Do you actually know how your business makes a profit? In Blackboard Fridays Episode 65 Jacob talks about Revenue, Profit, and Business Financials. Need this implemented into your business? Talk to the international business advisor who can do exactly that – Contact Jacob, Learn More, or Subscribe for Updates.

Happy Friday Blackboarders,

Very few of us started a business because we’re good at maths. So unless you’re one of the special few, you’re probably like most of the entrepreneurs I speak with. You can tell me:

- Last month’s revenue

- This month’s likely sales numbers

- How much cash you have in the bank, and

- Roughly how much money you have left over each year – aka, your net profit.

You also want the last of those (heck, all of those) to be a higher number, right?

Well there’s a critical number you need to be able to calculate: your Break Even point. In this week’s video I walk you through how, exactly, you can determine this pivotal figure, the point at which your business shifts from loss to profit each month.

It’s not quite as simple as it sounds … but combining a couple of numbers you already have become easier when you can see the extra profit on the other side.

Watch this week’s episode here.

Who is Jacob Aldridge, Business Coach?

“The smart and quirky advisor who gets sh!t done in business.”

Since April 2006, I’ve been an international business advisor providing bespoke solutions for privately-owned businesses with 12-96 employees.

At this stage you have proven your business model, but you’re struggling to turn aspirations into day-to-day reality. You are still responsible for all 28 areas of your business, but you don’t have the time or budget to hire 28 different experts.

You need 1 person you can trust who can show you how everything in your business is connected, and which areas to prioritise first.

That’s me.

Learn more here. Or Let’s chat.

Transcript

Do You Know Your Numbers?

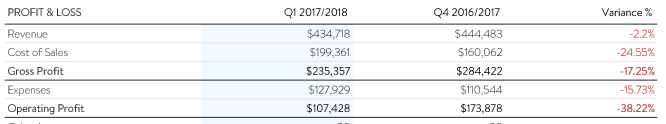

When starting and growing a business, there are many critical numbers: your revenue, your profit margin, and how much cash you have in the bank are three figures that immediately come to mind!

And when I talk to existing business owners, they are usually clear about those pieces of financial information. A number that they’re less clear about – but which is just as important – is their Break-Even Point on a monthly basis.

In other words, do you know how much money your business needs to generate this month in order to Break Even (ie, cover all of your expenses, so neither losing money nor making a profit)?

Why Do You Need to Know Your Break-Even Point?

Knowing this figure gives you a specific target when planning any of your revenue or growth plans. If you know how much the business costs to run each month, then you have the first monthly sales goal for example.

If you’re not yet in business, you might think this is an easy figure to calculate, but the reality is that some of your monthly expenses are fixed and some are variable – they are linked to how much revenue you bring in.

In this episode, I combine that information to share with you this magic formula – the formula to help a business understand where their Break Even Point is and therefore what their formula is for profit.

Step 1: What are your Fixed Costs?

The first step we need is to understand what a business’s fixed costs are. These, by virtue of being fixed, are a straight line.

This is analogous to the giant pool of money that you put on the roulette table at the start of every month as a business owner. If it costs you ten thousand dollars to open the doors, fifty thousand (a million?) dollars every month to run your business, those are fixed costs.

Things like your rent, most of your staff, a lot of expenses overheads, leases, software, all of those things – they’re going to be the same regardless of whether you sell a dime worth of actual business services.

As a business coach who understands these numbers (and provides most of my clients with monthly financial reports) I’m still surprised how many business owners don’t know their Fixed Costs. They don’t accurately separate their Fixed and Variable costs in their financial system.

Step 2: Your Variable Costs and Gross Profit

Once we understand those fixed costs – the expenses you incur regardless of sales or work delivered – then we can to separate out the variable costs within your business.

These are costs that you will only incur when you sell your product.

Almost by definition, they are a percentage of your revenue and I say almost by definition because if you find that your variable costs in and of themselves exceed the actual revenue that you generate from that product, then you’ve got a dog of a business. You’re going out of business backwards.

I’m not a believer in loss leaders. I can certainly understand that some products or services may have a lower margin but you don’t want to create a business where for every dollar of revenue you generate, your variable costs are more than a dollar. Because remember: your variable costs (sometimes recorded as “Cost of Sales” or “Cost of Good Sols” are going to sit on top of the fixed costs, those overheads / expenses that you can’t get out of.

