When and How to Value your Business. In Blackboard Fridays Episode 24, Jacob talks about Valuation and Commercial Vision. Need this implemented into your business? Talk to the international business advisor who can do exactly that – Contact Jacob, Learn More, or Subscribe for Updates.

The best time to plant a tree is 20 years ago. The second best time to plant a tree is today.

The best time to develop a valuation plan for your business is the day you started. The second best time is today.

How well do you understand the valuation drivers that impact your business, and the tax implications that will determine how much of that value will make its way into your family?

This short #BlackboardFridays video asks some key questions, and shares the two best times in your business lifecycle for you to sell.

Want to know how this applies specifically to your business? Contact Jacob to discuss how the most colourful business strategy in the world approaches to Valuations and Exit Strategies.

Who is Jacob Aldridge, Business Coach?

“The smart and quirky advisor who gets sh!t done in business.”

Since April 2006, I’ve been an international business advisor providing bespoke solutions for privately-owned businesses with 12-96 employees.

At this stage you have proven your business model, but you’re struggling to turn aspirations into day-to-day reality. You are still responsible for all 28 areas of your business, but you don’t have the time or budget to hire 28 different experts.

You need 1 person you can trust who can show you how everything in your business is connected, and which areas to prioritise first.

That’s me.

Learn more here. Or Let’s chat.

Transcript

Hi! Jacob Aldridge here, in partnership with the accounting, valuation, and brokerage team at businessDEPOT in Australia.

There’s an old proverb that says “The best time to plant a tree was 20 years ago, and the second-best time to plant a tree is today”. I think that’s applicable to understanding the valuation of your business.

The best time to start thinking about how much your business is worth is the day you started the business. If you haven’t done that, the second-best time to have that consideration in mind is today.

Right now, wherever you are in your business journey, you want to have some idea of what that exit plan could look and feel like. At its simplest, if you were to sell the business intentionally or were the worst to happen you had to sell the business in a hurry, how much would you want or need to sell that business for?

There’re some good considerations you need to factor in, including the actual process of selling your business and things like taxation. Selling a business in Australia, you as the business owner, could end up with somewhere between a 100% of that revenue or having to pay the maximum personal tax rate on that return.

Make sure, if you are planning to sell your business at some point, that your tax accountant and your strategic advisers are all working together and understanding how to make sure that that puts the most amount of money in your pocket.

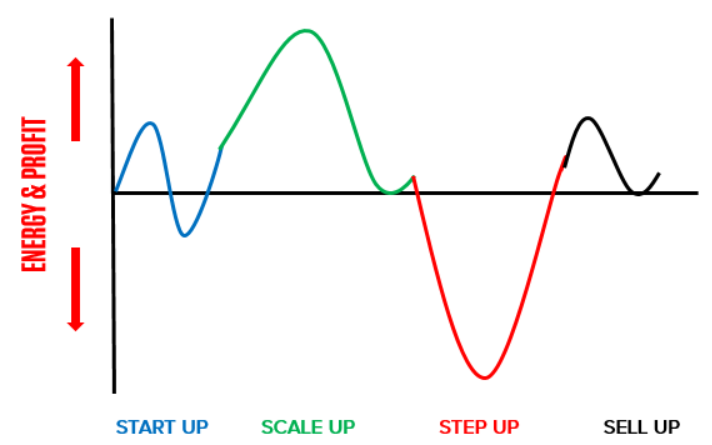

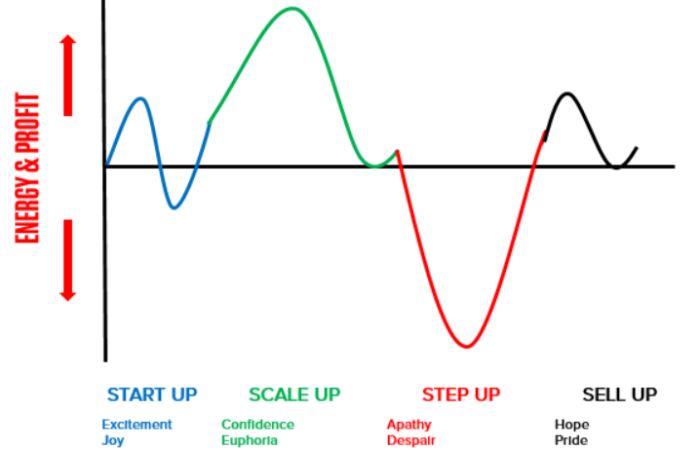

If you’ve watched a lot of the Blackboard Fridays videos that we’ve created, you’ll know I talked in Episodes 1 and 2 about the best times to sell a business:

- At the peak of the Scale Up phase of business, or

- During the appropriately-named Sell Up phase.

If your business is heading into one of those phases, now is a great time to be having the conversation about exactly what the business is worth and how to get there.

But regardless of where you are in the lifecycle of your business, you need to be thinking about what the key steps are to take you from where you are now to that exit number that you want to create for you and for your family.

It’s never too early to have an exercise about understanding what the valuation drivers are in your business.

Even if you don’t want a full-blown valuation, or a conversation about how exactly you might sell the business, understanding what those drivers are means that your strategy and your day-to-day activity within the business is creating that long term wealth for you, not just the short-term profitability.

Next Steps

Want to learn more about how this can apply to your business? It costs nothing to chat:

- Email me jacob@jacobaldridge.com (I read them all)

- Call, Text, or WhatsApp me +61 427 151 181

- Or just Subscribe https://jacobaldridge.com/about/subscribe-to-jacob-aldridge-com/ to stay in touch

[…] Episode 24, When and How to Value your Business – https://jacobaldridge.com/business/when-and-how-to-value-your-business/ […]