November economic snapshot. Let’s talk execution!

This month you’ll be pulled in many different directions. I’m here to remove some of the noise:

- Create a time for reflection, and celebrate your COVID Blessings.

- When bombarded with negativity farewelling 2020, ‘Decline the Invitation’.

- We are still in a Recession. Keep giving love to your clients.

- AND – make sure you are ready to execute your plans for business post-recession.

Point #4 is the focus of this month’s Economic Snapshot and Business Forecast video. Are you ready to execute your plans for the four transformations a recession forces on small businesses?Who is helping you design that strategy? And how will you know with confidence that the time is right to execute? The video transcript is below, and watch this month’s video here:

It’s been a number of months since I told you to start getting your post coronavirus recession plan planned. Today, when are you going to be ready to execute. You don’t want to be too soon: being too soon is expensive, being too late, could cost you everything. I’m Jacob Aldridge, this is, “Don’t waste a good recession”.

Number 21: reviewing the financials for the Australian UK, US economies as indicators for most of the Western world, as at the end of November 2020 and therefore using them as a forecast for your small medium sized business in December of 2020.

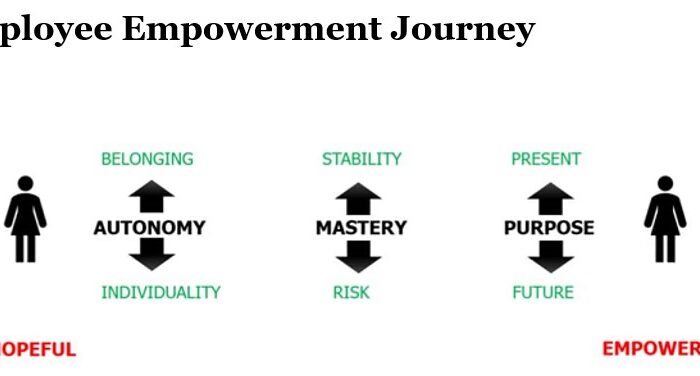

The focus, as I said is around execution. You may recall, we talked very early on about the transformation that every business has to go through during a recession. For the business that goes into a recession is not the same business that comes out the other side. To succeed for the long term you need to evolve, to reinvent yourself. I’m not talking about the crazy pivots that maybe we had to do, back in March, April of 2020, just to survive. I’m talking about the committed focussed, strategic development of your organisation, and every recession changes the business in these four ways.

So you can either make that transformation yourself, or bury your head in the sand and hope that it doesn’t affect you and watch as your business slowly declines, or fails to maintain the pace that it could as we go into the next decade of economic growth.

The four transformations we’ve talked about:

Firstly, the transformation of your client base, and that doesn’t necessarily mean different clients, but what motivates your clients their value proposition what drives them will be different on the other side of this recession, as it was going in.

Your clients will have changed, your packaging pricing even – perhaps they will also need to change. You’re selling to different people, different value proposition, how you bundle and bundle price your services may change. It doesn’t necessarily mean discount. We’re not talking here about how you get through a recession, but how you use the opportunity of recession to prepare yourself for the long term future, that may increase your prices, your sales and marketing strategy also needs to change.

If you’re selling a different product at a different price to different people, it stands to reason that how you sell it and how you attract them through the marketing strategy also needs to change.

And then the fourth transformation is your team / your people. They will also have gone through a transformation. None of us go through a recession, let alone a pandemic without some introspection some opportunity to reflect what people to us and to change by working with your team getting through the recession so that they are aware of what’s happening with your clients, your pricing with your marketing and your sales.

If you have not planned those four, if you’re not ready to execute those four changes at a moment’s notice, then we need to talk. We need to get something into your diary before Australia Day, that goes through how your business is responding to the coronavirus recession, how it’ss planning to profit for the long term, by making those four transformations – this is the same for other economies that are similar to Australia in terms of being less impacted by coronavirus. This is most southern hemisphere countries like New Zealand Fiji.

If you’re in the Northern Hemisphere conditions you still have time. In fact, you may still be looking at how you focus on your position product packaging sales and marketing. It doesn’t mean you can ignore this. Remember, before it moves in a cycle. The point of credit risk is at the top of the cycle when we’re careening down the motorway 200 mph COP is out of control is waiting for something to go wrong.

