Since you all enjoyed my Mental As Anything reference, I needed another classic rock anthem for this month’s economic snapshot and who does it better than The Oils: the rich get richer, the poor, get the picture.

The coronavirus recession is about to split into:

- speedy recovery for some, if indeed you even suffered financially

- long term lingering woes for many others.

Make sure you’re on the side you want to be, with our updates: Don’t waste a good recession, economic snapshot number 18, designed for small to medium sized business owners.

As always, we look at these four economic indicators

- active COVID-19 cases in three countries: US, UK, Australia

- Share market performances over the last month, and since the bottom of the pandemic.

- Latest unemployment figures

- Latest GDP figures (which, for all of my Australian viewers are going to be especially timely as today’s newspapers are focused solely on those GDP figures that are a lag indicator = they’re behind the times for you, but of course, as a ‘Don’t waste a good recession’ fan, we’re always making sure you’re well ahead.)

ACTIVE COVID-19 CASES:

The first of those lead indicators that we keep an eye on are active Covid-19 cases.

In July, two months ago, I said we would probably look back on June 2020 as the month when we chose the economy over our health, and the time since then that has absolutely proven to be true. Yep. It is now, maintain! Maintain the pandemic – try and keep it under control but as you can see that just means slowing down the growth.

It’s already been going backwards: 2% growth week on week across the UK and the US and globally.

I’ve put a question mark on figures for the UK. If you’re new to don’t waste a good recession, the UK Government has made a point of changing and hiding some of the figures. It’s frustrating, we’re getting a little bit of an idea around some of the data.

We know globally it’s not looking like there will be any kind of eradication until we either get a vaccine, or the disease evolves to be less stable and we learn to live with it. Instead, you need to think, local, and since most of my viewers like me are here in Australia, Australia is the extreme example of thinking locally.

We had a clear second wave and almost all of that was in one state: Victoria. Cases, compared to the previous week, are down by almost a quarter, and compared to the previous month which was the peak of the second wave in early August down by over a third

Deaths, as you can see in that second table, are slower to change. That’s obviously lag active cases and so both of those are up and quite significantly over the month but the cases are trending downwards and we would expect it to do the same.

Now, the Victorian economy, especially in central Melbourne is hurting. I’m barely a two hour flight away with state borders closed to Victorians. Up here in Queensland, I’m eating out at restaurants, and we’re even debating how many 10s of thousands of people are going to be allowed to attend the Brisbane based AFL Grand Final.

Back in February/March when the pandemic became officially a pandemic, we kind of assumed these lock downs were going to continue until the disease got eradicated. Clearly, that wasn’t the case. Not everybody out there like me, has a Guinness World Record for nonstop movie watching and so the Netflix fatigue kicked in. Whether it was that caution-fatigue, that feeling of ‘surely we’ve done enough’, whether it was conspiracy theories or whether it was economic desperation, we were compelled to reopen economies. Had we had a strict lockdown undoubtedly hundreds of thousands of lives would have been saved. But, of course, I say that with hindsight, and there are consequences to any business decision. We shouldn’t be surprised, day to day, even in the before times. Most of us push ourselves too hard, we put our health at risk in order to chase our income, our jobs or our business. So, why would we act any differently in a global pandemic with less than a 5% case fatality rate?

Back to my main point: a two track recovery

In many countries, that’s going to mean that some cities or regions are hit harder by COVID-19 lockdowns than others. And, as a result, the economic fortunes of businesses in those regions are going to be hard to hit, but for the most part, the two-track recovery actually looks at the type of business you run and the type of work that you do.

