The Impact of Debtors on Cash Flow. In Blackboard Fridays Episode 20, Jacob talks about Business Financials. Need this implemented into your business? Talk to the international business advisor who can do exactly that – Contact Jacob, Learn More, or Subscribe for Updates.

Revenue is Vanity, Profit is Sanity, Cash is King. Yet Cash Flow can be confusing, and beyond the numbers has an emotional impact on you and your team.

Using a simplified version of a Cash Flow report I prepare for my Como AI coaching clients (contact me to learn more), in this week’s case study video I talk through:

- How staff, owners, and your accountant all view your revenue and expenses differently – and why that creates stress

- How Debtors can mean a profitable business still struggles to pay its bills, BAS, and superannuation obligations on time, and

- A specific project about how we helped a client implement some process and mindset changes with their team to put cash back in the bank – cash now being investing back into growing this business

Who is Jacob Aldridge, Business Coach?

“The smart and quirky advisor who gets sh!t done in business.”

Since April 2006, I’ve been an international business advisor providing bespoke solutions for privately-owned businesses with 12-96 employees.

At this stage you have proven your business model, but you’re struggling to turn aspirations into day-to-day reality. You are still responsible for all 28 areas of your business, but you don’t have the time or budget to hire 28 different experts.

You need 1 person you can trust who can show you how everything in your business is connected, and which areas to prioritise first.

That’s me.

Learn more here. Or Let’s chat.

Transcript

Here is a critical concept I learnt during my two years as a Partner at the leading accounting firm businessDEPOT: Revenue is vanity, Profit is sanity, Cash is king.

And here is a case study of exactly how that shows out.

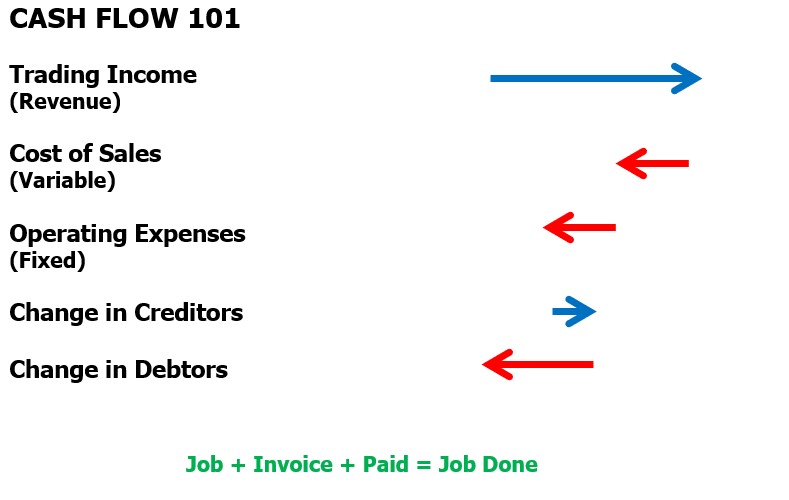

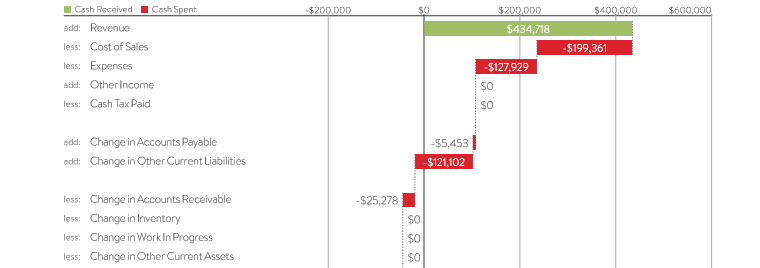

What I’ve drawn on the video blackboard (and repeated in an image above) is a cut-down version of one of the reports that I provide to my business coaching clients, on either a Monthly or Quarterly basis (there’s another example below). It’s looking at Cash Flow, and specifically we’re just looking at a couple of key elements of the operating cash flow.

How Does Cash Flow Impact Emotions

I want to talk about this, not just in terms of numbers, but in terms of the emotional impact that has on you as a business, as a business owner, and importantly the two key things that I did with this client to improve their cash flow.

You can see at the top, at the start, is Business Revenue for the period. Revenue gives us a blue arrow which heads to the right, showing cash flowing in to the business.

If the arrow extends further, it means more revenue. The further we are to the left, the more profitable we are. But then as the month goes on, the red arrows below start to pull us back.