The point of greatest financial opportunity sits at the bottom of the cycle by when it’s like the streets when everybody else is getting despondent, that is your opportunity as a business leader to come with motivation, to come within, to come up with new solutions. If you’re waiting for the execution point to stop planning, you’re going to be behind, you’re going to be as we’re seeing here in Queensland where borders to other states have just opened. If you’re the hotel, the restaurant,e the tourism operator, who waited until now to try and find the staff or a marketing plan, you got to be weeks behind on that profit opportunity. You need to plan for it as we are still in the downside.

We’re still going through that planning phase, we are now getting close to the point where you want to be ready for the execution, and you won’t know exactly when does the execution point. If anything, moving too early, if you can afford it. Let’s look at when do we know the economy’s execution point so you can execute those plans. So, what does execute point move on.

In a typical recession, there’s a few factors that lead to that recession. We’ve got a long form content on the domestic recession on our YouTube channel that show how a typical recession progresses, but the coronavirus recession is different. These three are showing us that the recession is on its way out into the next year.

First the lead indicators of the economy are positive, especially, (which of course is not the remit of these videos), are you managing a handful of lead, current or lag indicator independent that give you insight into the future of your business. We’re going to be talking about the lead indicators of the economy, the lead indicators of your business, even more importantly.

Second is Execution. First In First Out sector X is the sector that goes into recession first, it’s normally the first one out, it leads to recovery leads the next economic growth period. And so when you know what triggered the recession, you can see that has ended and it has taken with it a lot of the economic mistakes, inefficiencies waste that was going on the economy

And then the third indicator that we’re at (the execution point) is when monetary policy/ fiscal policy / governments and reserves around the world, decide is no longer needed It hasn’t necessaruly ended – they are slow moving shifts, the money printing machine, and they are slow to turn them off because they don’t want to prematurely send us back into recession or a slower solid recovery. It’s not that they had ended but that they do have a clear end point that we can trust the governments are going to indicate.

So those three factors: The lead indicator, Sector x and the monetary and fiscal policy:

Let’s now apply those to this recession / coronavirus recession in December of 2020., And you may remember in the last month, we looked at those two lead indicators: COVID-19 cases, and the share market. We talked about how Australia was really pulling ahead. The 2-track recovery that we talked about in the October forecast was underway. Australia was very much ahead of the UK and the US in regard to business opportunities for small, medium sized organisations. In the UK and the US, not so much. Stock markets had gone down there’s still a lot of financial uncertainty, going into November.

Now, let’s look at what he gave us in terms of those figures:

Active Covid – 19 cases: Up Up Up. Increase across the board. Now remember, these are not total cases, there’s total deaths there, total cases and some news media reporting will always go up, You can’t un- die of COVID-19. The number will always increase. Active cases don’t necessarily have to keep going up. Indeed we want to see them going down. This means that there are more people who actively have COVID-19 than there was one month ago and the increase in the active covid cases floating around means it’s more likely that lockdown makes it more likely to respond by not spending by not going to work by not providing supporting the economy because of increased taxes or because they may be home sick or sadly, much worse.

Australia once again a little bit green. In fact, Australia went through the entire month of November with zero COVID-19 deaths across the whole country. There was a little bit of a cluster in South Australia, so the case numbers week to week has gone up slightly, most of those active cases in Australia are in quarantine. They are returning travellers from overseas, there’s very limited community transmission going on in Australia.

The same can’t be said for the UK, the US and globally. The number of people with active COVID-19, across the world, and some other countries are up by almost half again during the month of November.

We’ve been talking for some time, about how heading into the northern winter, people will be closer together, spending more time in enclosed spaces. And the fact that colds are worse during the winter months. Possibly for that reason, possibly because it’s just colder. all of these factors underlying suggests increased COVID-19 cases, as opposed to the opposite. Though in terms of lead indicator, not looking so good, from an active COVID-19 cases perspective,

The economy. We look to share market – people putting their money where their mouth is. You buy today because you believe things are going to get better in the future you sell because you think things are gonna get worse.