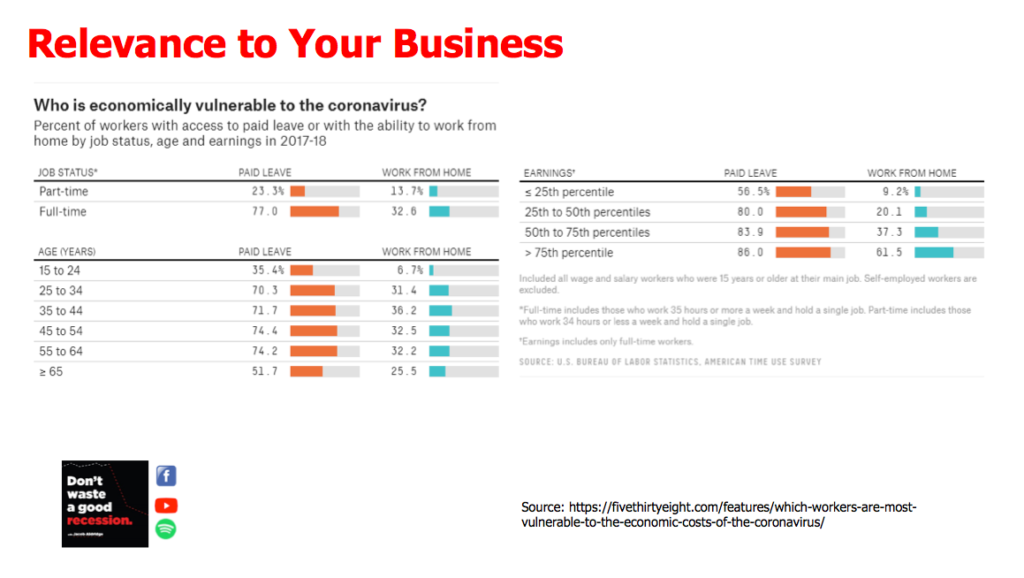

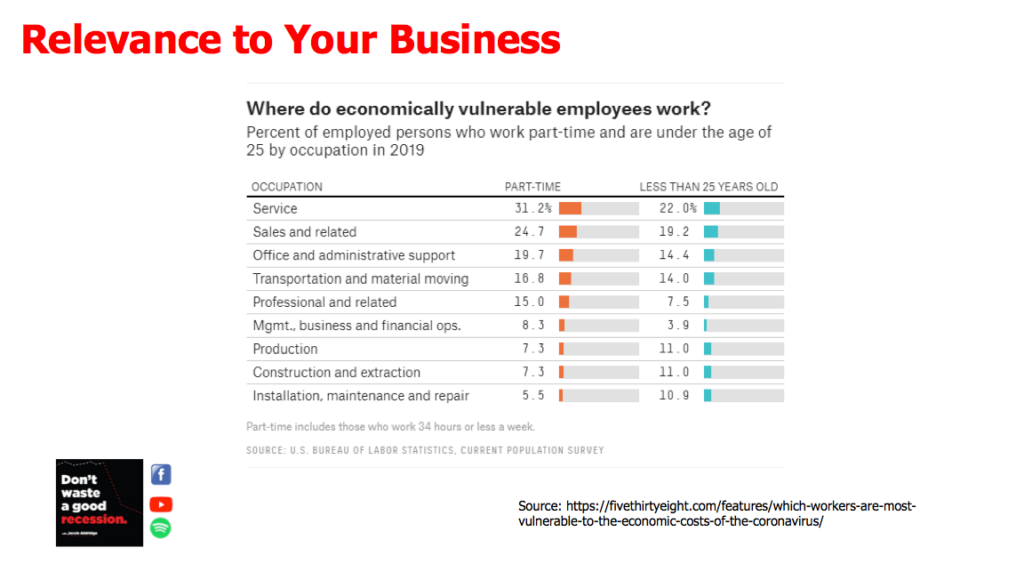

This is some research from 538. This US-based research into who is most vulnerable economically to the coronavirus looks primarily at whether people could work from home, could they continue earning money, even in lockdown, or in self-imposed protection or shielding. As you can see, the more money somebody earns the more likely it is that they’re going to be able to either work from home or take paid leave to ride out a short term or a long term storm. The poorest workers are those that are most affected.

And, if we look at two key safety nets full-time work and benefits like paid vacations and sick leave, plus, having years of experience, since older workers normally have more secure jobs, as well as personal savings, you can see that the industry is most impacted by COVID are services like hospitality sales like retail transportation jobs. These are those industries, with the highest percentage of part-time and young employees, all in the same stormy seas. If you’re a 22-year-old working part-time in a retail store, you’re paddling around in a very different boat to a 45-year-old finance manager on 200 grand a year.

