When to Raise Prices, or ‘The Perfect Number of Beers’. In Blackboard Fridays Episode 85, Jacob talks about Sales and Growth Planning. Need this implemented into your business? Talk to the international business advisor who can do exactly that – Contact Jacob, Learn More, or Subscribe for Updates.

It’s hard to know which I love more – money or beer? So it was inevitable that I would combine these two great passions in a tale about raising your prices, and as a result dramatically improving your profit and cash flow.

Chances are, your prices are too low. You – and your team – are worth more than your clients are paying you. Am I wrong?

So what’s holding you back from charging more? This week, I will walk you through the specific experience that 5 different clients of mine have had with raising their prices – all successful, sometimes surprisingly so. I’ll even share the process I recommend that has clients saying “Thank You” when you increase your fees.

And what does that have to do with the perfect number of beers at a party? You’ll have to watch this week’s episode here to find out.

Who is Jacob Aldridge, Business Coach?

“The smart and quirky advisor who gets sh!t done in business.”

Since April 2006, I’ve been an international business advisor providing bespoke solutions for privately-owned businesses with 12-96 employees.

At this stage you have proven your business model, but you’re struggling to turn aspirations into day-to-day reality. You are still responsible for all 28 areas of your business, but you don’t have the time or budget to hire 28 different experts.

You need 1 person you can trust who can show you how everything in your business is connected, and which areas to prioritise first.

That’s me.

Learn more here. Or Let’s chat.

Transcript

I’m often asked in my free Blackboard Fridays business video series to share more case studies, more examples of real businesses really using some of the tools, tactics, and strategies that I talk about.

So today I’m going to share five different conversations linked to pricing. Particularly, when and how to raise your prices.

The Perfect Number of Beers

I want to start with a question for you, a question about one of my favourite topics, beer.

I want you to imagine that you’ve hosted an amazing party. One of those real all-night ragers where everybody’s drinking bottled beer. Now, that might be Natty Light, or XXXX Gold, or the craft beer of your choice. It could even be my personal favourite, the Newcastle Brown Ale, a meal in glass.

You wake up the next morning a little bit dusty, glad to see that the guests have finally left. You wander your way into the kitchen. You open up the fridge, and you want to see how many beers are left.

So my question for you is this. The morning after an excellent party, what is the perfect number of beers that you will find in the fridge?

The morning after an excellent party, what is the perfect number of beers that you will find in the fridge?

Now, most people think that zero is the perfect number. If we had no beers left, then that’s a fantastic sign, perfect number. HOWEVER…

The problem with zero beers left is that you’re not sure how many people wanted more beer. How many of your guests wanted another beer, but weren’t able to drink it because you’d run out?

So in my experience (business, and drinking) the perfect number of beers is one.

If there’s one beer left, then that means:

- Nobody went to an empty fridge and missed out

- Everybody had exactly the amount they needed.

- Plus you didn’t over-cater for that party, by buying dozens of beers that went undrunk.

- Lastly – bonus – you’ve got a cold beer for your hot shower the morning after.

Shower Beers and Hangover Cures, all part of the Blackboard Fridays service.

Beers, Pricing, and Sales Conversion Rates

So, what the heck does having one beer left have to do with pricing?

Well, it comes back to your Sales Conversion Rate. If you’re converting every single client that you sell to, then almost certainly your prices are too low. Just like people miss out on beers if you run out of beers, your business is missing out on revenue (extra revenue that would go straight to your bottom line) because you’re not priced appropriately.

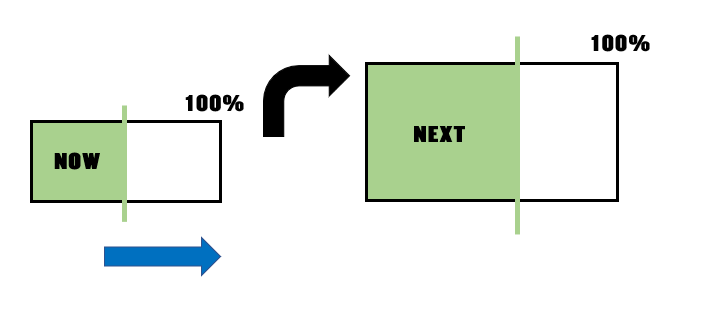

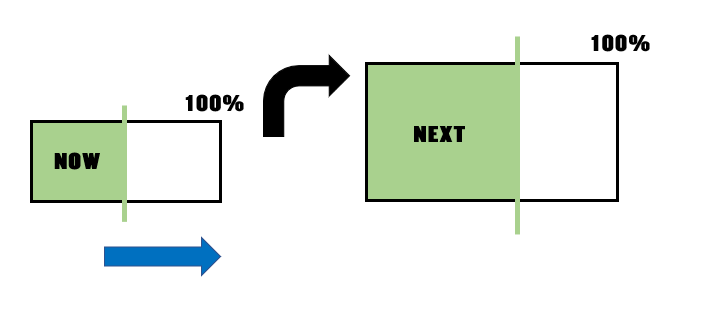

Make sure that you’re pricing yourself accordingly. Here’s how it fits into that Capacity Engine framework that I love to talk about.