We’ve had that one month lead indicator. The share markets versus the real economy in small to medium sized business. So, what did November give us? A great month. When I shifted the economic update from weekly to monthly i decided to focus on when they go up or down by 10%. Actual volatility that means something. Well that’s what we had in November. 9% in Australia, 13 14% in, respectively -The Dow Jones Industrial industrial index, and the footsie 100 in the UK.

Big growth month.

Now, ‘Because’ remains the most horse shit word in financial journalism. I think it’s pretty clear that what triggered, in November, the markets to really bounce off where they were in October was the announcement not just once from Pfizer but three four times from the vaccine manufacturers that the initial widespread secondary clinical trials which are enormous level of efficacy – very very positive results that spoke to a much faster earlier rollout of those vaccines, and for those businesses that are waiting for the vaccines, to get up and running with the recovery, that could possibly start much sooner.

The election in the US probably didn’t hurt things – You may have seen a very very brief press conference with Donald Trump congratulating himself, and the US economy for the DOW reaching 30,000 points. This was a new record high. It has reached a new record high. It’s come off it ever so slightly last Friday. Americans aren’t great with irony. REaching that was at least in part triggered by him losing an election is somewhat ironic.

For us, SME businesses, even though we’re not listed on any of these exchanges that certainly bodes well for economic confidence from right now. In fact, from several weeks ago. If your business is wondering whether this Christmas, often a good period for spending, the economy is going to be good. General indicators are certainly suggesting it absolutely will be.

The Last point I wanted to make (see highlighted in white) – the growth trajectory: you can really see the blue of the footsie and how it’s lagging. If you want an indication of the impact of Brexit. The UK left the EU in January of this year. And now, looking at what is possibly is possibly a hard Brexit at the end of December, my feeling is that there’ll be some deals (for PR purposes, if nothing else) and stuff created. If you want to have the economic impact of Brexit. I think that chart shows it – the footsie is up 27% since March, it has not gone back to February record highs that it held. And it’s lagging, even though it’s good growth, it’s lagging behind the US, and some of that is definitely because of the looming Brexit and the impact that’s going to have on the UK economy.

The point is there’s an execution point coming in the coronavirus recession.

Question number one: lead indicators? Are they positive? – well in Australia, they continue to be.

So for Australia that first of the three factors: big tick. In the UK and the US unlike last month, the markets are up strongly heading into Christmas which is often a good period for spending. However, with active COVID-19 cases, the lockdowns continue to be in the red – they’re not looking good. Increased across UK already in place. Joe Biden comes in as president on the 20th of January and he’s already talked about, not being able to enforce the national things because of the way the US government is set up. But he can make much stronger recommendations to the stateson what they need to do to prevent the ongoing rise of COVID-19 cases in that country, which will lead to some economic impact – not necessarily a greater economic impact.

So, positive for Australia, less clear for the UK and the US. While we’re on the topic of economic indicators let’s quickly look at the two lag indicators: unemployment and GDP growth

Unemployment figures came out of the UK for September. That was up by 0. 3%. The UK continues to be good by historical standards, let alone coronavirus recession standards around the world.

Australia was up ever so slightly, as we went through the last bug locksdowns in Victoria

In the US unemployment was down by 4%. And even though there were some one-off things we were talking about – the census, election-related employment – the final push for the election campaigns show in the October figures; campaigns hiring, vote counters all of those impacts being recruited is temporary but you can’t take away from the fact that it’s very very good news for the American economy, Remember, Americen unemployment in April was 14.7%, so that’s 10s of millions of people who are back working in October who were not working in March and that is going to be a great lead indicator for the economy moving forward.

GDP growth:

Australia abut the time this video will hit the airwaves, will announce in September quarter, is expected to be, as the UK and the US was, the month before, it’s much the same – The best quarter GDP growth in history .

What does that mean?