Yes, we get it we get it.

So, your business. Did you review these questions that I asked you last month? How likely are you to be affected by the COVID-19 active cases?

Share market performance

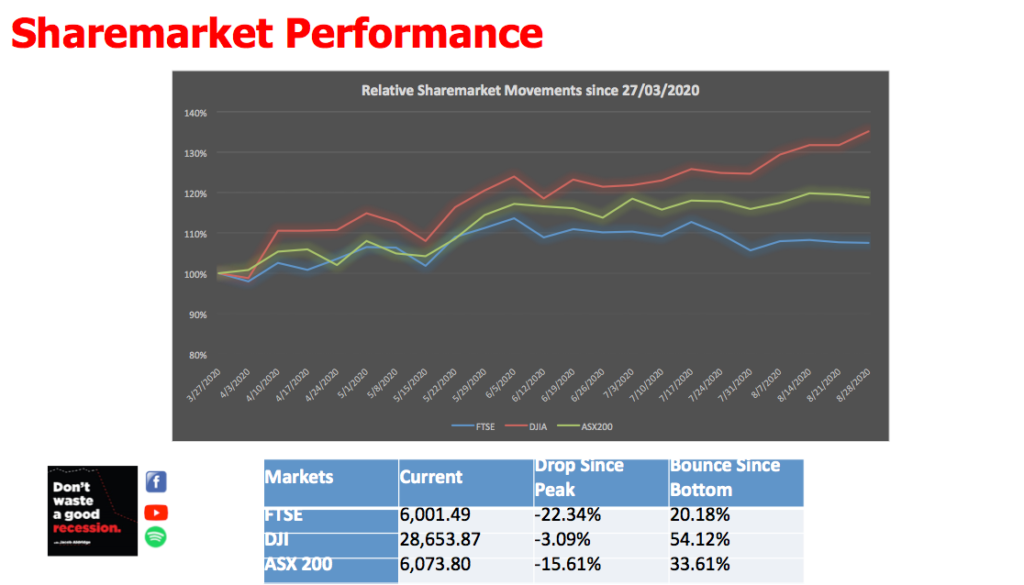

At the beginning of this pandemic, February, March, the belief was that because every human could contract and die from COVID that every business would be impacted. We now know that that is just simply not the case. Our second key indicator is share market performance, and if we use the match bottom as our baseline across the US, Australia and the UK, you can see that the US has continued to outperform, even as those markets have been a little bit flat for the month of August. The Dow Jones is now barely three points off its record all time highs.

In fact, you may have seen these kinds of headlines through the month of August, about the S&P500 closing at a record high.

So why do we use the Dow Jones and not the S&P?

The S&P is definitely a better representation of the overall US economy. But the Dow Jones has a much longer history. Through the Great Recession and the GFC, learning from that and looking at some of their comparisons was of great value to the presentations that I was running around the world, and the many business owners who came to them.

So, how does the S&P work? How come it hit a record high, whereas other indices like the Dow Jones have not? Let’s ask Graham Steffen:

This index is weighted by a company’s total market value: the more valuable the company is, the more influence that company has on the entire S&P500. Something like this is really really important to understand because out of the entire S&P500, 5 of the largest companies make up more than 20% of its entire value. We can break this down even further based on the category. We can see that the categories which are hit the hardest due to the shutdown like travel hospitality and restaurants, only make up a small part of the entire index – about 25%. So even though 25% of the S&P500 got hit really hard. The other 75% is doing well, or even better than well and that is causing the stock price to go up.

Graham Steffen

Okay, so the Dow Jones only looks at 30 companies. The S&P500, as you might guess, covers 500. In that sense, the Dow Jones is not as representative, it’s also not as tech heavy, so it hasn’t benefited as an index from the high growth of some of those companies like Amazon and Microsoft.

Now you might remember the episode 14 economic snapshot that I did in June, I talked about how the S&P was approaching its previous high. The Dow Jones, the FTSE and, to a lesser extent, the ASX 200, were getting close and I talked about ‘the ceiling’. At that point the S&P got close, and then dropped 6% in a day. I talked about how that ceiling of the previous high might be a barrier: it might be a point that we bounced up against a few times and that that was going to be quite telling.

