This isn’t a post for startups. This is a starting point overview for established businesses that are finding growth stalled or stopped on their way to $1 million in annual revenue.

My friends at Shirlaws Group have done some incredible research and reporting on the specific structural roadblocks that impact small businesses, and I wanted to piece together some of their better articles on the topic.

The predictable problem of business black holes

I wrote several years ago about Black Holes and No Man’s Land, and the predictability of these points in growth where businesses can get stuck, sometimes for years. How predictable? The research demonstrates, and I’ve seen this in action myself, that specific revenue milestones are linked to specific commercial and structural challenges – if you know the revenue of a business that’s stalled, you can generally determine accurately what changes they need to make to continue their growth. Shirlaws has the milestones from $80,000 per annum up to $14 billion in revenue – sole trader, small business, private enterprise, all the way up to corporations and multi-national conglomerates.

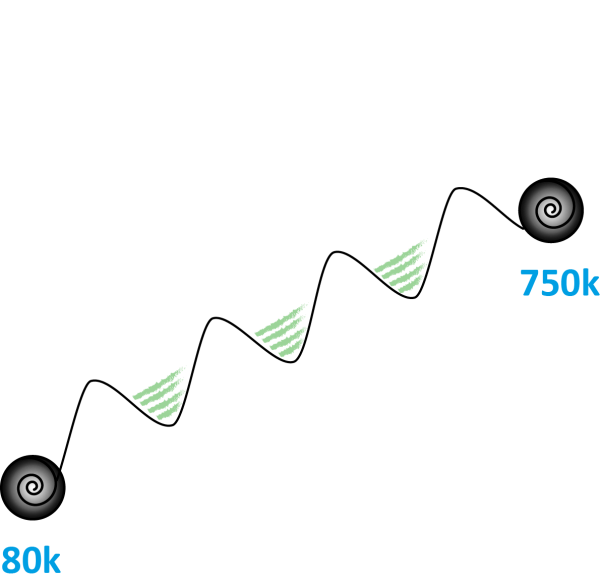

There are ‘Black Holes’ at $80,000, $750,000, $17 million, $170 million, $800 million and then further up (far beyond the scope of my consulting, or this article).

Here’s the excellent overview by Darren Shirlaw – https://www.shirlawsgroup.com/Magazine/2015/06/24/The-predictable-problem-of-business-black-holes

For the sub-$1 million business, the key figure here is the Black Hole that shows up at $750,000 in revenue.

“$750k is the point at which people have typically built up a business to seven staff, each reporting to the founder. There’s no business leverage without reporting lines, yet this idea often puts the owner into a quandary. ‘I need someone who can sell/manage staff/service clients like me. But I don’t think anyone is else is quite good enough!’”

Black Holes represent fundamental structural issues within a business. They’ve generally grown beyond one profitable point, but not yet reached the next – management, sales and administration resources are stretched, but the cash flow isn’t comfortable enough to invest in more people. They either need to shrink back to regroup OR take the risk and invest in growth; both are uncomfortable options, which is why so many small businesses spend years going round and round the Black Hole.

Explain those figures!

Here’s a key point for reading these links – the revenue figures quoted are based on a typical professional services / personal exertion business model. For other businesses, you will need to remove some product costs so your figures line up and the recommendations are accurate – it does not include Cost of Goods Sold (COGS), for example, so you may need to use the Gross Profit figure from your P&L NOT Total Revenue.

- Example 1: A catering company is generating $80,000/month ($960,000/year) in revenue. Food costs are 40% of their gross revenue. When looking at the Black Hole numbers, we use 60% of their revenue (ie, $960,000 x 60% = $576,000).

- Example 2: A retail store has an average markup of 50%, which means their Gross Margin is 33.3% of revenue. When looking at Black Hole numbers, we use 33.3% of their total revenue.

It’s also critical to appreciate these are contextual numbers, not specific-to-the-dollar predictions. If you’ve been turning over $850,000 in annual revenue for the past 3 years, you’re likely stuck in the $750,000 Black Hole.

