a mandatory two week hotel quarantine, the lockdown in Victoria seems to be over the worst of it.

Reducing community transmission seems to have worked again. ‘At what price?’ this decision – many of you are asking. Stay tuned to the end as we look at the practical consequences of these numbers.

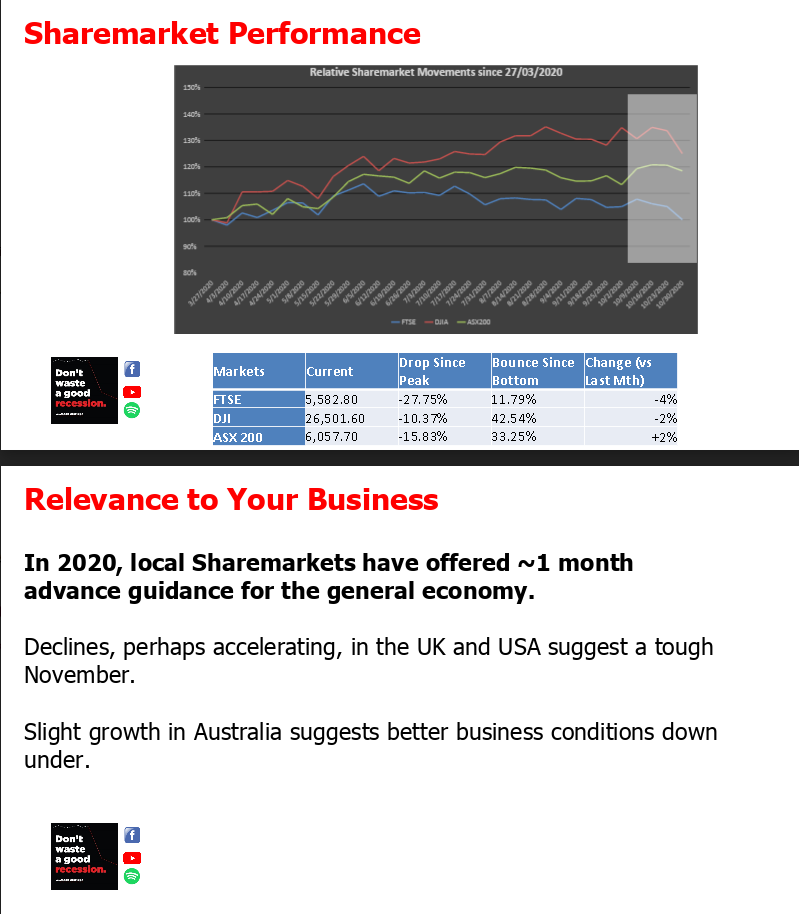

The second indicator that we look at is, stock market movements. The chart that I show there is comparison to the bottom of the markets – that happened at the end of March and here we are now seven months in and the markets have grown but they haven’t really continued the trajectory that they had through the northern summer, for the month of October.

We had three different months across those three economies:

Australia was up for the month although down slightly in the final week

the US was down slightly for the month as we head into the presidential election

and in the UK, through October, the markets slid into the lockdown which was announced after the close on Friday.

For those regular viewers, the Dow Jones, never made it back through the February record high that I’ve been calling a ceiling, neither obviously did either of those other two markets. The more representative S&P 500 did break through that ceiling at the start of September, and has come back in terms of a V shaped recovery. There is now no evidence that that has taken place, and certainly when we look at the two lead indicators, share market performance, and the active COVID-19 cases, we have much to give us cause for concern about the economic fundamentals, as we head into November and into December

So far this year, the stock markets have been about a one month forecast. In Australia where the markets were up for the month – the economy is going to be a little bit better in November than it was for you in October

Quite the opposite in the USA and the UK

If you’re in one of the other countries, how are your markets performing, how are active COVID-19 cases going in your community in your city in your country, and what impact will that have on government policy, and the mood of your customers, your suppliers and your staff?

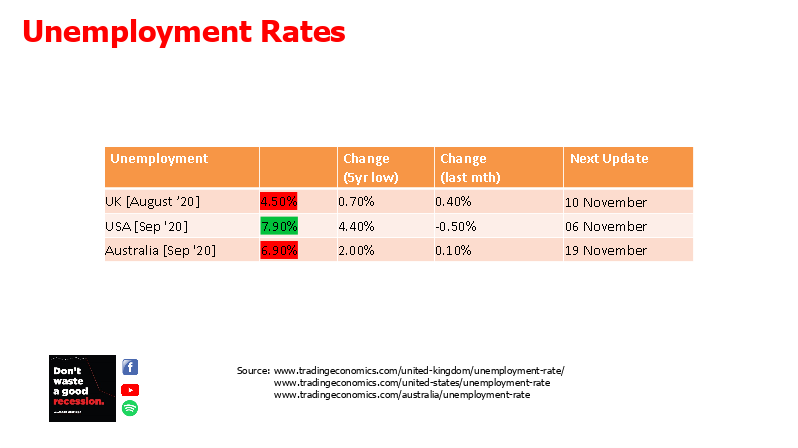

Let’s get into now some of the lag indicators: We start with unemployment. Australia up slightly with more people unemployed as Victoria went through one of the strictest lockdowns in the world. I’m seeing forecasts from trading economics, which is where we collate our data that this unemployment will rise again in Australia leading into Christmas, but I feel it will drop faster than the model suggests, given the success in reopening the economy and borders.