If it burst through that ceiling to all-time record highs have managed to maintain that, and that was going to tell us something about the Florida economy, versus bouncing off the ceiling, and eventually potentially going into some kind of panic or to longer economic downturn in the markets.

So, the S&P hit a record high! Did it manage to burst through that ceiling?Boy, did it! And, it has sustained its position

The Dow Jones, as I said, is around 3% off – we’re still keeping an eye on that and keeping an eye on some of the other countries. We’ll talk about that in a minute. But, what does that mean, not only for your investment, but for your business, and the economy?

Again, we can clearly see a two track recovery.

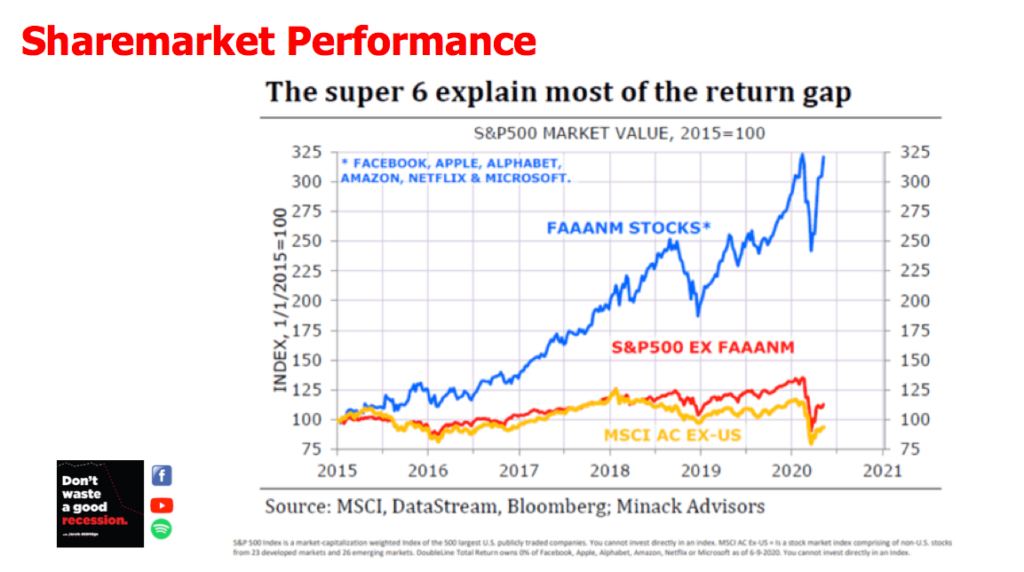

Let’s have a look at the Phantom stocks, those top six companies: Facebook; Apple; Alphabet; Amazon; Netflix and Microsoft – those companies that alone constitute such an enormous part of the S&P500.

And, if we look at the bounce back from the February and March declines, you can see that those six companies, collectively have exceeded their previous record highs, they are at record highs. If you just take the other 494 companies in the S&P500, we take just those top six, and we’re barely halfway back to the recovery.

If we look at the world stock markets, excluding the US (taking out some of those companies as they are disproportionate) Apple alone is now worth more money than the entire FTSE 100.

And so, the global economy outside the US tech stocks is still in a bear market and has recovered even less. For most companies, most countries, we’re still in a bear market.

But, undoubtedly many companies are riding high and this isn’t just a tech stock thing.

My target market for these audiences, these conversations, are businesses like my advisory clients. Small and Medium private-owned companies with primarily 12 to 96 staff but anywhere from two to 500 staff and in that sweet spot.

You don’t have to be Apple to be doing well. Indeed, most of my clients right now are practically printing money, because of how strong they are coming into this recession, and how well they’ve managed to respond.

So what does this all mean? Does this mean that the coronavirus recession is done and dusted? I asked, will the lockdowns crash the economy? For the most part it looks like that ship has sailed.

We’re going to do local lockdowns but the chances of more severe widespread lockdowns across entire countries again are fairly remote.

Deflation is one of the big things that could cause these economies to crash. If holding on to your money suddenly makes it more valuable than investing it or then spending it (the opposite to inflation) then that could create a risk, with money getting pulled out of the markets and the markets going south in a downward spiral.

