Every Friday I prepare an Economic Snapshot – to track the Recession, pinpoint the Recovery, and help you make better decisions in your business. Subscribe here for updates by email.

Welcome to the economic snapshot for Friday the 29th of May 2020.

Is this a Dead Cat Bounce / Bull Trap, or signs of an economic recovery and a V-Shaped Recession?

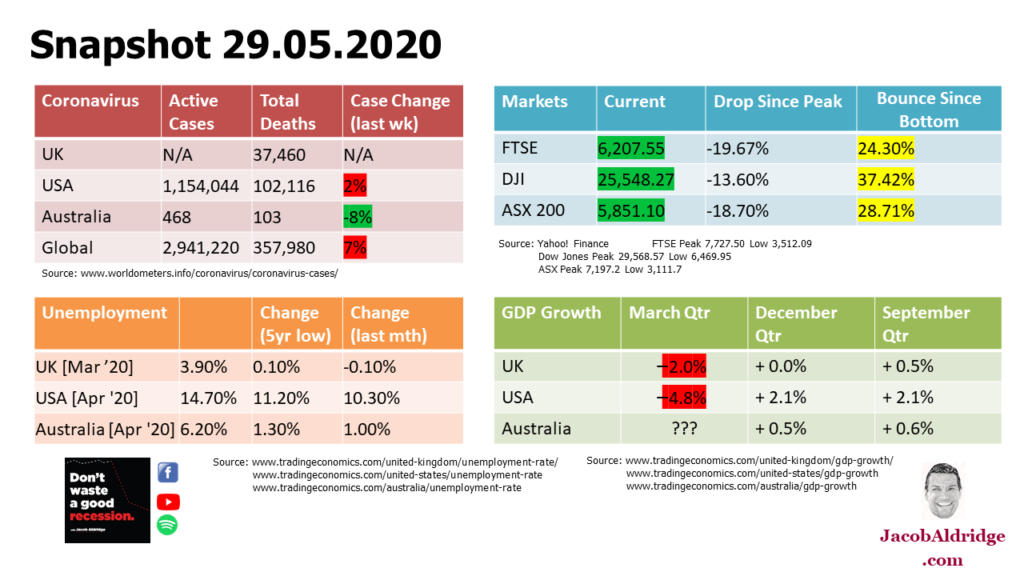

Global stock markets have rebounded strongly from the initial Coronavirus Pandemic sell-off. The FTSE, Dow Jones, and ASX 200 (among others) are now below the 20% Decline used by many to define a ‘Bear Market’.

Does that mean the Bulls are ascendant again? Some experts are predicting that the economic fallout from the Pandemic may be smaller than feared – and while that would be great news for your small business, the rest of the my research suggests it’s a little optimistic and naive.

The four economic measurements that we currently look at every week:

Welcome to the economic snapshot for Friday the 29th of May 2020. I’m your host, International Business Advisor Jacob Aldridge, and this is “Don’t Waste a Good Recession”.

In regards to the metrics we’ve been tracking for two months now, not an enormous amount of movement this week.

- The UK is still not releasing formal Active Coronavirus Cases. The US has some good news even though the number of Active Cases stayed in the red again this week it was up by just two percent, which means that even though the headlines are around the US passing 100,000 dead from COVID-19 the actual growth in Active Cases does appear to be slowing both there and Globally. In Australia that number has continued to decline – the rate of decline has slowed a little bit, and that’s almost to be expected once we’re down into very small numbers, we’re now down below 500 active cases across all of Australia.

- No new data in regards to Unemployment and GDP growth.

So this week’s economic update is going to focus on the stock markets. A question that I asked myself and spent a lot of time this week looking into is “Are we looking at a Dead Cat Bounce?” Is the growth we’ve been experiencing in the markets, that we discussed in our economic update last week, a Bull Trap? Or is it a sign of an actual recovery in the markets?

One thing I’ve done is changed the data that we’re going to be presenting every week to include the “Bounce Since the Cycle Bottom” so this is an idea of how far we’ve come back up so in all three of the main markets: the FTSE, the Dow Jones, and the ASX200 that we’ve been tracking.

The drop since the peak earlier this year is now below 20% and in all of those cases it’s actually bounced more than 20% off the bottom. Now for people who like nice round numbers to define a Bull Market or a Bear Market that would suggest that the “Bear Market” has ended and we’re back in a growth phase.