Getting to $750,000 in annual revenue

If you read the above link, you’ll have seen the first Black Hole shows up around $80,000 in annual revenue. This is the typical ‘one man band’, and the structural need is here is employing a staff member or running mate.

Once a business moves through this point, they enter the ‘DOING PHASE’ of a business. Small Business is, well, small – the business owner is still going to be hands-on and responsible for ‘Doing’ most of the strategy and revenue-generation work.

Between two Black Holes (eg, $80,000 and $750,000) sit four Revenue Cycles. These Cycles are contextually the same, and in the same order each time: Sales, Channels, Product, Brand. But the specifics in each of those topics will change from Phase to Phase.

Here’s Darren Shirlaw explaining these in more detail, specifically using examples from the ‘PROCESS PHASE‘ (between the $750,000 and $17 million Black Holes)-

https://www.shirlawsgroup.com/Magazine/2015/07/30/The-four-cycles-between-the-black-holes

In the DOING PHASE, the revenue milestones for each Cycle are:

- Sales – $120,000. You can reach this number, especially with a team member helping deliver the work, fairly easily. Growing beyond it means improving the consistency of your sales process. You’re still doing Sales, but you’re doing it more efficiently (eg, all your Sales Meetings follow the same refined structure)

- Channels – $240,000. Sales is running more efficiently, but you’re still having to find them all yourself – and that puts a limit on your growth. Having Channel partners who refer you pre-qualified, pre-sold customers (this includes online) improves your conversion rates and sales efficiency.

- Product – $400,000. Now is the point at which product extension normally begins. You’re selling $30,000+/month of your core product, so you have a decent number of clients – what other products or services can you sell them?

- Brand – $600,000. You’re a growing business with a small team … but you’re probably using the Branding you created as a startup. You don’t look the part. Brand (which is a lot more than just Branding) is actually the key to accelerating growth – Shirlaws recommends small businesses at this point consider ‘What will our Brand be when we are a $12 million business’ and act accordingly to rapidly pull you through the coming Black Hole.

Intentionally or not, a business that’s reached about 7 people and $750,000 in revenue has addressed these four cycles. It’s probably taken them a few years – keep in mind, we’re talking about small businesses here not Silicon Valley startups who leverage Venture Capital money to ‘act as if’ they are a $120 million business and accelerate their growth accordingly.

But despite that successful growth, and having the $1 million vision in their sights, they stall. Congratulations – you’ve hit the second Black Hole.

Getting past $750,000 – think $1.5 million, not an even $Mill

I’ll write one day soon about how round numbers in a business vision are based on ego, not sound business experience. For now, let me tell you that you have as much chance created a business with a stable $1 million in annual revenue as you do of capturing 1% of a massive market.

And for the same reason – if your product is good, you will grow beyond that round number milestone. If it’s not, you won’t even get that far.

As noted above, the next phase – from $750,000 to $17 million – is the ‘PROCESS PHASE’. It’s no longer sensible, or possible, for the business owner to be DOING everything – and so consistent, transferable PROCESSES need to be built. But to get there, another restructuring hurdle looms.

Since I can’t explain jumping the $750,000 Black Hole any better than Darryl Bates-Brownsword, I’m going to hand you over to him at this point.

Part I – https://www.shirlawsgroup.com/Magazine/2015/07/07/How-to-jump-the-750k-black-hole-part-1

Part II – https://www.shirlawsgroup.com/Magazine/2015/08/18/How-to-jump-the-750k-black-hole-part-2

I will touch on the emotional element of this Black Hole.

In the ‘DOING PHASE’, the small business owner has an awful lot of freedom and control. They know everything that’s happening in their business, they can do everything that’s being done in their business (‘if I weren’t so busy’), and they justifiably feel proud of all the little things. To transition to the ‘PROCESS PHASE’ they need to let go of all that – they’re going to jump fairly quickly to 12 staff and $1.5 million in revenue, and at that point they can no longer know all of the detail.