But, governments are focused on creating inflation. Many of the government’s stimulus packages like in Australia job keeper and job seeker, which were scheduled to possibly end in September or October, have been extended. Even in the US, with Democrats and Republicans debating how many trillion dollars to pump into the next round of fiscal policy, the Federal Reserve has stepped into that gap. They’ve actually created a different monetary policy, loosening their inflation guidelines, in an effort to juice up the economy and allow for runaway inflation.

As an aside, I often get asked how governments are going to repay enormous debt that they’re going into right now and the answer is, inflation.

If we managed 3% inflation over 50 years, then the government debt, say $1 trillion would stay the same, but because the value of money was decreasing due to that inflation that $1 trillion would be repaid with the equivalent of just $200 billion. If you stretch that to 100 years, it would be repaid with the equivalent of just $52 billion. With patience and inflation, governments have all the time in the world. They could manage to get a 95% discount or more on repaying that debt. So governments want inflation.

You know who else benefits from inflation? People who have assets – people who already have wealth. If you’ve got mortgage, if you’ve got money in the stock market, if you have your business or other asset classes, inflation is going to work in your favor. If you’re a 22-year-old working part-time in retail, or hospitality, you’re struggling to make ends meet, inflation means that your paycheck is getting smaller, every week.

So, short of a solar flare wiping out electricity grids worldwide and taking tech stock valuations with them, it’s going to take a reversal of one or two major government policies to crash the economy. As we go into the northern winter and we have another huge wave, new cases or perhaps even a mutation of COVID-19, making it more fatal to more people, then governments may decide to reverse the easing or the localization of lockdowns that have been going on. That could have a wider impact on the economy, particularly if it’s an unexpected reversal.

Similarly, governments might look at the stimulus packages that they’ve been pumping out and the unprecedented size of fiscal policy that they’ve created and they may turn off the money printing machine. They may decide they’ve created enough debt for future generations. That, for my cynical self, is is not the sort of thing that governments tend to think about. They tend to think about the next election, not the next generation. But one of those two factors would definitely have an impact on the economy, especially because it would be so unexpected.

Or, and this is the known unknown, we could actually have in the background, the looming supply-side recession that I’ve been talking about since April.

So a supply-side recession has been our biggest risk since the COVID-19 coronavirus kicked off in China, the manufacturing hub of the world. Supply-side shortages are happening. Wait times on anything that requires international shipping – on boats – are often double, or more than they were at the beginning of the year.

The cost of air freight has increased as passenger flight numbers have dwindled. A lot of commercial freight gets stuffed into those commercial flights: fill the flight get a better rate, fewer planes going? it’s more expensive to get things shipped around the world,

However, the supply side of manufacturing has not gone the way that it looked earlier on this year, to my surprise. To be quite honest, factories full of sick people all over the world have been reopening and, in many cases, not even reopening at a reduced capacity. People are risking their lives going to work in these conditions. We’re not talking about stronger in countries like China, North Korea, we’re talking about meat processing plants in the US or Victoria, or welders in factories in the Midlands. These people are risking their lives because they need that paycheck.

If you had hoped that the coronavirus recession would reverse the last three decades of widening wealth inequality than the evidence so far and the two-track recovery that we’re looking at would suggest, not only is it not going to reverse that could actually make it worse.

Businesses aren’t shutting down, because they want the financials, and the employees are still showing up because they need the money. If something changes, or something has changed, and we’re just not seeing the full effect of that, then that will have a forced impact on the global economy. If you can’t buy the things that you want to buy, then, you can’t spend that money and that money doesn’t go into GDP

Economic indicator #3: unemployment rates

I was unimpressed with what the UK is doing with their COVID-19 recovery and active case figures, but, wait till you see what they’re doing with the unemployment figures: 3.9% for the fourth consecutive month!

The official unemployment rate in the UK is and has been for the last four months, 3.9% which is historically, very very impressive figure, let alone for a country that is in the deepest recession in 500, years. But, let’s dig a little bit deeper into those numbers and look at the actual employment numbers.