Not much really . You’ve got to look forward, . Absolutely though, it’s good news for the economy that it’s not worse than it could be as we head into it. The thing that is going to be interesting for the December quarter,when we look at the share market, when we look at what’s happening that would suggest that the December quarter is probably, whatever the outcome is – not going to be as positive as the September quarter. It’s not going to (when you look at the GDP of those countries or any of the other countries around the world), it’s not going to send that back above pre corona virus recession GDP levels. This has not happened, it’s not going to get us into recovery until mid to end of 2021.

So the next 2 execution points:

Sector X has recovered. Sector X has, historically, been things like agriculture. The 1706 recession in the United Kingdom was the agricultural recession with the solar minimum, the little ice age. Also, the 1999/2000 dotcom bust up and the real estate and banks in 2008, railroads in 1857 – all these specific sectors… and with ‘first in first out’ we talked about when the mining sector collapses, it starts to recover, then it takes the rest of us with it.

With multiplier effects – we’re all in this together – its good for the economy potentially good for you as a business owner, even if you lose your business, because it’s a chance to wash out all of those inefficiencies. It makes a stronger economy, small business being anti fragile, it benefits from the volatility of the recession.

The coronavirus recession was different wasn’t a specific industry, the crash was the pandemic. This meant we had the double impact of government enforced lock downs that were causing economic distress, and then the wider inefficiencies of economies.

Some countries like Germany and Hong Kong went into recession before the pandemic arrived. It wasn’t the pandemic that set them off. All these other countries were also in uncertain troubling Financial Times prior to the pandemic. But that was the trigger. So where are we at the pandemic coming out?

Well, the vaccines, as we talked about, remember this is incredible news we have never before created the coronavirus vaccine. There’s no cure for the common cold, that’s what we all got told. At least a quarter of the annual common colds are caused by the coronavirus family. Things like SARS and those, that’s coronavirus. It’s taken COVID-19, which is pretty high risk factor to actually get this real focus on creating a coronavirus vaccine.

So, for the coronavirus recession. If the pandemic was Sector X, what does recovery look like? It’s not the end of the disease itself yet – the mining companies are back to where they were so they’re on the road to recovery they’ve got some stability, they’ve got some growth based on efficiencies, not wildcard down the freeway.

So, the end of sector x for the pandemic is not that the disease has been eradicated or cured necessarily, it’s the consistent, predictable management of it. A vaccine is important first step towards that consistent management of the disease, that can therefore start the economic recovery.

The first step: we have to think about how is this going to be rolled out? Remember you can execute those strategies. You can start taking to your customers to your staff, a post recession, pricing and packaging solution. A post recession sales and marketing approach. You do that too early, you’ll miss the opportunity – they won’t be ready for it. So the reason why we want to know the next steps for the vaccine rollout is we want to know when we can execute, so we time that appropriately.

And here’s the headlines. Let me boil it down with a little analogy. If you had every English Premier League football stadium with the UK military providing what they reckon is 100,000 shots a week at that football stadium. If you had that happening at every single English Premier league football stadium, you still wouldn’t get through the UK population in a year. And that makes the assumption that we’re vaccinating people who can get up and stand in a queue – twice – with most of those vaccines, you’re going to need two jabs. So you know, going into some of those high risk communities who can’t just get up and go to a football stadium, it will get harder.

This is a military operation, a matter of national security. We will roll out this vaccine. And for all the anti Vax child murderers that are out there are going to oppose it, for all the people who aren’t clear, I think when we see the effects, assuming that the efficacy continues to be there, even if some of those risk groups who can’t be put into a trial. This will drop take us to the point where we’re gonna have enough uptake in purchase from governments and businesses around the world to make it happen.

The last unknown, which will come as part of that profit phase, it’s not going to impact when we execute, it’s going to impact, to a degree, a large amount of the economic growth over this macroeconomic boom is: how long will it actually provide that protection? Is it going to be like polio, like smallpox where you get a series of doses and you’re therefore protected for the rest of your life? Or is it going to be like the flu, where you’re going to need an annual job it’s going to provide a level of protection against however the coronavirus has mutated that year? For me for my business, my family and my clients it’s necessary that I get that level of protection and I’ll obviously get a coronavirus vaccine every year as necessary.

