Calculating Your Business Capacity. In Blackboard Fridays Episode 34, Jacob talks about Growth Planning. Need this implemented into your business? Talk to the international business advisor who can do exactly that – Contact Jacob, Learn More, or Subscribe for Updates.

WARNING: This week’s Blackboard Fridays Episode uses mathematics and 3 different coloured chalks. Entrepreneurs with ridiculously profitable businesses are encouraged to look away now!

For the rest of us mere mortals, it’s time to face the truth: knowing our numbers usually leads to having higher numbers at the top of the bank account, and the bottom of our P&L statement.

Your journey to greater profit and improved cash flow begins by understanding the real capacity of your business, your team, to generate revenue. Not some mythical perfect world scenario, and definitely not whatever level of mediocrity some of your team consider business as usual.

Knowing that one number can open your eyes to new opportunities. And it starts by calculating your capacity in one of the ways I explain, in simple terms, in this week’s episode.

Who is Jacob Aldridge, Business Coach?

“The smart and quirky advisor who gets sh!t done in business.”

Since April 2006, I’ve been an international business advisor providing bespoke solutions for privately-owned businesses with 12-96 employees.

At this stage you have proven your business model, but you’re struggling to turn aspirations into day-to-day reality. You are still responsible for all 28 areas of your business, but you don’t have the time or budget to hire 28 different experts.

You need 1 person you can trust who can show you how everything in your business is connected, and which areas to prioritise first.

That’s me.

Learn more here. Or Let’s chat.

Transcript

Welcome to this week’s Blackboard Friday’s video where we’re going to be talking about money.

I’m going to focus on money because money is exciting and energizing. Doing math tends to be a little bit boring for most business owners; however, there’s some simple math that we may be able to do to help you make more money.

(That ought to keep you engage for the next four to five minutes.)

After more than 30 Episodes of Blackboard Fridays, I’m surprised to see I haven’t spent a whole lot of time talking about your capacity engine.

This is a key tool that I use with an awful lot of my clients to help them identify whether there is hidden profit sitting in their business, and set some trigger milestones for when they need to grow.

What is a Capacity Engine for Capacity Planning?

If you think of your business – all the team, the resources, the technology you’ve got – I want you to abstract all of those into the concept of an “Engine”.

When they’re working together, they’re humming along pistons powering away, they’re going to create a certain amount of output. In business, we tend to define output in terms of dollars (well, money – you may prefer GBP, Euros, or Swiss Francs). Your output is measured as “How much money can your team produce monthly?”

Now an engine has certain capacity, a certain amount of power that it can put out when everything’s running well together. What I encourage my business clients to do, is to calculate what that figure is for them.

Because you’ll probably bogged down in the stuff, you’re a busy business owner and if you ask your team, they’re also going to tell you that they’re busy and that you need more resource. But do you need to invest in that growth yet – or is there some waste, some inefficiencies built into your current engine that you can get rid of first?

If you can reduce waste, your increase utilisation in your engine. You generate more money from the current resources by utilising the capacity they already have. And more money with no extra (fixed) expenses means more money in your pocket, or some spare cash to invest in that future growth.

Is My Team Efficient?

To understand how efficient your team are today, the first thing we need to do is calculate the capacity of your engine. What is 100% Capacity? And then we can look at the utilization rate percentage, which is how much of that revenue are you actually achieving each month?

The gap between those two – Utilisation % and Capacity – represents waste in your business.

How much waste you tolerate is going to depend on how you want to feel on the journey. You might be happy with a lot of waste because that allows you to grow quite fast – but most business owners I coach want to get rid of some of that waste before they’re ready to grow.

Their struggle? Where to start?! It starts with calculating your capacity.

How Do I Calculate Capacity in My Small Business?

Now the more complex your business, the more details you may need to go to calculate this.

But I want to talk about the three most common ways that you can calculate the capacity of your business – and as a result see how much money you might be leaving on the table each month through inefficiencies.

Capacity Calculation Method #1 – Hourly Rate

The first is a very simple hourly rate. If you’ve got five lawyers who each bill $500 per hour, and are expected to bill 6 hours per day, then the capacity of your business is:

- $15,000 per day (5 lawyers x $500 x 6 hours)

- $300,000 per month (Monthly is my preferred method, and I assume 20 days per month but this varies for budget purposes)

If your firm is running at $200,000 per month … the your Utilisation Rate is 66%. That may sound high, and acceptable, but remember – your assumptions (like 6 billable hours per day) already take into account an acceptable level of inefficiency or non-dollar-productive time (like sales, or training).

If your assumptions are reasonable … then a team falling 34% short of their capacity each month would cause me a great deal of concern.

Capacity Calculation Method #2 – Project Rates / Fixed Fee

Hourly rate is definitely the simplest way to calculate your capacity, but most businesses have started to shift away from that: teams don’t like calculating and reporting all of the time, and clients don’t want to be on the clock the whole time so they often like a more value-based or fixed fee conversation.

So increasingly I find businesses are talking about their “Capacity” based on the value of the projects they’re delivering, all the clients that they’re managing.

This is a slightly more complicated process in part because unless you can separate each individual and the clients that they’re working on, it tends to require you to understand how your team work together.

