One of the key tenets of the Financial Independence movement is “The 4% Rule” – if you don’t know what that is, go look it up, because this article isn’t a primer it’s a critique and I want to jump straight into why this “safe” target that many people think is too risky … is actually way too conservative for the average early retiree.

Quick thoughts…

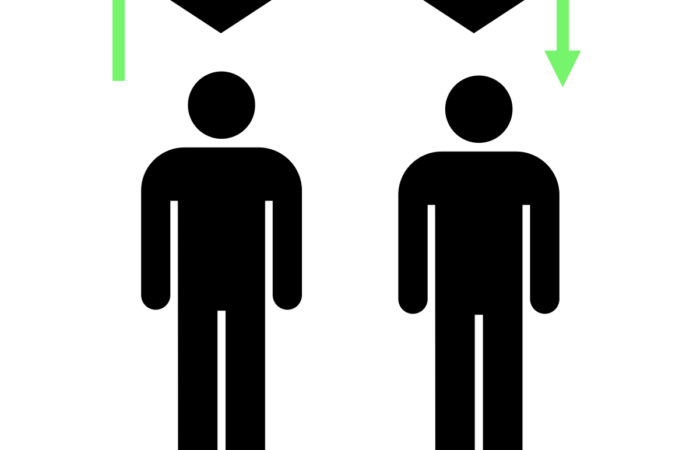

The two elements of the 4% Rule that can be viewed as conservative are ‘risk appetite‘ and ‘real world flexibility‘.

Take ‘risk appetite‘ – if you had a 95% chance of winning the lottery, would it be risky to buy a ticket? If you had a 5% chance of dying every time you drove a car, would it be risky to drive a car?

The Trinity Study showed (historically) that the 4% Rule survived 30 years in 95% of cases. To me, as a business owner used to taking chances with a <50% likelihood of success, only taking a chance on something with 95%+ success is too conservative. A 5% Withdrawal Rate under the same conditions survives 85% of the time – that’s still pretty good for me.

Ergodicity kicks in here though, or to be less of a wanker “What are the consequences if you fail?”. Hence the comparison between winning the lottery or dying in a car – the consequences are fairly different, so the actual percentage is misleading. Going broke at 80 is a pretty bad outcome, especially if the alternative is working two more years in your 30s or 40s.

So it comes back to personal preferences and risk appetites (noting also that 60 years of retirement is different statistics to the 30 years of Trinity et al). If you’re the sort of person who freaks out when the markets drop 10%, then a 60-year retirement at a 4%WR may be too risky – it’s likely to work mathematically, but if you’re going to be stressed and miserable why bother?

This starts to touch on ‘real world flexibility‘, because nobody will/does follow a blind “adjust for inflation and withdraw x% each year” approach. If you look at the great ERN series, Kitces research etc, things like the Sequence of Returns Risk loom large in the distinction between a successful and unsuccessful.

Most of us spent a lot less money in 2020 and 2021 than we did in 2018 and 2019 – either consciously (can’t travel, quit the gym) or subconsciously (eating less because of financial uncertainty). The same would be true in retirement – if there’s a recession and your portfolio tanks, you’re likely to respond by spending less.

This depends on how much ‘fat’ you have in your budget of course – it will be harder for a LeanFIRE budget to spend 20% less in a year. Funnily enough, a LeanFIRE $40K budget at 3% needs a higher stash (~$1.33M) than a FIRE budget of $65,000 at 5% WR.

So yes – if you plan to blindly follow the 4% rule, then you might wake up 10 years post RE and discover your actual WR is 10%+ and you’re almost certainly going to run out of money. The research seems to suggest that <3.25% you could go blindly and be fine, so 4% is too risky.

But if you plan to, you know, think before you act – then 4% may be too conservative. Perhaps plan your post-FIRE budget for essentials and discretionary, and plan accordingly.

(Countering my point, you also need to factor in the increased likelihood that you will reach FIRE during a boom, and so the cyclical nature of markets increases the likelihood of a bust during those critical first years.)

Our plan – which is a ways off so no doubt needs further stress testing – is to run a 5.5% Withdrawal Rate. So for me, 4% is too conservative (for me – not necessarily for everyone). We have fat in our budget, and if our actual WR starts approaching 7% then we will cut back significantly until it corrects itself.