The UK had a larger jump in unemployment back in August, the delay that we’ve noted, and conversely as they head into the winter second wave, I would expect to see that number continue to rise and perhaps rise quite significantly. Although I believe the furlough program has been reinstated and with it, the horsesh*t data from the Boris Johnson government.

The next US figures will be out later this week. It will be interesting to see they’ve come down quite considerably from the immediate March and April unemployment highs. That will possibly continue. If we have a change in the presidency this week. And if we have a change, particularly in the Senate and therefore the overall Congress heading into the new Congress in January, much stricter restrictions and lockdowns are likely to follow through, as seen in Australia and around the world. Lock downs lead to higher unemployment. However, people dying and pandemics lingering has the potential to lead to much longer lingering periods of unemployment.

Do you want the short, sharp shock, or do you want the long lingering pain? The metaphor with the actual disease itself is quite deliberate. It’s one however where we can make choices as a country, and as an economy. What choices do you have for your business? We will get to that in a moment.

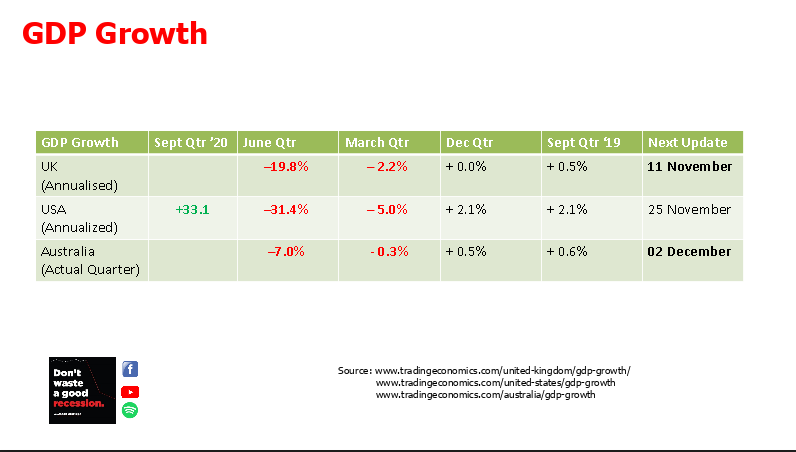

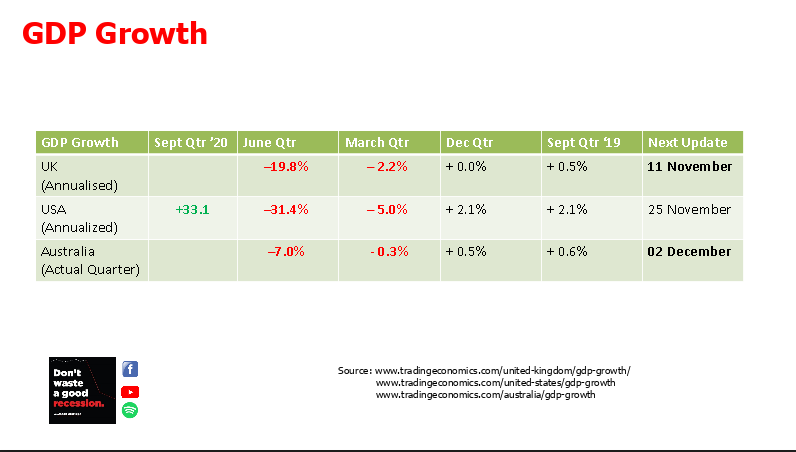

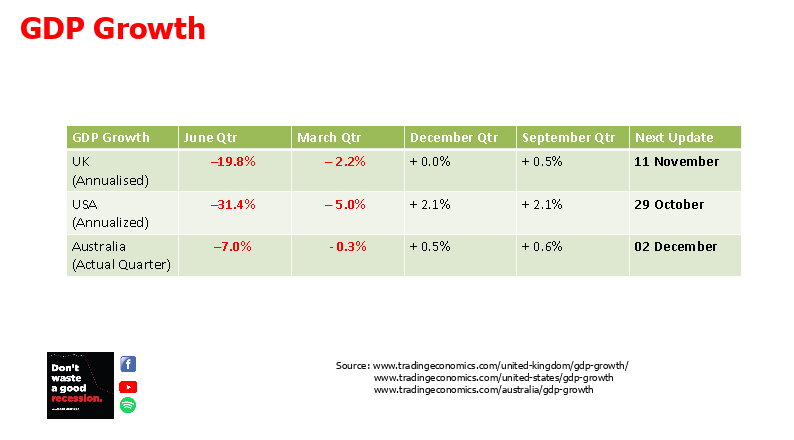

Lastly, the fourth of the indicators that we look at which is GDP growth. The US figures have just come in and as as predicted it looks amazing.