By virtue of your variable costs being a percentage of revenue, you can start to calculate, “Well for every extra dollar of revenue I generate, what extra variable costs will I incur?”

This then tells us your Gross Profit Margin. Your Gross Profit Margin is how much profit you have once those variable expenses are paid.

I know some businesses where their variable costs one or two cents on the dollar, they have very very fixed overheads. They have a Gross Profit Margin of 98-99%. I know some businesses where their variable costs are much much higher, by virtue of the fact they are on selling a product at a low margin. They have a Gross Profit Margin of 10%-20%.

If your financial reports, your Profit and Loss Statement does not separate out fixed and variable costs, then you will struggle to discover where exactly your break-even point is. This is because, if we review the drawing on my blackboard, your break-even point is calculated by adding the variable costs on top of the fixed costs, and working out where that revenue crosses the line.

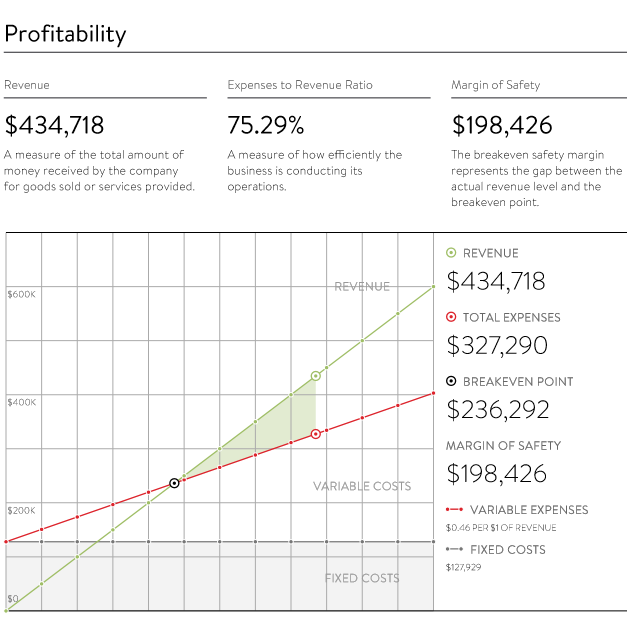

Step 3: Your Break Even Point is your Fixed Costs divided by your Gross Profit Margin %

I’ll repeat the diagram here, because some of those terms probably make more sense now!

Let’s look at this real life example:

- Fixed Costs are $127,929 per month

- Variable Expenses are 46% (46c per $1 of revenue). Therefore the Gross Profit Margin is 54%.

- Break Even Point is $236,292. ($127,929 divided by 54%. Note that this example has some rounding in the figures.)

Why I call it your Profit Formula

Everything that your business generates over and above that break-even point is profit.

This is the situation where:

- all of the fixed costs have been met

- you have exceeded the gateway on those variable costs, and

- moving forward you continue to grow the margin as a percentage over the top those variable costs.

As you can see, understanding your Break-Even Point gives you a specific target each month. The earlier in a month that you hit the target, the more you can exceed and build out that profit.

Do you know your Break Even Point?

If not, what would change in your business if you DID know this crucial number?

If your current support team are not helping you with your financial growth planning, contact the experienced coach who will.

Variations on the Break Even Point

Now there are other ways of calculating this number, and there are other more complicated elements – like knowing your cash break-even point, which of these expenses and which of this revenue is actually cash as opposed to being calculated by your accountant in another way.

Often, the cash breakeven point is a little bit higher. So you may actually that find as a business you exceed the break-even point we’ve calculated today but your cash flow continues to go backwards. If you’re finding that’s the situation, then you definitely need to do a more detailed analysis of your Profit Formula.

This is something that your accountant is definitely able to help you out with. A good accountant will always pay for themselves when it comes to helping you to grow your business.

Hopefully today you’ve seen how we can use just these four simple elements, fixed costs, variable costs, your revenue, and then ideally that profit, how you can calculate this number for yourself.

Next Steps

Want to learn more about how this can apply to your business? It costs nothing to chat:

- Email me jacob@jacobaldridge.com (I read them all)

- Call, Text, or WhatsApp me +61 427 151 181

- Or just Subscribe https://jacobaldridge.com/about/subscribe-to-jacob-aldridge-com/ to stay in touch