10s of 1000s of people die from the flu every year. We know that COVID-19 is potentially around 10 times more lethal than the flu, so that could look at hundreds of 1000s of people die every single year. The vaccine will exist and everyone get a vaccine every year that’s the risk that is going to go on and we’ll have some years that are better than others.

Even though the vaccine is not a magic pill, however, its fantastic news for the end of Sector X and what that means to for the economy.

Now, the third of those factors : monetary, fiscal policy, no longer required – how’s that going?

Australia: Good, positive Lead indicators. The government has said job keeper/ job seeker- the fundamental fiscal stimulus programmes where the government has been funding money to prop up the economy here. They’re winding down already and due to expire in march. The government has said there’ll be no exception. So they’re talking the talk of ‘it’s no longer required /the economy is gonna be in good shape from early 2021’.

The Federal Reserve Bank, in putting out its statement yesterday, has said they’re not moving interest rates, which are at record lows here in Australia, has said ‘Bumpy Recovery’. Some people reading the tealeaves are saying the Federal Reserve won’t lift interest rates for at least three years.

That means that they’re going to allow some runaway inflation. We know the government wants some big licks of inflation, rich people want big licks of inflation, so it’s probably going to happen. What that also means is that, because interest rates are some of the bluntest ways to curb inflation, it’s not thought its going away anytime soon.

So, they’re not forecasting, a return to boom times in 2021.

It is worth noting, that Joe Biden’s gonna come in and talk about stimulus. So there’s more coming down the pipeline in the US. The Furlough programme is going to extended in the UK. There’s a lot of uncertainty, lockdowns, tears. You’re going to have Christmas off (Boris Johnston has a week long truce with COVID-19 apparently), but certainly we don’t have a firm end date for those programmes in place .

The headline : Pm rules out JobSeeker/JobKeeper extension is actually from May of this year, and Scott Morisons government extended both of those programmes subsequent to making that announcement.

So, where does that leave u:

The lead indicators are they positive? absolutely in Australia looking very very good, the UK the US we’re getting mixed signals. Look at the local area: How is COVID-19 impacting you locally, and, of course within your business sector.

Sector X? Has it recovered and are we managing the pandemic in a consistent manner? The rollout information for the vaccine: that’s starting this month in the UK. We’re going to have that information very very soon.

Monetary / fiscal policy / intervention / stimulus no longer required. CErtainly we’re not there yet, so they’re not there yet , but Governments are talking that way, (except perhaps in the US where the current President would love to have some cheques witih hos signature on the, leaving the White House.)

Combining those three factors. There’s certainly nothing there that tells me that the execution point is absolutely coming before March of 2021. However, combined with your business lead indicators, you may see that the post recession economy is coming your way.

Remember, you have to separate out: How are you dealing with the recession the economy, and some of the ups and downs that goes along with that, for how your business will be structured, after the recession, after the execution point.

Before transformations of a recession, you either do, intentionally or you have thrust upon you, different clients, different pricing and packaging, different marketing and sales strategy, different team, different team approach.

Have you got the plan in place yet for how those are going to look post recession?. If you don’t, who’s helping you to create that? If you need to have a conversation, my emails my phone, always remain available. Based here in Australia, trapped in Paradise, I’m having a lot of conversations with sme business owners, heading through Dec and Jan, making sure that they are ready. If you’d like to be one of those, reach out and let me kknow

In the UK and the the US you do still need to continue implement the back to basics approach that we talked about. I’ve been talking to alot of business owners in those countries and others around the world about that juggle: What do I do with my business to get through the recession and benefit from the opportunities, while also planning and preparing for the future.

Those are both opportunities for you to balance with the investment of time you make every week.

Both now and for the future, my message remains: Don’t waste, a good recession! Grab those opportunities. And if you’re really not sure how to apply that for yourself, what the lead indicators are in your business, or how do I transform while I keep my business running, tick subscribe, share it with your friends, reach out let’s have a conversation.

I hope you have a fantastic December, both in terms of your business, your health, and what happens as we head into January, 2021, a new year.

And I will remind you, not to buy into any of the negativity that’s going to pop up around that transition but instead to count your blessings and to move forward with power and focus on brand new business and lifestyle.