In June, 2020 (the latest UK figures we have – they take forever to give us their unemployment numbers), there were 32.9 million people employed. In February 2020, before the pandemic, there were 33.1 4 million people employed. I’ll do the math. That’s 220,000 fewer people who are working. But, for some reason, even though they are not working because they are not ticking the right boxes to be unemployed, they’re not counted in the official unemployment figures. They’ve dropped out of the labor force.

And, if we add in people who are not employed, that bumps the unemployment rate from 3.9 to 4.2%

This is still very very impressive by historical standard. However the UK is also reporting there were 300,000 people who are away from work, because of the pandemic and received no pay in June: 300,000 people, who didn’t work, who didn’t get paid, who weren’t on any of the government programs.

If I don’t work, and I don’t get paid, I’m unemployed. But, for some reason, in the UK, I wouldn’t be unemployed?!? I think we should still add those people into the numbers. This will jump the unemployment rate to 4.6%.

The UK Government’s COVID-19 stimulus package is the furlough program. It’s a great program and great idea, currently paying 7.5 million people directly from the government to them stop them from losing their jobs.

I want to highlight just a subsection of this:

There are 3 million people who’ve been away from their jobs for more than three months. They may be receiving some of the official furlough government program or some other government programs. But, as the economy has picked up and as that program has eased off (forcing employers to contribute to the program on their behalf), there are 3 million people whose employers haven’t actually gone in and contributed.

These people have been away from their jobs for more than three months, the employers are not bringing them back on. In any other environment the boss saying, ‘don’t come back for at least three months’ would mean ‘I’m unemployed’. 2020 is a strange new world because the boss is promising that if conditions improve next quarter or next year or in 2022 then absolutely you can come back, I still want you to have that job because of that promise.

Technically, they still have a job. Technically. And this is a good thing for Boris, because if we add those 3 million people in, the unemployment rate in the UK would be about 9%. This brings the figure much more in line with what we’ve seen internationally.

That’s still well below where the US, but keep in mind that the US has a far less efficient and successful program for keeping people employed than the UK and Australia.

The US numbers will be updated again this week as we come towards the end of summer, and Labor Day, My American viewers may be expecting that number to decrease again slowly to continue that trend of moving down from that immediate freak out. But although it’s slowing, it’s still quite high.

The Australian unemployment figures were out only slightly, and I’ve actually done a number of interviews over the past month, talking about the success of the job keeper program in Australia, which will continue, looking at the last indicator GDP growth.

The UK (since my last video) has announced the June quarter annualized a decrease of over 20% – the worst quarterly figures in recorded history for the UK.

The US updated figures show they’ve improved ever so slightly.

Australia is officially in the recession, we couldn’t avoid though. Remember, we had the Australian Treasurer on this program three months ago confirming that Australia was in the middle of a recession.

The 2-track recovery: mindset + macro-economic impacts for your business

So the two-track recovery when it comes to GDP growth covers, two things, both your mindset and your understanding of some of these macro economic fundamentals and what they mean for your small medium sized business.

MINDSET: the media is going to be all about the recession. Now, the recession is in all three of those countries and many other countries around the world. The only exceptions are ones that went into it earlier. The recession ran from January to June, it’s now September, the news media are pumping usfull of the fear and sadness of a recession. And yet recession two consecutive quarters of negative GDP growth we look at that figure, you are now in September. Two thirds of the way through the best ever quarter for GDP growth in history.

The figures that afor the current quarter are going to be astronomical. So mindset wise, to track recovery, which track are you choosing to take? Are you going to focus on the official recession? Particularly, for my Australian friends the first time in 30, years, Welcome to the Party! Is it as bad as you thought? Or are you going to take the more positive mindset -which is well that’s ancient history now, particularly in the context of a business, and a business responding to everything 2020 throws at you, are you going to focus on the growth that’s going on right now? The opportunity that is always in front of you? If this is your mindset the results you achieve in your business are going to be alot better than the doom and gloom, you might be seeing on the news today.

A best-ever quarter for GDP growth does mean that people who misunderstand macro economic fundamentals are going to start making some other mistakes.

You’ll be seeing best-quarter bounce back in October/November/December, but, this does not mean a V shaped recession.