Let’s say the Engine on the left is your business today. But unlike the diagram, where the power from the engine is only about 50%, your team are running at close to 100% capacity. They’re pretty full, your revenue is maxxed out.

And you’re a great salesperson, so you’re selling an awful lot of customers. Can you see where this is heading?

For the sake of doing some numbers, let’s say you have 100 customers at $100/month each. So you’re bringing in $10,000 per month – that’s your capacity. That’s the size of your Capacity Engine. And it’s your actual revenue, because the team is running at 100%.

(In reality, maybe you make $10,000 per day, or per hour, so adjust accordingly for your business.)

Now, if you were one of my clients and this were a coaching situation, I would casually and jokingly ask “What happens if you put your prices up by 50%?”

And you’d probably tell me that you’d lose all of your clients. You’d have a bigger business, as defined by a bigger Capacity Engine (now able to do $15,000 worth of revenue per month, 100 clients @ $150 each, with the same number of staff). But you wouldn’t actually be generating any revenue. So that’s not the solution.

But let’s say you put your prices up by just 10% and lost 9% of your clients. What would that situation look like?

Well, now you would have 91 clients instead of 100, at $110 each per month instead $100 per month. Now, that adds up to $10,010. Okay, your revenue’s going to go up by 10 bucks, hardly something to write home about. Until you remember that your team have the capacity to service 100 clients.

So in actual fact your capacity has gone up. It’s gone up by 10% to $11,000. Without having to hire any more people, without having to incur any more costs in your business, you’ve managed to increase the capacity.

And because you’re a great salesperson, even if you don’t convert every single person anymore you’ve still got the revenue coming in to make sure that that engine gets full pretty quickly.

You know right now that you need to put up prices.

Nice Theory, Coach Man. Show me the Money in Real Life

Let’s talk about some real experiences of doing it – after all, I’ve coached more than 350 businesses (and counting) so surely I’ve helped put up prices a few times.

[Side Bar 2024: If you watch the video, you’ll see I reference the point in the Economic Cycle when it was made. There are definitely points in that cycle where raising prices is easiest, and yet most small and medium size business owners wait too late. My early coaching years 2006-2008 were one such time; 2017-19 was another; and the inflationary period from 2022-2024 is also an easy time to be putting up your prices on at least an annual basis.]

The first client example I want to use is a client of mine in the UK. Now, in this strategy they’ve just raised prices for new clients, they haven’t yet decided to put up prices for their existing ongoing clients. But given the high sales conversion rates they’re achieving, they’ve put their prices up per product from £475 to £525.

How high were there conversion rates? At the old price point they were selling 100% of the time. No beers left at the end of the party.

Want to guess what they’re selling at now? Still 100%. Their conversion rate hasn’t changed. And that tells me they probably could have gone to £550 or £575.

All of that extra revenue goes straight to the bottom line, and it’s not taking them any more time to bring it in.

Case Study #2: “Thank you for increasing my fees”

Let’s say, however, you do want to raise prices for your existing clients. An essential task we do need to do this from time to time.

Here is a lovely process that I’ve run with a number of businesses that actually gets your clients to thank you for putting prices up. That’s right, you raise prices, you cost them more, and their response is … “Thank You”.

The key is to do it this way. You send out a letter, or an email, make a phone call (depends on the volume of clients that you’re working with). And you let them know, no need to justify why, “We’re raising our prices from [say] the first of September.”

“However, to value your loyalty, and as our thanks to you for being a great client all this time, we’re going to hold off increasing prices for existing clients until the first of January.”

What you’ve actually done is send them a letter saying, hey, from the first of January your prices are going up. But by positioning it that they’re waiting longer than new clients who will get that price rise in September you’re actually demonstrating that you value them.

You’re giving them something. And that’s why they say thanks.

It’s a wonderful way to have what can otherwise be seen as an adversarial conversation.

Case Study #3: We Tripled our Prices

When it comes to increasing your prices, most business owners worry about the clients that will leave. In my experience, fewer clients will depart that you expect, and you a much bigger consideration is “what happens if the clients stay?”.

I’ve seen some businesses with clients they don’t want simple go down a route of trying to put the prices up to the point where those clients leave.

If you’ve got a situation like that ask yourself this question: “What is the amount of dollars, the revenue I can bring in from that client, that will actually energize me and my team to do that work?”

Money is energy. The client relationship is energy. If you’ve got painful clients, is there a dollar figure where they stop being painful? If not, you probably need to skip the pretences and sack them as a client.