I’m less confident, but that’s the question that I wanted to talk about. If we have a look at a chart of any of those indices, and in the video version I do have a chart of the ASX200 for the past twelve months and the FTSE and Dow Jones are very similar-looking charts, we can see that steep and rapid decline once the Coronavirus Pandemic took place and the steady upwards growth that has happened since.

The question is: Will that growth continue upwards or is this what’s known as a Bull Trap, a trap that will catch people who are expecting a return to a Bull Market when in fact we are still in a Bear Market and that trajectory will go downwards?

What is the difference between a Bull Market and a Bear Market?

For those who aren’t familiar with some of the animal terminologies that we’ll be using, a “Bear Market” is when the Bears are tearing down prices. A “Bull Market” is when the Bull is tossing prices higher with its horns.

The Bull is often seen as a symbol of Wall Street, there’s a famous statue on Wall Street in New York City of a bull tossing prices ever higher as they hope.

What is a Dead Cat Bounce?

A Dead Cat Bounce is something that gets talked about at this point in the economic cycle. The idea being that if you want to know whether a cat has life in it you can’t just throw it in the ground and see what happens when it hits the bottom, because “even a dead cat will bounce”. That doesn’t necessarily show that it’s got up and is walking away.

The same is true of the markets: have they hit the bottom and they’re now slowly walking their way back up to growth, or have they just bounced like a dead cat without that actually meaning there are signs of life moving forward?

I’m not going to make a definitive answer here. I’m going to walk through what I see is the three possibilities of those markets, and which I feel is the most likely to be an indicator.

Are Stock Markets a Lead Indicator of the Wider Economy?

As we jump into that, it’s important to remember why we care. We care about this because we see stock markets as a lead indicator of the wider economy. Those who are investing and speculating in the stock market today are doing so based on what they see as being the future Growth or Decline opportunities in particular stocks, or the market overall.

So we get a bit of a “wisdom of the crowd” consensus as to what the future economy is going to do. If the markets are plummeting today, that would suggest that there’s greater expectation of wider economic doom ahead. If the markets are going well today, then perhaps there is a forecast that the general economy will continue to do well into the future.

Why are the Stock Markets up in April – May – June 2020?

There are three possibilities for why the markets may have bounced more than 20% (and, in the case of the Dow Jones, more than 30%) off that bottom.

- This could be a V-shaped Recession

- Markets have actually disconnected from the wider economy – so we can’t use them as that lead indicator, or

- This is just a Dead Cat Bounce creating a Bull Trap

Let’s go through those in order.

1. Will this be a V-shaped Recession?

I’m not going to belabour that point as I’ve already done several videos and the economic updates and on the “Don’t Waste a Good Recession” YouTube channel about why this will be an L-shaped Recession not a V-shaped Recession.

The best evidence that I’ve seen supporting the possibility that market growth suggests a fast recovery focuses on the speed of recovery. So for example the firm Strategas Research has observed that the bounce we have seen is actually “the second best 40 day period in history”.

Every rolling 40 day period in the history of the Dow Jones, well over 120 years now, this is the second best 40 day period for growth. And their projection therefore is that that speed of growth augers well for the general economy.

For me however that ignores the rapidity of progress that is going on at the moment. The video I did on why the Coronavirus Recession is different to a Typical Recession talked about how this is moving much faster. So I don’t think that pointing out speed of that 40 days is evidence that this is actually a sustained recovery. Just as the drop was faster, so too the Dead Cat Bounce has been faster. It doesn’t mean we have, like we might have ten years ago or 80 years ago, a rapid recovery.

2. Have Markets disconnected from the wider economy?

The second possibility is that markets have disconnected from the wider economy, and there’s some evidence to support this. Money has to go somewhere. In Australia we think about the Superannuation system, where employees have to put money away for their retirement. That money has to be invested according to the rules that they set up in those Superannuation trust-like structures, so there’s still money flooding into the market even if it’s blind money or dumb money.

Indeed, even the smart money has to ask itself, “Well where else am I going to invest right now?” Bonds, Banks, they’re offering negligible or even in some cases negative interest rates around the world. And so if you’ve got to put your money somewhere why not put it into the stock markets?

Especially if you’ve got a long term outlook! Even if we assume this is a bull trap and the market is going to drop, well you could buy stocks cheaper in three months or six months if you can accurately catch a falling knife, but if the markets are going to be a lot higher in ten years (and they will be) then buying today as opposed to trying to catch that knife and buy a little bit cheaper in a few months is maybe not even worth the effort.