How many client-facing staff do you need versus the administrative staff to support them, and the business development or growth staff to keep feeding them the work. That team mix can then simply be multiplied by the number of clients that they can manage on a monthly or yearly basis and then multiply the gain by the average dollar value of each client.

It’s a little more complex than just 6 hours a day by an hourly rate but it is something that is achievable for most companies.

Indeed, to let you in on a little secret, a lot of clients to a value based really do bring it back to time anyway.

Capacity Calculation Method #3 – Capacity Constraints

The third way to calculate capacity can get a little trickier and this is when you start to break up different divisions within your business, when your customers or clients start to touch multiple areas that each have their own level of capacity.

So as the customer goes through their journey, they might:

- Deal with Sales,

- Then the Onboarding process for your business,

- Maybe the actual delivery of the work,

- and Lastly, often the accounting department when they get their invoice and must pay it.

You can go through and calculate the specific capacity for each of those areas in your business.

- How many sales can your sales team bring in each month?

- How many new clients can you onboard?

- How many actual client projects can your delivery team, as it currently exists, deliver in each month?

- From the accounting department, how many invoices can make it out? How many debtors can they analyze?

What you will discover is that some of those teams are going to have a smaller capacity than those other constraints within your business. The weakest link represents your overall business capacity.

As an example of Capacity Calculation Method #3, I ran this project with a SaaS software business who felt they needed more sales. They needed to grow the revenue of the business, and the opportunity they saw was growing their sales team.

When we calculated it, indeed their sales team was doing quite well. All the measures of capacity and efficiency looked good – they had a steady flow of leads, conversion rates were high, and there was no hidden churn based on salespeople over-promising.

Based solely on the sales team and those incoming leads, it was clear they could recruit some more people. Seems obvious right – we want to grow revenue, so let’s grow our sales team. But it would not have worked!

Because their onboarding team was challenged. They were struggling to keep up with the current volume of new clients coming onto the platform.

Adding a new salesperson, bringing in more new clients, was going to completely overwhelm them. We needed to increase the resource in that onboarding team, to grow that capacity, so that the sales team could push more revenue through the business, to get more power out of that engine.

(Pop Quiz for the Capacity experts playing at home – how else could we have solved the problem? The answer lies in the expectation of the Onboarding Team – especially for a SaaS business, they were very hands on, making sure their new customers understood the product and how to benefit from it the most. This was a deliberate choice, but a choice nonetheless – and they could just have easily said “Keep this team the same size, spend less time with new customers, and you’ll be able to onboard more customers and therefore will have a higher capacity.)

Think about your business.

Think about even on a gut feel level how much you feel, when everything is humming, your business can generate each month? And then do the actual analytical element.

I encourage you to do that because when you do the numbers it’s much easier to share the assumptions in the calculations with your team. To get their buy-in, so that it’s not just your gut recognising the waste that exists.

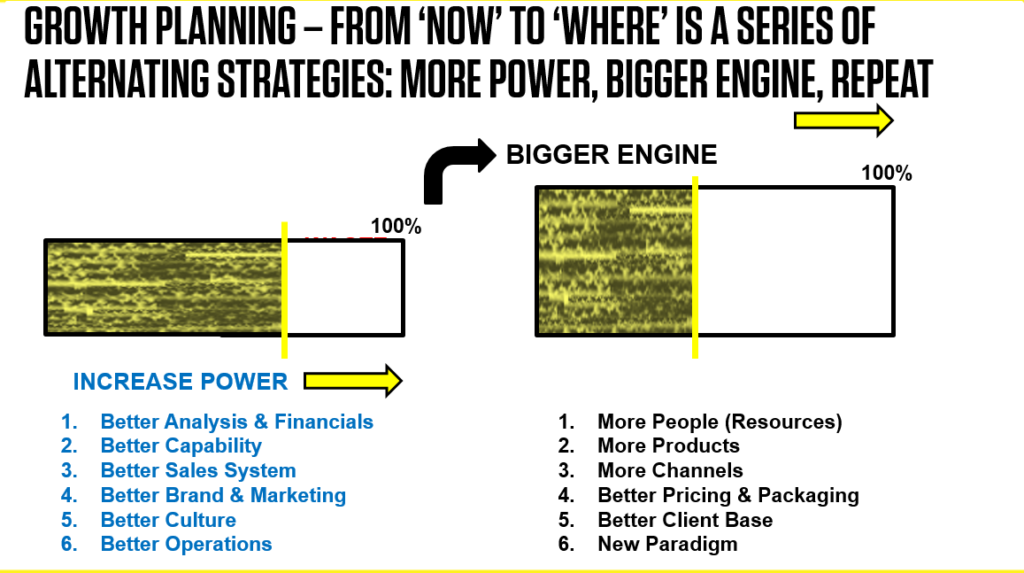

By having an objective measure of Capacity – and therefore Utilisation, Efficiency, and the “Be Better or Be Bigger” debate – you and your small business team can then work together to reduce that waste, grow in an aligned manner, and ultimately put more cash in your pocket and help fund the future growth.

Next Steps

Want to learn more about how this can apply to your business? It costs nothing to chat:

- Email me jacob@jacobaldridge.com (I read them all)

- Call, Text, or WhatsApp me +61 427 151 181

- Or just Subscribe https://jacobaldridge.com/about/subscribe-to-jacob-aldridge-com/ to stay in touch