But here is a great experience with an accounting business who faced this problem. They had identified a pool of 15 clients that were using a particular service of theirs that was just really painful. And when we did a client base analysis of their business, that service and those clients were completely unprofitable.

So they sent out a letter to the clients letting them know that from next financial year the prices had to go up on that service. If you read the heading above, you’ll know this wasn’t a 10% or 20% increase – they actually tripled their prices (from ~$3,000 to ~$9,000pa).

Deep down they were kind of hoping that all 15 of those clients would say thanks, but no thanks, we’ll go somewhere else. Instead, all 15 clients said we’re quite happy with that. We’re still getting value at three times the price, so we’re staying.

Thankfully, the accounting business was happy to keep those clients because at three times the revenue it was now a profitable service. If they’d just doubled their fees they still would have been unhappy, the client still would have stayed, and nobody would have won.

Ponder that next time you are filled with fear as you consider a small price increase. This firm tripled their fees and nobody blinked.

Case Study #4: We Fired Half Our Clients

Sometimes you do just want to get rid of your clients. Not necessarily a small few who are painful or abusive, but a whole swathe of clients who reflect where your business used to be not where your business is growing to.

Another business that I worked with sacked half of their clients in one fell swoop.

We again did a customer analysis, reviewed their entire client base across measurements like lead generation source, services used, and profitability.

We realized that there was a specific service they were delivering, which half of their clients were using … and every single one of those clients was unprofitable.

You may have heard of the Pareto Principle, the 80-20 rule that “80% of your output comes from 20% of your actions”. It’s not a universal law like gravity, but most customer analysis projects I run do reveal something like this 80/20 split.

Well this business (unconsciously) ran 90-10! 90% of their profit came from 10% of their clients, and was being dragged down by 50% of their clients that were unprofitable.

So what did we do? We wrapped those clients in love and sent them on their way. Specifically, we found a competitor in a nearby suburb and did a deal to just hand over all of those clients. Didn’t even try and sell them, they just got rid of them.

What that did in terms of their capacity engine was grew it enormously.

Suddenly, all of these staff that were delivering a low-value no margin product were able to deliver the high value, that 10%. The average revenue per team member went up through the roof, and everyone was energized to go out and sell.

Case Study #5: The FAF

I’ve saved my favourite pricing and packaging case study for last, because I do particularly like it: Allow for FAF.

Now FAF stands for … let’s go with “Faff Around Factor”, but you can insert the F word of your choice.

This case study is from a wonderful home services tradie client of mine, who had a very complex pricing process and spreadsheet. This allowed their sales team to go through and work out the exact product and pricing for their construction clients.

They would get the pricing very, very precise – it calculated the number of nuts and bolts required, for example.

And yet despite that precision, the very last field that they had in that spreadsheet was called “FAF”.

“FAF” was designed to take into account how difficult the client was. If you’ve read this far, then you’ve been there I’m sure – you’ve worked with clients that (even though they’re buying the same product or service as everyone else), you know will take you more time. Those clients who you can tell from experience will cost you more in mental effort, and exertion, and their complaints, their queries, all of that stuff. If you’ve been in business for any length of time you can pretty much gauge with gut feeling the sales process when you’re getting one of those clients.

Now, you could say no to those clients. And the worst of them, or if you sell an ongoing relationship, “Just Say No” is the best advice. For a one-off sale and clients who are difficult but not abusive … another option is to account for FAF.

So these salespeople would put in 20%, 30%, 50% in the FAF box. This would take the very precise estimated price … and increase it by 20%, 30%, or 50%.

One time they put 80% “Faff Around Factor” because they knew that client was going to be extraordinarily difficult.

Why? Their solution was to increase the price such that if they won that client they would be energized.

As often as not, the clients would actually buy because so many of their competitors wouldn’t even price it, wouldn’t even come back to them with a quote, because they knew they were a difficult client.

So by accounting for FAF, the revenue still came in. Even though those clients took a lot more time, the profit margin was still there for the business. And they were also able to give a bit of extra cash to the guys who were out on-site dealing with some of the pain day to day – pretty good for culture as well.

In Summary

Getting your pricing right is critical. Too many business owners – because they love their customers, and love what they’re doing – keep their prices artificially low. That does not do a service to your business, does not do a service to you. Certainly, it doesn’t help you pay your team what they’re worth.

At the end of the day all of those things have a negative impact on your customers.

- Price your product or service appropriately.

- Work with the customers who will value that.

- Understand that there is more to the relationship with your business than just your price.

If you do that you’ll be able to work more easily, you will have more profit, and you’ll have a heck of a lot more time for those raging beer parties that I love to talk about.

Next Steps

Want to learn more about how this can apply to your business? It costs nothing to chat:

- Email me jacob@jacobaldridge.com (I read them all)

- Call, Text, or WhatsApp me +61 427 151 181

- Or just Subscribe https://jacobaldridge.com/about/subscribe-to-jacob-aldridge-com/ to stay in touch