Wealth Quadrant for Business Owners. In Blackboard Fridays Episode 5, Jacob talks about Commercial Vision. Need this implemented into your business? Talk to the international business advisor who can do exactly that – Contact Jacob, Learn More, or Subscribe for Updates.

Who is Jacob Aldridge, Business Coach?

“The smart and quirky advisor who gets sh!t done in business.” Back independent since 2019.

Since April 2006, I’ve been an international business advisor providing bespoke solutions for privately-owned businesses with 12-96 employees.

At this stage you have proven your business model, but you’re struggling to turn aspirations into day-to-day reality. You are still responsible for all 28 areas of your business, but you don’t have the time or budget to hire 28 different experts.

You need 1 person you can trust who can show you how everything in your business is connected, and which areas to prioritise first.

That’s me.

Learn more here. Or Let’s chat.

Transcript

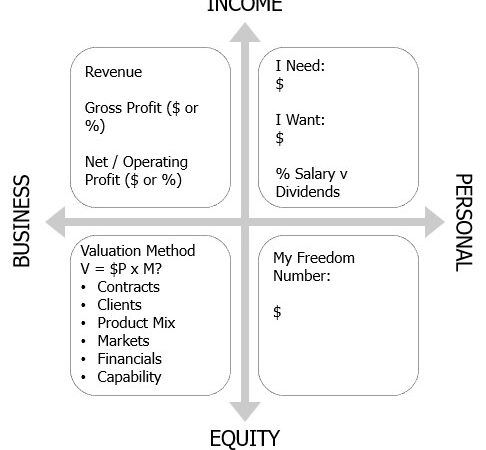

Hi! I’m Jacob Aldridge, Director of Strategic Advisory here at businessDEPOT. Today, we’re talking about wealth–wealth quadrant framework for business owners. When I sit down with business owners, whether at the start of their business journey or towards the end, maybe they’re starting to think about selling, one of the key questions I always want to know is what’s your number? What I’m really asking is, what is the dollar amount that you feel you need sitting in a wealth quadrant to retire and to live the rest of your life with the freedom to do whatever it is that you want?

When we analyse it for most business owners, that number ends up being a whole lot smaller. In fact, recently, I had a conversation with the business owner, or we went through this and realized that based on the valuation of his current business, he had already in fact reached the number that he wanted to live on forever.

Here’s the conversation and a little bit more of the structure behind it. So, this framework is what we call the wealth quadrant. What we’re looking at is for different types of money and financial assets that sit within your life. Some of them are volatile, a short-term up and down and unpredictable and some are a lot more stable.

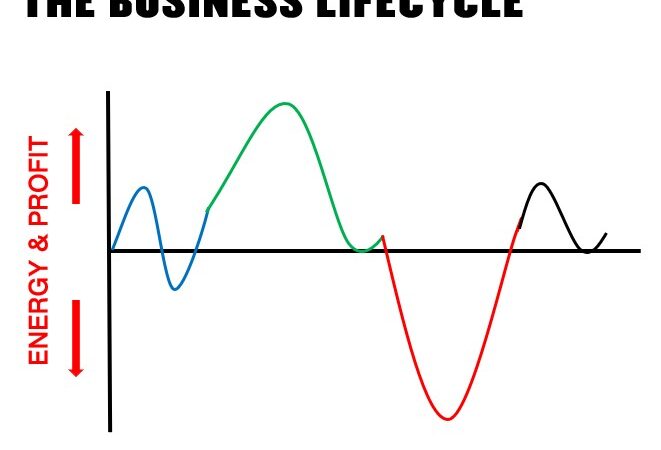

Similarly, some will provide an income and some are more equity based. Most of us start our life in the job quadrant and even many small and micro business owners are still actually sitting in the job quadrant. Their income is volatile. They’re not confident about what revenue they’re going to have coming in in 3, 6, 9, or 12 months’ time.

This is a quadrant that is inherently built with anxiety and anxiousness. The reason we as business owners put up with that anxiety is because we believe that we’re building something of wealth for the longer term. We’re optimistic that one day we’ll be able to sell this business and as a result, all of those years of anxiety and volatile income won’t matter because we will have that wealth.

Of course, up in the world quadrant, there are other forms of equity that you could be building. Investment properties, portfolio of diversified index funds, shares, bonds—those kinds of things. You could even have a systemized business that is not dependent on you at all, sitting up here providing you with some long-term value. So, in building your business, what we’re really looking to do is take that volatility and uncertainty and create systemization and stability.

We’ve got a lot of different processes we go through depending on exactly what your number is. There are other ways, of course, to build equity wealth like flipping. Flipping houses investment properties, property developments, day trading are all different ways that people create short-term volatile equity opportunities. What you’re really looking for from this wealth quadrant is an idea of what freedom is for you.

At the end of the day, your financial situation is not an end of itself—it’s a means to an end. It creates the freedom and choice that you want for your family for the long term. What I encourage you to do is have a think about what you need to live on each year to fund the lifestyle that you want and really think about it. This is one of the benefits of doing a budget is that you’ll often find that a lot of the gut feel assumptions we make about what we need to live on are rounded up.

It’s much bigger particularly when you look at things like paying off a house, no more school fees for children, and even just the day-to-day commuting and lifestyle costs that you may have built in while you’re running the business. You may find that freedom to travel, to be philanthropic, to do things that you want to do with your time actually cost a lot less than you currently need for your lifestyle.

Now we take this figure and we relate it back to the wealth quadrant—your net worth. There’s a body of research that suggests to be safe, you can draw four percent of your net worth every year to fund that lifestyle. In other words, if you need $40,000 a year, you need $1,000,000 dollars in net wealth. 1,000,000 times 4% equals 40,000 and now that’s a medium risk approach.

People with a low-risk appetite would treat that as 3%. They need more up here because they’re drawing a lesser amount each year. Those of us and many business owners like myself and my clients find that they’ve got a higher risk profile. They may want 5% which means they need a smaller amount here to fund that year after year after year.

The great thing about the freedom quadrant is that it doesn’t necessarily mean retirement. In fact, I like many business owners, I know have no plans to retire in the traditional sense; however, what we want to do is make sure that we have choice freedom and flexibility in our life. As long as our business keeps us sitting in the job quadrant, volatile, uncertain, a little bit anxious, we struggle to see the opportunities in the dreams that are sitting in front of us.

When I work with my clients, it’s not just about helping their business for the short term. It’s helping create their long-term wealth so that they can live the life that they really want to live.

Next Steps

Want to learn more about how this can apply to your business? It costs nothing to chat:

- Email me jacob@jacobaldridge.com (I read them all)

- Call, Text, or WhatsApp me +61 427 151 181

- Or just Subscribe https://jacobaldridge.com/about/subscribe-to-jacob-aldridge-com/ to stay in touch

[…] that help define where you want to go as a business, and with your personal life. Connected to the Wealth Quadrant episode, we also talk in both Income and […]

[…] Episode 5, Wealth Quadrant for Business Owners – https://jacobaldridge.com/business/wealth-quadrant-for-business-owners/ […]