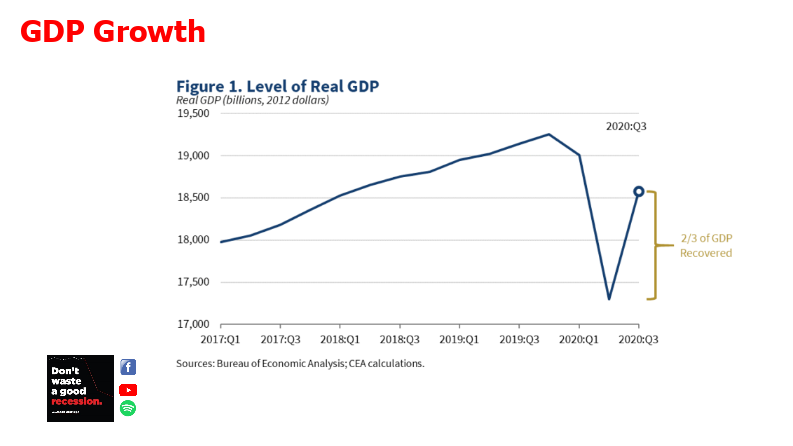

And in some ways, it is 33.1% annualized quarterly growth is the highest ever quarterly growth of GDP since records began in the 1940s, but remember the trap, minus 31% plus 33% does not equal plus 2%. It actually equals minus 9%. So it’s one of those areas where math and statistics are not intuitive.

So if we factor in the March quarter, when the US annualized lost 5%, the US economy has only recovered two thirds of what was lost in terms of GDP.

So even though a plus 33% may look bigger than a minus 31%, it does not actually reflect a V shaped recovery and coming back to the status quo. We were always going to get a huge September quarter bounce, because of how disastrous the June quarter was so expect the same in the UK and Australia when their quarterly GDP figures for September, are released, but don’t think that’s the end of the recession, slower growth and perhaps even some more negative quarters, especially from northern hemisphere countries, lie ahead.

Let’s recap some of what we’ve talked about. And while I would still basically bet my house and what I’m doing right now which is betting my business on Australia, having a recession in 2020. There’s no doubt that given the impact of the coronavirus that can damage on only economy. Australia is well placed at this point to write it down. This is the most common type of recession.

However, for reasons we’re going to talk about I don’t think is what we’re going to experience through the coronavirus recession.

And in terms of unknown unknowns, is a chart. The number of coronavirus vaccines we’ve successfully created for Apple. I honestly think and I might do a detailed video on this in the future I think we’ll look back on June, 2020, as the month that we chose money, and the economy over health.

You are now in September, two thirds of the way through the best ever quarter to GDP growth in history. The figures that are going to come out for the current quarter that we’re currently in are going to be astronomical so mindset wise to track recovery, which track, are you choosing?

If we look at that number, that is the L shaped recession that we have been talking about V shape shows that its very very clear that by the December quarter by Christmas of this year the economy is as large as it was at the beginning of the year, or larger, and they will shape recession may not be as pessimistic as that shape that I’ve drawn there, but would suggest as we’ve been talking about for some time that it’s going to be middle or late 2021 before we actually get validation.

You don’t need me you don’t need the evening news you don’t need data about the PMI in China versus the PMI in the USA, to make good business decisions. You just need better data about your business. My final question for you is not. What do you need to do what the f is happening in the world right now. Final question to you: What if this is the best opportunity of your business life. It turns out in 20 episodes of this economic forecast plus, all of the other critical content on the don’t waste a good recession YouTube page. We’ve managed to cover an awful lot of specifics. We have been able to forecast and see some of these consequences. That’s why many of my clients are thriving right now because they find their decision making to be months or months ahead of the competitors of their clients of what their clients are asking for, and as such they can make better decisions right now in the present moment. So, to track recovery.