The first of those red arrows is the Cost of Sales, sometimes known as COGS (the Cost of Goods Sold) if you’re in retail business or product business. Cost of Sales brings that revenue line back to the left – it costs you money when you sell and deliver your work, so that variable, growing Revenue arrow to the right is offset against a variable, growing Cost of Sales arrow to the left.

Here’s one of the challenges you have as a business owner: your team will usually have a pretty good idea of the Cost of Sales … but nothing below that in the diagram, or the cascading cash flow.

This means that when they think about how profitable your business is, they only think about (1) the revenue, and (2) the impact of the Cost of Sales. They think the rest of that is profit!! And in a sense, they’re correct – it’s Gross Profit. But Gross Profit (GP) is a useful accounting and advisory measurement, not cash in the bank you can give payrises with.

Of course as the business owner paying all the bills each month, you know better. You’re aware that even after those variable costs, the next thing you face is fixed and ongoing expenses. This is the next red arrow pushing the cash flow back to the left.

All these other overheads are not related specifically to getting sales out the door. Rent, for example, is one of them are the biggest ones that I see in businesses.

Revenue, less the Cost of Sales, less Expenses, starts to give you an idea of things like Net Profit or Operating Profit.

This is where some business owners can get stuck because again, just like the team finish early, the business owners can finish early, and feel that they’ve got all this profit and therefore they ought to have all this cash. Where has all my cash gone?

SME Cash Flow Case Study

So, in this case with a client, I wanted to go through and find out why they were struggling with cashflow month after month even though they had very strong revenue. It sat in the next two elements on my diagram — the fluctuating change in Creditors (Accounts Payable, AP) and change in Debtors (Accounts Receivable, AR).

On the video you can see the change in Creditors very gently moves the blue arrow back to the right. That means the business is paying their creditors a little bit more slowly; they’re holding on to their cash a little bit longer. The example report image just above here is different – while still small, the red arrow is moving back to the left, which means the business is paying their Creditors faster and cash is going out the door sooner.

TWICE in my business coaching career I’ve had to tell my clients to STOP PAYING ME SO FAST. It helps with my cash flow, sure, but I don’t need to worry about that – if you have a cash flow crunch AND you’re paying all your bills early, this is something you need to consider changing.

The example report also shows an extra level of complexity in this simple approach to cash flow management, one that is covered in other Blackboard Fridays videos – the impact of your Balance Sheet on your Cash Flow.

Moving back to the case study in the video, the big change in data is the next line – Accounts Receivable, It’s so big that it pulled us almost back to the very beginning. What this tells us is that the change in Debtors their Accounts Receivable has blown out. Their clients are holding on to my client’s money a lot longer, and that money is therefore not coming in the door.

This is Why Cash Flow is Struggling

This is why their cash flow was struggling. This is why they’re sometimes finding it difficult to make sure that they have the money for some big expenses, like a quarterly Superannuation or Tax, or even wages. Because even though revenue is strong expenses are under control, they’re letting their clients treat them like a bank.

So, what are the two things we had to do with this business to help overcome this? The first was putting in place a debtor management program – getting the administration team and the specific professionals who are doing the client work on the phone with their clients much more frequently, chasing up those debtors and helping very rapidly turn that from a red arrow into a blue arrow as all of those long-term debtors kicked in.

The second thing we wanted to do was build a system so that this didn’t happen again. That system broke down simply into:

- improved workflow meetings with the team every Monday

- having a look at the work in progress

- making sure that the team was scheduled through the week, so that they were each at a reasonable level of capacity

- encouraging the team to make sure that they were finishing jobs,

- or if they were partial jobs, getting partial invoices out, and

- making sure that they were delivering invoices to the client in a more timely manner.

Because clients love receiving the work, they less love receiving your invoices. If you can tie those two together energetically, the clients are much happier to pay. When they’re happier to pay, they pay faster. The key mantra that my SME client developed, which I love, and I use with a lot of other businesses, is to get the team to stop thinking that “the job out the door = the job done”.

The job is not done for the team until the job AND the invoice are out the door, AND the invoice is paid. That’s Job Done!

And that turns a red arrow for Debtors into a blue arrow, helping push your cash flow much closer to your profitability, giving you a happier, healthier business.

Next Steps

Want to learn more about how this can apply to your business? It costs nothing to chat:

- Email me jacob@jacobaldridge.com (I read them all)

- Call, Text, or WhatsApp me +61 427 151 181

- Or just Subscribe https://jacobaldridge.com/about/subscribe-to-jacob-aldridge-com/ to stay in touch