Let me explain.

This chart shows GDP growth for the USA – an economy that continues the longest ever run of quarterly growth, as shown in the top positive figures;

Note the dip in the March quarter and the plummet in the June quarter. GDP growth or a negative growth rate, (lack of growth) is defined as a recession of two consecutive quarters. it doesn’t define a recovery, because that measure in the September quarter is going to be compared to the June quarter, (the worst ever in history), so it is going to be an enormous growth figure for the September quarter, in comparison to a ginormous plummet.

Comparing the growth rates for a recovery does not tell you the has the proper story about what’s actually happening in the economy to look at what’s actually happening in the economy, you can’t look at GDP growth rates, you need to look at actual GDP, the actual figures, though not the growth as a percentage that’s what we’re looking at here in the US.

And you can see again a decline and then the plummet in the June quarter. What we want to look at is what happens to the actual GDP amount, not the percentage growth. Because remember, looking at percentages it’s a little bit, non-intuitive sometimes I mean, a 33% decline we’ve seen almost that annualized in the US needs a 50% recovery to break even. You just can’t go comparing apples to apples.

If you look at the actual figures though that’s when you can see whether the recovery has caught back to where we were.

Optimist want a V shaped recovery that’s what they’re projecting they want it to look like a V which means that the total GDP of the country, or that sector whatever they might be looking at, gets back to those previous highs very very quickly.

Are we going to do that in the September quarter or are we going to see a more subdued return? It’s going to be good growth as a percentage, but it’s not going to necessarily go back and, and it will take us time to grow out of that.

My conversations/commentary/ research/ what we’ve been talking about here through 18 editions of this economic snapshot is that we are not going to see that immediate V snap-back. We’re not going to see GDP growth in Australia, the UK, the US, Hong Kong wherever it might be, get back to those previous levels within one or two quarters. We are going to see a much slower, more gradual growth back to those figures.

And if we look at that number. That is the L shape recession that we have been talking about the shape, very very clear it goes back with main that really by the December quarter by Christmas of this year the economy is as large as it was at the beginning of the year, or larger, and they will shape recession may not be as pessimistic as that shape that I’ve drawn there, but would suggest as we’ve been talking about for some time that it’s going to be middle of life 2021 before we actually get back.

Thanks for we help this month pay.

3 ways to make sure you’re on the fast track that you want for your business

- Don’t get affected by the pandemic

This may be more about luck than about a business plan, but the reality is, when you’re six months into the pandemic either your business has survived (with some hard times); it wasn’t affected or, it was affected in a positive way

Or, you’ve come to the point where, despite all the stimulus packages, all the support, it’s not going to work moving forward.

For me, both of those are fantastic: both of those situations – where you’ve come through and you’re okay, or you completely stuffed, give you a lot of options for the next 18 months. The uncertainty of the response phase that first three months of a recession, has gone. You can now make decisions with confidence.

If you were affected, make decisions moving forward with confidence.

2. No matter how hard things are, remember that there are many people, many businesses who are doing well right now. Your opportunity is to see how you can expose yourself to those businesses. How do you get yourself exposed to the benefits of those industries? It may mean re-skilling, it may mean starting a different business temporarily or permanently – but, that’s the opportunity that you have in front of you.

3. The third and universal point, don’t buy into the hype. Don’t buy into the news media doom and gloom, that is out there. In March we experienced misguided predictions that this year, economically, the stock markets, would be far worse than they actually turned out to be.

And, even if that had been the case there still would have been opportunities. If you buy into the doom and gloom, you’re setting your filters up to only see more doom and gloom. You walk into your business every day seeing more doom and gloom.

If you buy into the opportunity and accept that the rich are getting richer but you have the opportunity to be part of that path, you’re going to see the opportunities. It all ultimately comes back to your business. It’s not what Facebook or Netflix are doing it’s not what Donald Trump or Boris Johnson are doing or not doing. It’s what’s happening in your business that circle of control, and the circle of influence that affects your numbers.

If you don’t know what your numbers are either watch that video do a search for the coronavirus recession better business indicators or reach out, send me an email, have a coffee with zoom me whatever it is that works for you to find out how you can get those numbers.