As we look at that graphic there you can see those two lead indicators active COVID-19 cases and the share markets Australia is green. So if your business is in Australia. How are your post recession plans coming. Those transformations that we’ve talked about. Are you ready to execute, if called upon? We’re not at the bottom of the cycle yet, but we’re certainly looking like we’re going to get this sooner than some of those other countries. If you haven’t yet worked out what your business is going to look like once the coronavirus recession is over, you need to make sure you’re investing, far more time in that from November from right now. Because you don’t want to be the business that is caught behind – you want to be the business that is one step ahead, and therefore can ride all of the upswing when it inevitably comes.

Clearly, though, we have a different scenario in the UK and the US, both of those lead indicators are actually in the red. Now even within those countries, I appreciate things are localized a little in some cities, some states that conditions are very, very different. You need to continue to maintain your personalized preparations. What I would suggest you do is go to the critical content playlist on the ‘Don’t waste a good recession YouTube page’. There are 16 videos there, covering things like how to prepare for cash flow, customer service sales staff their wells, how to surround yourself with good advisors and so on. As you face a recession, we talked about those things at the start of the coronavirus recession. And for those two countries and many other around the world. the situation you are facing right now is very very similar.

Next month is going to be harder it’s going to be worse, and unless you are doing the right things, you are going to struggle. The first question you need to ask yourself, quite honestly right now: Will your business survive until Christmas? The cash flow forecasts can help you with that, looking at some of the conditions can help you with that. This is an important question because if the answer is no, don’t get too caught up in hope because sometimes the best thing you can do with a business that is failing, whether because of mistakes that you’ve made, whether because of sensible risks that you’ve taken that unfortunately haven’t paid off, or whether because of these external factors that are outside your circle of influence, like a pandemic, like government lockdowns -whether those are the reasons why your business isn’t going to survive, it’s often better to fail fast. Don’t drag it out Don’t drag your family your staff and your finances, through the worst of it. If there’s an opportunity to cut it much cleanly in advance. And remember, always. The vast majority of businesses fail, eventually, it’s people it’s you the business owner the entrepreneur who took that risk who, who has that spirit, you are not a failure of just because your business.

And so by cutting it cleanly as quickly as you can. You set yourself up, emotionally, financially for that next opportunity. The next business, whatever that might be. If you don’t know where to start. You don’t know what conversations to have about your business the sustainability of your business, how to respond. Google ‘business recession war cabinet’. And in that video check out what advisors and friends you already have, you can talk to openly vulnerably, people that who are there to help you, who want to help you.

And in many cases will be able to do that in a low fee or no fee, because they’ve got the spare capacity and they’ve got the empathy to know what you’re going through.

And of course you can reach out to me. My business, partly through luck, and ,of course my belief that I choose and create the whole of my reality I control my own luck and I established myself to have an anti fragile method, running through my organization has meant that I’m in a quite a strong position.

So, if you have questions, if you need someone to talk to, and you don’t have anyone around you who already knows your business, send me an email, organize some time for us to speak at no cost. It’s my great delight to be able to help business owners around the world. And I know, as I said at the outset, many of you are doing a tough right now. And if I can be of some support in that whatever the forward progress, then please do reach out and let me know how I can help. Specifically, a couple of things that are coming out that I am putting out there to be able to help. I’ve had some volume, because I only have so many hours in the week and of course I have my own businesses, and my own client commitments.

So, a few more of the volume things like the practical antifragility courses are around last week, I have coming up in November, a two-day online strategic retreat, covering all 10 core principles of the antifragile business. We’re going to go with as always practicality and positivity and look at some of the things that you can do in your business to implement those principles to create a business that gains from disorder the benefits from the volatility that’s going on.

I always have been and remain more of a gymnasium than an ambulance. So that course and then the full anti-fragile method transformation programs that we’ll be launching in January, are there as gymnasiums for businesses that are already in ok shape.

If you need an emergency room if you need an ambulance if you need to dial 999, 911 or triple zero, then recognize that some of those courses while they will have great content. While there may be some specifics, you can take, then not going to be specific enough to you are practical enough with speed to be able to change the trajectory of the business that is looking at a Christmas deadline.

And so don’t count on those to solve all of your problems. Pick up the phone reach out again as I say to me, or even better to those specific advisors in your wall cabinets that you have around you. And if you do feel alone. The very last thing that I would encourage every business to do is to share some of these links with your network, with your leadership team, with your friends in business. The more people you know in real life more your clients your suppliers are also applying some of these positive and practical steps, the better place you will be as an ecosystem to ride out the worst of this storm.

I hope you don’t need that emergency help in your business. I hope wherever you and your family are the second wave that is hitting some communities is going to ride over the top of you with minimal humanity. And I hope that you find, despite some of the pessimism in that forecast that November is a really strong month for you emotionally for your business for your family. If I don’t see you in some of the workshops, I run in November. I look forward to seeing you. Hopefully with a little more positivity. At the end of November for the next episode 21 of the Don’t waste a good recession snapshot and forecasting.