Like this? There’s more like it in my latest book The Start-up Business Guide.

Most small business owners feel somewhat at effect of the market and their customers when it comes to pricing and payment terms. As a result, cash flow struggles are almost universal even when the company is profitable.

As we move into the downward phase of the economic cycle, cash in your bank is the most important it has ever been. Receiving payment on time is the most important step in the process.

Frustrated by clients (debtors) using them as a free bank loan, and willfully ignoring payment terms by paying weeks or months late, eventually many business owners will ask themselves: Should I introduce a Late Fee to manage cash flow in my business?

Few SMEs have late fees built into their service agreements, and an even smaller number actually enforce that condition. Customers don’t like them, and there’s a risk they may damage the relationship between your business and a potential repeat client.

This is the fear that stops most business owners from implementing a late fee. They’re scared to lose the sale, or the ongoing business, and it’s sensible to value a future $x,000 worth of business more than a $50 one-off fee … that might burn the relationship forever.

For my clients who struggle with late payments, instead of a late fee I recommend an on-time payment discount. Rather than adding 10% or a fixed $50 administration fee to payments after the due date, we increase the base price accordingly and then offer a 10% Discount for payment received on time.

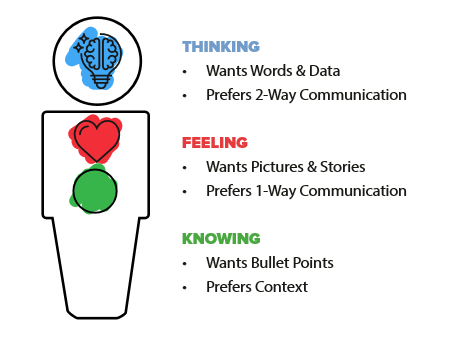

Suddenly, customers feel they are being offered a benefit rather than a penalty.

This process is not without its risks, as some customers may feel the new standard fee is the cost of doing business and ignore the discount in order to still pay you late.

As famously shared in the book Freakonomics, a childcare business that introduced a “late fee” (in that case, quite literally a fee paid by parents if they were late picking up their kids) led to an increase in the undesirable behaviour. By putting a price on it, something priceless (your time) becomes a commodity.

It’s also important to highlight the discounted amount in your proposals so you don’t price yourself out of competitive tenders.

Like many types of additional fees – quoting fees, administrative fees, and now late fees or early payment discounts – there’s no single solution. If you feel a late fee might help with your business, test it out on a series of clients and see if it makes the difference you hope for. If it does, then implement it more widely … and remember to be open to changing the fee (raising it? removing it?) as your business and economic cycle changes.