Some people who are just accepting that it is what it is, they’ve got a long term outlook. “Let’s keep buying today.”

There’s some speculation that the markets are dehinging, disconnecting from the wider economy because of tech stocks. Now, we’ve heard that before! The Dot-Com Boom in the late 1990s was around the fact that these tech businesses had a very different business model, business structure to the rest; and the speculation that’s going on today is that things like Zoom and Amazon have really shown that that sector will lift the wider markets even if the general economy continues to be in the toilet.

My take on that? I’ll ask you the question – if you’ve been back to the supermarkets recently, have you noticed that toilet paper is back on the shelves everywhere? We ran out of toilet paper in a lot of countries around the world. There was panic, it drove demand, we had toilet paper selling out as a result of that, there was even more panic, people panic buying toilet paper because other people were panic buying toilet paper, and we ran out. It was this big crisis, it was in all the newspapers over toilet paper, and now it’s come back to the shelves. The panic that drove that demand has eased, and we’re now back into some level of normality.

I see a connection there with tech stocks things like Amazon delivery, AWS, companies like Zoom which is now worth more than every single airline in the world (it’s worth more than the top 7 global airlines combined). But that’s being driven by the health pandemic crisis … and that will end.

Now some behaviors will undoubtedly change, and those are good companies. But the bubble that drove them up will slow them down, so saying that the markets are growing because of these tech companies and these tech companies are going to go on forever I think misses what’s driven those which is a little bit of panic and I suspect a bit of a mini bubble in some of those stocks.

Besides which, on the broader point, tech is not the only sector that has actually climbed.

So could the markets have disconnected from the wider economy? It’s a possibility. I’m not seeing any evidence of that, however I’m certainly not taking any of this research and using it to speculate with my own investments. The markets can stay irrational for a lot longer than you can stay solvent.

3. Is this a Dead Cat Bounce?

So then the third possibility: is this a Dead Cat Bounce?

The reality is, we only know it’s been a Dead Cat Bounce in hindsight. A recovery keeps growing – we look back and say, “Oh that was a recovery”; a Dead Cat Bounce eventually goes back into a Bear Market, it declines back below that bottom, and we look back and say, “Oh, that was just a Dead Cat Bounce.”

So we have no way of knowing when we’re in the bounce whether it is or whether it’s not.

One thing I would point out is the impact of sentiment of those traders and speculators on the forward direction of the stock markets. There’s a lot of research that goes into doing this economic update each week, which gets added to my decades of experience in economics and business: the broad consensus that I’m seeing in the research at the moment seems to be we just don’t understand why the markets are so strong .

That consensus is very similar to the peak of a long bull run.

At the very very peak (which we had 2018- early 2020 if you’ve seen some of my earliest recession forecast videos) Traders, Speculators, Investors, Everybody knew that a bust was coming. They just didn’t know exactly when.

And nobody wants to go first. Nobody wants to miss the last eking out of a peak by being the first one to try and sell and get out of the market. However, everybody wants to go second.

As soon as there’s the sign that the Bull Market has ended and we’re going into downward territory, everybody wants to get out. That’s why it happens so fast.

I’m sensing a lot of similar sentiment here around this market situation, what I am calling a Dead Cat Bounce. There’s a lot of people who really don’t understand why the markets are going up like this … who really don’t expect that to be sustained … and while none of them want to be the first to get out just in case they’re wrong, as soon as there’s a strong indication that the markets are going to turn south again everybody’s going to want to go second.

So when that first domino falls, we can expect another crash and quite possibly fast given how many people are waiting for that other shoe to drop.

Why do I think it is a Bull Trap, a Dead Cat Bounce? I think there’s the distortion of government stimulus money that’s flooding the markets, it’s flooding the economy that’s giving false hope to a lot of business owners I’m talking to personally. And a lot of what’s happening in the wider economy and the stock markets now makes me ask “how long can that government stimulus money last?”

Most of the programs that have been announced are temporary, ending in June or September. In the US there’s the small matter of a presidential election in November – I suspect those currently in power will find ways to stretch the public purse through to then, maybe even through to January if we end up with two runoffs for the Georgia Senate election that could decide who controls the Senate.

But that government stimulus is not going to last forever. And once it stops, those zombie businesses are going to have their heads cut off; A lot of sentiment that was optimistic or naive is going to be exposed; and any confidence that this is going to be a V-shaped Recovery – that we are going to go back to normal very quickly – will be put to bed.

How does the 2020 Dead Cat Bounce Compare to others in History?