Failing to appreciate that leads to snakes and ladders of business growth – just when you think you’ve made it through the Black Hole, it pulls you back in! It’s not for nothing that I tell a lot of my small business clients that they need to ‘Let Go to Grow’.

Implementing the four cycles from the ‘DOING PHASE’ plus the team and emotional restructure involved with jumping the $750,000 Black Hole will set your business on track to $1.5 million. At this point, the four revenue cycles will kick in again.

How big businesses and consulting firms stuff everything up

Have you ever seen a small, growing business be acquired by a large company (Yahoo!, I’m looking at you) only for it to collapse? Or seen a strong company attempt to copy a strategy that worked for a large corporation, only for it to burst into flames? Maybe you’ve just seen staff members with a wealth of experience coming into a business and trying to shake things up, unsuccessfully.

In many cases, this comes from applying the lessons of one Phase into a business that’s in another Phase. For example, the next phase (between the $17 million and $170 million Black Holes) is the ‘CAPABILITY PHASE’. At this point it’s critical to employ (or, if possible but it’s not easy, upskill) employees with strategic capability to take over core functions like Sales. These people will have experience managing teams, refreshing or overhauling key processes, and making strategic recommendations. They are used to being in a business of 120 – 1200 staff and communicating accordingly.

Put one of those people – or the strategies they execute at that scale – into a ‘PROCESS PHASE’ or ‘DOING PHASE’ business and you can kill it dead, just as if you took someone with only sole trader experience and made them responsible for Nike’s global brand strategy. It seems obvious that the Sales Process you need at $220 million is not the Sales Process you need at $120,000 or $1.5 million … and yet plenty of Consultants will tell you that it is. ‘If it’s good enough for Boeing, it’s good enough for you.’

It’s the flipside of having grown from $600,000 to $12 million and saying ‘We don’t need to review our Brand; we did that already’. Just because you did it once … and it worked … doesn’t mean you don’t need to review it again ready for the next growth phase.

Bringing strategy down from corporates to private enterprise and small business, the biggest risk is ignoring the impact of the business owner’s emotional state on decisions and change. If you don’t work with them to make a difference, the difference won’t be implemented – if a great Sales System feels like it will threaten their freedom and control, roadblocks are guaranteed.

So you’ll see large corporations (and consultants used to that size company) bringing down systems they know work. And the benefits of consistency across their business lines / products / clients are obvious, but ultimately specious when their recommendations aren’t tailored for the size of business.

Next Steps

I don’t personally coach many businesses below $1 million in annual revenue. I’m always happy to answer questions or catch-up for a coffee, if that would help you.

Shirlaws Group – for all their excellent research into sub-$1 million small businesses – are private enterprise specialists best equipped to help companies from $1.5 million to $120 million in annual revenue. If it’s fast growth into that range that you want, and you’re willing and able to invest for that speed, start upgrading your advisors sooner and bring these guys into your team.

So where do I refer small businesses looking to invest what they can to bust through $1 million? Key Person of Influence fills this gap excellently, and having worked myself with their team, their expert speakers, and many of their program graduates I can attest to the KPI Method’s value.

Why key ‘Person’ not business? Because this is the ‘DOING PHASE’ – it’s still all about you, the business owner, the decisions you make, the activity you do, and the emotions you embrace (let go to grow) that will determine your outcomes.

See – it all fits together.

Subscribe here for future business tips, thoughts, and links.

If you’re Dustin Curtis, you should follow me on Twitter here.

Where are you stuck?

[…] Enjoy this post from the 2014 Shirlaws Australia Conference. You might also enjoy the expanded version, focusing on busting through $1 million and packed with links for more bu…. […]

[…] The second million is easy, but 80% of the real estate industry don’t make it past the first one. That’s the challenge – building a database, a reputation, being able to afford support staff etc. It’s not real estate industry specific, but most of the challenges that apply to general businesses are relevant to real estate agents and (especially) principals and directors: here’s my recent article on the challenges of growing a business beyond $1 million. […]