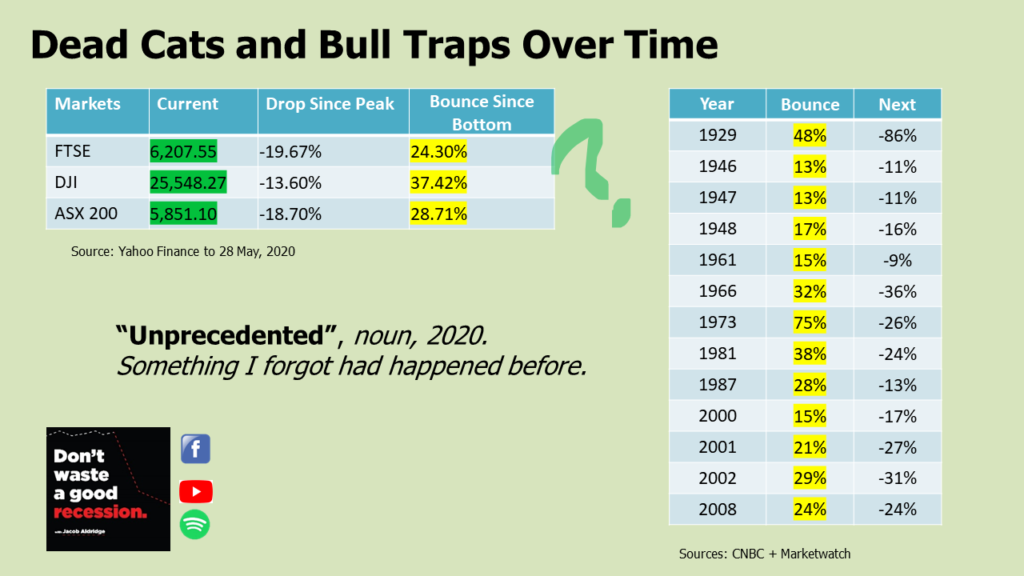

Lastly, let’s compare the current situation to Dead Cats and Bull Traps over time.

So the FTSE is up 24% since the bottom. The Dow Jones up 37% since the bottom. The ASX200 up 28% since the bottom. If you bought the bottom of these markets then you’re patting yourself on the back right now, you’ve had some solid growth between the bottoms the 23rd of March and today 28th of May. It’s been a very good two-month period.

Does that augur well for ongoing growth? Well let’s have a look at how markets have bounced over time, and particularly I want to look at previous Dead Cats Bounces off the bottom that were followed by a further downturn or continued decline in the Bear Market.

If we go all the way back to 1929, so we’re looking at the last hundred years of recessions, there was a 48% bounce off the bottom in mid 1929 during that Recession … that was then followed by an 86% decline. So if you thought that the bounce was the end of it then you lost a lot of money.

The 1940s it was a period of drag, similar bounces 13%, 17%, quickly followed by similarly-sized drops.

If you go through the list above or watch the video you can see the full list of 13 Dead Cat Bounces in the last 100 years.

Take 1966, which was the worst year in history to retire (possibly being challenged by those who retired in 1999 or 2000). In 1966 there was a Dead Cat Bounce. Markets bounced up 32% … and then immediately proceeded to drop by 36%.

1973 they went up 75%, then came down again. 1981, 38% bounce, then came down again. Even through the Dot-Com Bust and September 11 of 2000, 2001, 2002.

In 2008 the start of the Great Recession there was a Dead Cat Bounce – where the markets went up by 24% (exactly what we’ve seen the FTSE do in the last two months) and then immediately gave all of those gains away.

Even if we take the Dow Jones, which is up 38% off the back of over $1 Trillion dollars of government spending, even if we use that enormous growth in a two month period that is only the fourth largest bounce in recovery history (in terms of Dead Cat Bounces). There were larger bounces in 1929 and 1973 and in 1981, all of which were followed by declines of over 20% shortly thereafter.

So this is not an unprecedented situation. There is nothing for me that says “A bounce since the bottom of this size and at this speed means that the economy is in full recovery”.

A Dead Cat Bounce is common. It doesn’t happen every time, but there’s enough other indications that this is not going to be a V-shaped Recovery and that we’re not going to be out of the Coronavirus Pandemic, and certainly not the current Coronavirus Recession in a hurry.

And as a result, as a Lead Indicator these markets are suggesting perhaps (as I said last week) a period of a couple of months where you could make some hay.